2 Stocks to Buy With Dividends Yielding More Than 6%

When you get up into the 6% yield range, you need to start thinking about dividend safety. Often stocks offering that high of a dividend yield have something going on that could put the dividend at risk. However, that's not the case with Enterprise Product Partners L.P. (NYSE: EPD) or Magellan Midstream Partners, L.P. (NYSE: MMP). As midstream master limited partnerships, their yields tend to be on the high side, and as you'll read below, both are particularly well run.

The giant takes a breather

Enterprise is one of the largest midstream players in North America. Its highly diversified portfolio includes pipelines, processing facilities, storage, terminals and ports, and a fleet of tankers. With a market cap of nearly $60 billion, it's among the biggest companies in the energy industry.

Image source: Getty Images.

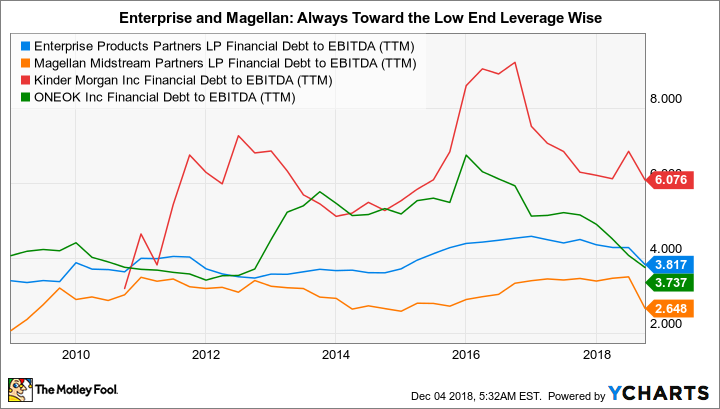

It is also a very conservatively run partnership. For example, debt to EBITDA has historically been toward the low end of its peer group. Currently, that figure is roughly 3.8 times, which compares very favorably to other industry giants like Kinder Morgan, Inc. and TransCanada Corporation, at 6 times and 5.9 times, respectively. Enterprise's leverage isn't a big risk.

Enterprise also works hard to ensure that its distribution is well covered by the cash it generates. For example, even during the deep oil downturn that started in mid-2014, the partnership was able to maintain distribution coverage of 1.2 times or greater. Through the first nine months of 2018, distribution coverage on the partnership's roughly 6.6% yield was a huge 1.6 times, which requires a little explanation.

EPD Financial Debt to EBITDA (TTM) data by YCharts.

Enterprise has historically funded itself with a mixture of debt and secondary offerings of MLP units, preferring to push out most of the cash it generates as distributions. It achieved an incredible record of success with this approach, with 21 years of annual distribution hikes under its belt. However, capital markets are a less desirable option today (which is partly a function of the partnership's relatively high yield, which increases the cost of this type of capital raise). So, management has shifted gears and is temporarily slowing distribution growth into the low single-digits so it can self-fund more of its growth with internally generated cash. Once it shifts to the new funding model, distribution growth is likely to pick back up into the mid-single-digit space. The 1.6 times coverage figure shows it is making very good progress on the self-funding goal as existing growth projects come on line.

The bigger takeaway from this move, though, is that Enterprise is clearly a conservatively run midstream company that puts a heavy focus on ensuring unitholders get paid. If you are looking for a 6%-plus yield, Enterprise should be one of your top picks.

Doing what it has always done

Don't stop at Enterprise, though -- Magellan Midstream should also be on the list of top picks. This partnership is much smaller than Enterprise, with a market cap of $14 billion -- a still sizable figure. And it isn't quite as diversified, focusing largely on pipelines and storage. However, when you dig into some of the numbers, its 6.4% yield looks rock solid.

For starters, debt to EBITDA is roughly 2.6 times today. That's even lower than Enterprise's already conservative figure. And distribution coverage is around 1.2 times, which is the partnership's long-term target. In the midstream sector, that level of coverage is considered robust. There's no reason to doubt that investors will get paid, here, a sentiment that is backed up by the fact that Magellan has increased its dividend every quarter since its IPO in 2001 (around 18 years and counting).

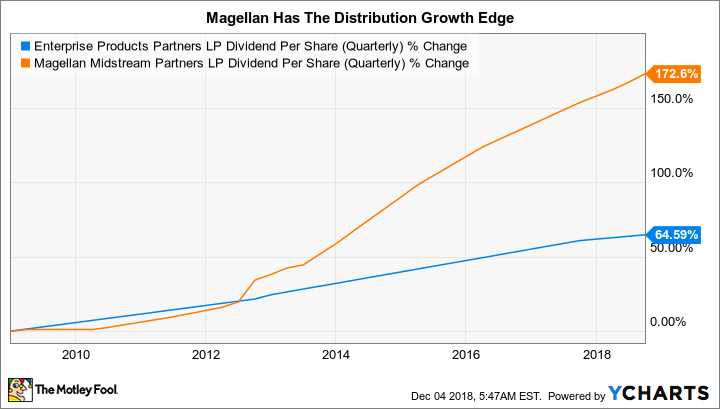

EPD Dividend Per Share (Quarterly) data by YCharts.

One of the interesting things about Magellan is that it has long focused on self funding. So Enterprise is, essentially, shifting its business model to be more like Magellan. That said, there is one notable difference: Magellan has been more rewarding when it comes to distribution growth. For example, while Enterprise is looking for low single-digit distribution growth, Magellan is projecting distribution growth of 5% to 8% a year through 2020. This is part of the reason Magellan's yield is a little lower, since investors tend to place a premium on distribution growth.

If you could pick only one of these two partnerships, Magellan should probably be the one that gets the nod. That said, if size and diversification are important to you, since such factors can add to distribution safety, Enterprise would have the edge. But either one would be a great high-yield option.

Nowhere near done yet

The best piece here is that the growth of U.S. land drilling has created huge opportunities for midstream companies to continue their expansion. For example, Enterprise currently projects that oil production will grow by 60% by 2025, natural gas by nearly 40%, and natural gas liquids by nearly 70%. Enterprise and Magellan will participate in that growth, and it will be the backbone on which they continue their impressive streaks of annual distribution hikes. And by buying in today, you can lock in 6%-plus yields backed by financially strong and conservatively managed partnerships.

More From The Motley Fool

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Kinder Morgan. The Motley Fool recommends Enterprise Products Partners and Magellan Midstream Partners. The Motley Fool has a disclosure policy.