Shortage in Helium Could Send These 2 Gas Stocks Higher

Let’s talk about industrial gas. It’s a big business, because gasses are vital to myriad of industrial and medical applications. While some gasses are common and easy to produce – nitrogen, for example, makes up almost 80% of the air we breathe – others are rare. And helium, which in some applications is irreplaceable, is not only rare but also non-renewable. It’s found in deep mines, trapped by nonporous rock, where it was formed long ago through radioactive decay of other elements.

As for uses, helium is vital to the functioning of MRI machines, as in its liquid state it is the only element cold enough to allow MRI superconducting electromagnets to function properly. It is also used in deep sea diving breathing mixtures, as an inert atmosphere in arc welding, and as a lifting agent for meteorological balloons. Its medical use in MRIs, however, takes up almost one-third of the global supply, making hospitals the largest consumers of helium.

All of this makes helium worth far more than its weight in gold – and that worth is getting pushed higher by a global shortage of the gas. In the US, which produces more than half the world supply, a leak at a Texas helium plant forced a shutdown. At the same time, Russia’s plans to enter the helium market in large way have been derailed by a facility fire that has pushed back planned production at the Amur plant by at least a year, and the Russia-Ukraine war has disrupted trade, making Russian helium doubtful in any case.

The upshot is, that investors have a chance now to break into industrial gas stocks, especially in firms that are equipped to handle helium storage and distribution. We’ve pulled the details on two of these companies from the TipRanks platform; here they are, along with analyst commentary on their prospects.

Linde plc (LIN)

We’ll start with Linde, the largest company in the global industrial gas niche. Linde traces its roots to Germany, and has been in business for almost a century and a half. Today the firm boasts a $143 billion market cap and is the leading provider of atmospheric gasses such as argon, nitrogen, and oxygen, along with volatiles like hydrogen. Linde can provide gasses in pure or mixed forms, and offers engineering expertise in pressurizing or liquifying gasses.

In addition to the more common industrial gasses, Linde also offers a reliable supply network for helium. Sourcing its helium from several geographical locations, including Kansas, Qatar, and Australia, and operating more than 50 transfill facilities around the world, Linde can provide helium to customers anywhere, at any time. The company offers a variety of helium transport, delivery, and storage options, including insulated ISO containers, dewars, multi-cylinder packs, regular gas cylinders, and portable cylinders.

All in all, industrial gas is more than hot air – it’s big business. Linde had annual revenues of $31 billion in 2021, and both revenues and earnings have been rising this year. The company is scheduled to release its 3Q22 results tomorrow – but in 1H22, Linde’s total revenues of $16.67 billion were up 12.4% from 1H21. Earnings in 2Q22 came in at $3.10 per share, for a 15% year-over-year gain.

Covering Linde for Wells Fargo, 5-star analyst Michael Sison is impressed by the company’s ability to thrive even in today’s difficult macroeconomic conditions.

“We believe the company provides investors with a way to invest in defensive growth, as LIN has an unparalleled track record of delivering consistent earnings growth even through economic slowdowns. While near-term uncertainty in Europe and China remain concerns, LIN's volumes have remained resilient so far in 2022. Additionally, LIN has proven its ability to mitigate rampant inflation by passing on energy costs, expanding margins, and lifting its ROC to a record in 2Q22," Sison noted.

"We continue to view LIN as a winner in the decarbonization shift, with a pipeline of +250 potential projects being evaluated to drive the next leg of growth.” the analyst summed up.

Following from his belief in Linde’s strong defensive attributes, Sison rates the stock an Overweight (i.e. Buy), and his price target of $370 implies a 25% one-year upside potential for the shares. (To watch Sison’s track record, click here)

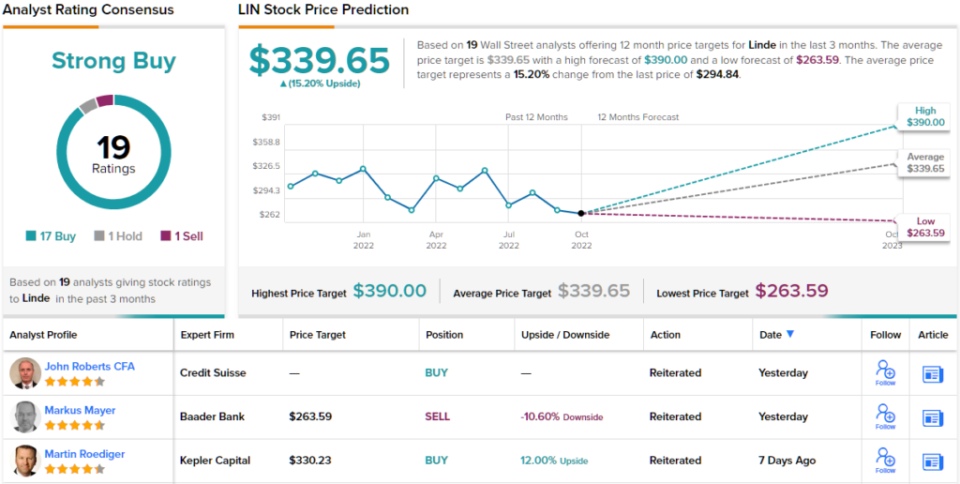

Overall, Linde gets a Strong Buy rating from the Wall Street analyst consensus, based on 19 recent reviews that include 17 Buys, 1Hold, and 1 Sell. The shares are currently trading for $294.84 and their $339.65 average price target suggests ~15% upside in the coming months. (See LIN stock forecast on TipRanks)

Air Products and Chemicals, Inc. (APD)

The next stock we’ll look at is one of Linde’s competitors, Air Products and Chemicals. APD is another major provider of industrial gasses, especially volatiles such as hydrogen, in which it has recently made a half-billion dollar investment in New York State. The company is also known as an important supplier of the air gasses, nitrogen, oxygen, and argon. APD has been in business for over 80 years, operates in more than 50 countries for over 170 thousand customers, and sees approximately $10 billion in annual revenues.

In addition to its air and hydrogen businesses, APD is also knows as an important helium supplier. The company offers helium as a pure gas, at normal pressure, and can also offer it in compressed or even liquified forms. APD has a global network of storage and transfill facilities, allowing it to meet helium orders worldwide with a minimum of loss – an important selling point when dealing in a non-renewable substance.

APD has been reporting steadily increasing revenues for the past two years, and earnings, while not growing as steadily, are also up in that time. In the most recently reported quarter, fiscal 3Q22, the company showed a top line of $3.2 billion, for a 23% year-over-year gain. Adjusted EPS, at $2.62, came in 11% above the year-ago value. In Q3, both the top and bottom lines were the highest in the last two years.

This company has a strong defensive nature, as much of its business is conducted under long-term contracts that will ensure payment for product and a steady bottom-line profit. This is a key point for Seaport’s 5-star analyst Michael Harrison.

“We believe the industrial gas business has impressive built-in growth potential related to the energy transition (including hydrogen and carbon capture), and note APD has ~ $2.3B in new projects coming on stream in FY23, which we believe can drive bottom-line growth even if industrial production slows. More than half of sales are under long-term take-or-pay contracts with built-in pass-throughs that reduce variable cost risk, and we expect these to hold up even in the case of energy rationing in Europe, noting EMEA hydrogen only accounts for 2% of total APD sales," Harrison opined.

In staking out this position, Harrison rates APD shares a Buy, with a $300 price target that suggests a 19% one-year upside potential. (To watch Harrison’s track record, click here)

There are 11 recent analyst reviews on file for APD, and they include 7 Buys and 4 Holds to give the stock a Moderate Buy consensus rating. The shares are trading for $252.02 and have an average price target of $284.55, indicating a potential gain of ~13%. (See APD stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.