2 Reasons Nutanix Is Built for Growth

The market for "hyper-converged" cloud infrastructure is expected to grow at a pace of over 43% a year from 2016 to 2022, according to the researchers at Markets and Markets, hitting $12 billion. This terrific growth will be driven by enterprises looking to seamlessly integrate their private and public cloud infrastructures.

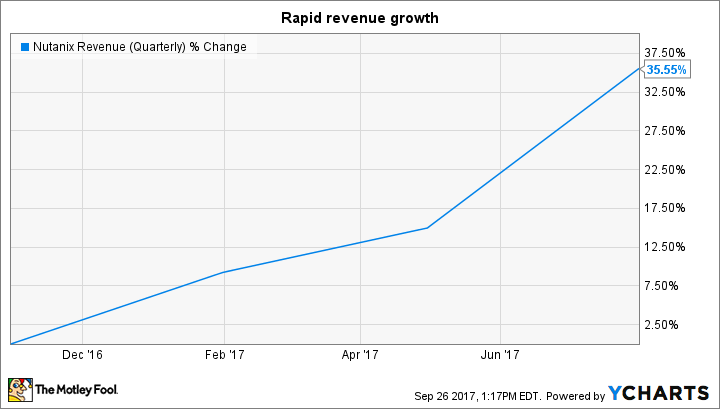

One way to tap this potentially fertile market is through Nutanix (NASDAQ: NTNX). This hyper-converged cloud computing specialist has been successfully taking advantage of the expansive opportunity, as you can see from its rapidly growing revenue.

Looking ahead, Nutanix shouldn't run out of momentum as it seems to be pulling the right strings to attack the hyper-converged cloud market. Let's see how.

A strong client base

The strength of Nutanix's client base can be understood from the growth of its deferred revenue. Deferred revenue is the money received by a company in advance for services that haven't been provided yet, and is commonly found in companies selling subscription-based products. A jump in deferred revenue indicates that the company's services are gaining traction.

This is exactly what's happening with Nutanix, as its deferred revenue increased 77% year over year to $526 million at the end of the recently reported fourth quarter. This outpaced the company's fourth-quarter revenue growth of 62%, indicating that its product upgrades and new software platform are in strong demand.

More specifically, Nutanix has already locked in 68% of the revenue that it generated last year.

The company's customer count swelled to over 7,000 at the end of fiscal year 2017, driven by the addition of 875 customers during the final quarter.

But what's even more impressive is that Nutanix customers are striking bigger deals. The number of $1 million-plus deals shot up 39% year over year during the latest quarter, thanks mainly to an increase in the penetration of its hypervisor virtualization solution and higher software sales. The cloud computing specialist's focus on growing its software business could act as a booster for its revenue and earnings growth.

Higher software sales

Last quarter, 17% of Nutanix's $289 million in bookings were from software sales. In fact, its software bookings jumped 96% year over year on the back of recent launches and partnerships. At the end of June, the company added multiplatform capabilities to its Nutanix Enterprise Cloud Operating System with the addition of the Calm platform.

Nutanix Calm will enable clients to use the company's enterprise software to launch applications across private and public cloud infrastructures, irrespective of the hardware or the cloud service provider. For instance, a Nutanix customer can now launch applications in the Google Cloud Platform from an on-premise infrastructure provided by IBM.

Such software platforms enabling hyper-convergence between public and the private cloud infrastructures have already started boosting Nutanix's business. This was clearly evident from the rapid growth in the software side of the company's business last quarter. Looking ahead, Nutanix's software sales should keep getting better as more customers buy into this platform to launch applications in a hyper-converged environment.

More importantly, Nutanix's improving software sales will help it bring down selling and marketing expenses thanks to lower customer acquisition costs. This is because software customers, who are usually on a subscription plan, ensure steady revenue streams for the long run, and bring down marketing expenses as it is easier to pitch new services that could generate more revenue.

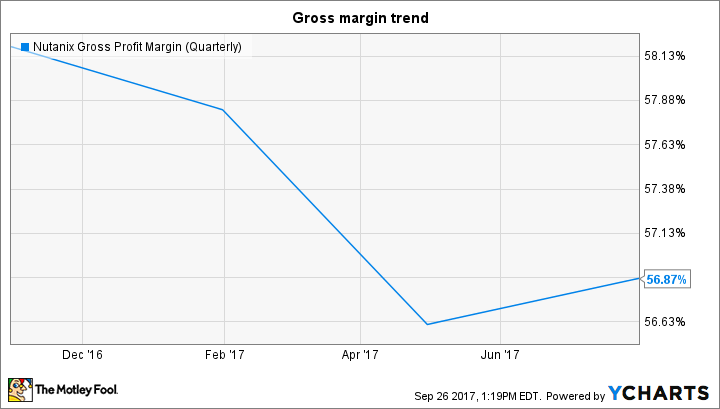

So it won't be surprising if higher software sales eventually boost Nutanix's margins. In fact, the company has already started reaping the benefits of an increase in its software sales as evident from the recent uptick in its gross profit margin.

Therefore, Nutanix's focus on increasing the size of its customer base and gearing toward higher software sales should help it make a bigger dent in the fast-growing hyper-converged cloud computing space, setting the stage for strong financial growth.

More From The Motley Fool

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.