2 Timely Holdings in Our Quality Value Strategy

Watch video here.

Can you describe your approach to Quality Value investing?

Our approach to quality and value investing really focuses on quality first, value second and said differently that means kind of our margin of safety is in the quality of the franchise that were buying and not the multiple that were paying.

Which of your investment themes are you finding most attractive today?

We have three different investment themes that we categorize our investments into. The first is compounder at a reasonable price, so these are companies with great business models and long runways for organic and inorganic growth. The second bucket is quality value. Also, really good businesses, but they have a higher degree of inherent cyclicality that makes their businesses not quite as attractive as a compounder. And the third bucket is special situations, which are things like spinoffs, turnarounds, or complex accounting that may mask the underlying franchise value.

Our investment holding period tends to shrink as you go from compounder down to special situations, which are a little bit more catalyst driven, and within those groups Id say that were finding the most opportunity today in quality value. And I think thats a function of whats going on in the market, where cyclicals in general are very attractively valued. So, were seeing opportunities in banks, P&C insurance, lots of opportunities within industrials, all the way down to specialty chemicals and even tech.

Whats an investment the team is excited about?

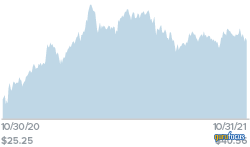

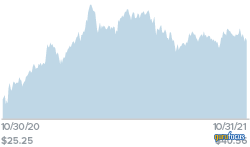

One of the companies that we like a lot right now is a company called BankUnited (NYSE:BKU). They fit with what were looking for in terms of what we like about a bank, and that is that theyre in the state of Florida, which is a very attractive growth market. That means theres population growth there, business formations, and that means opportunities for local, community, and regional banks to make loans and gather deposits. They have a higher cost of funding than many of their peers, and because of that they have lower margins and lower returns on assets and returns on equity. And we think that theyre dramatically improving their funding cost over time. They made a very conscientious effort to attract new clients, bringing with them their transaction accounts and their low-cost deposits, and over time as that funding cost goes down the margins are going to go up. The last reason we like BankUnited is that because we think, given their scarcity value in the most attractive market in Florida, theyre likely going to be a take-out candidate by a larger bank at some point.

BankUnited

10/31/20 through 10/31/21

Can you discuss another company your team thinks is undervalued?

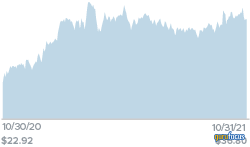

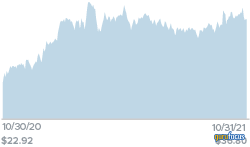

Another company that we really like right now is the Franchise Group (NASDAQ:FRG). Its a unique business model that owns today four consumer businesses. Two are discount furniture retailers, one is Pet Supplies Plus, which is kind of a regional version of PetSmart, and the last is The Vitamin Shoppe. And the reason we like this company is because over time theyre going to transition from owning these assets and operating them themselves towards franchising them and collecting franchise fees as their primary source of revenue. And what that means is higher margins, lower capital intensity, and much more free cash flow. And we studied this in other industries where you move from high capital intensity to low capital intensity and when that happens you see pretty significant multiple expansion. So, thats what we think is going to happen here.

Franchise Group

10/31/20 through 10/31/21

The second reason we like it is that over time we expect them to dramatically diversify their holdings from four concepts today to something much larger, both within the consumer space and outside of the consumer space. And as they do that, theyre going to significantly reduce the reliance and risk of any individual concept, and create a diversified revenue stream of royalty payments, and we think that the markets going to like that a lot.

The thoughts and opinions expressed in the video are solely those of the persons speaking as of November 2, 2021 and may differ from those of other Royce investment professionals, or the firm as a whole. There can be no assurance with regard to future market movements.

The performance data and trends outlined in this presentation are presented for illustrative purposes only. Past performance is no guarantee of future results. Historical market trends are not necessarily indicative of future market movements.

This article first appeared on GuruFocus.