2 Undervalued Dividend Champions Worth Considering

For those looking for top dividend growing names, the Dividend Champions can be an excellent place to start a search. Companies with this status have increased their dividends for at least 25 consecutive years.

In this article, we will look at two Dividend Champion stocks that offer decades of dividend growth and market-beating dividend yields and also trade at a discount to their intrinsic values as calculated by the GuruFocus Value chart.

Warning! GuruFocus has detected 8 Warning Signs with BEN. Click here to check it out.

NYSE:BEN) is a leading asset manager that has more than $1.5 trillion in assets under management. The $17 billion company generated revenue of $8.4 billion in its most recent fiscal year.

Following a 3.6% increase for the Jan. 14, 2022 payment date, Franklin Resources has now raised its dividend for 42 consecutive years. The latest increase does trail the dividends compound annual growth rate (CAGR) of 14% for the last decade as the size of the raise has dwindled over the past few years.

However, the stocks new annualized dividend of $1.16 does result in a forward dividend yield of 3.5%. This compares very favorably to Franklin Resources 10-year average yield of 1.9% and the average yield of 1.3% for the S&P 500 Index.

Wall Street analysts expect that Franklin Resources will earn $3.58 in fiscal year 2022, giving the stock a projected payout ratio of just 32%. This is slightly higher than the 10-year average payout ratio of 24%, but in-line with the five-year average. Regardless, the dividend appears well covered.

With shares trading at $33.22, Franklin Resources has a forward price-earnings ratio of 9.3 using analysts estimates. For context, shares have an average price-earnings ratio of more than 13 since 2011, suggesting that the stock is cheaper than usual.

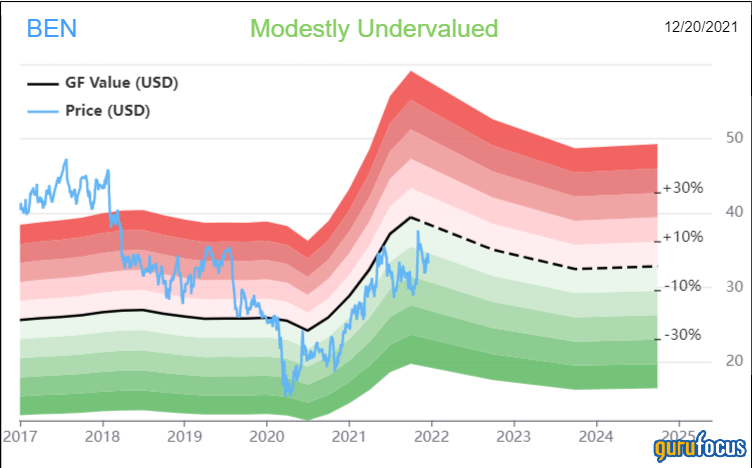

The GuruFocus Value chart also shows the stock to be undervalued.

2 Undervalued Dividend Champions Worth Considering Franklin Resources has a GF Value of $38.46, implying a price-to-GF-Value ratio of 0.86. Reaching the GF Value would reward shareholders with a return of 15.8%. Factor in the dividend yield and total returns could approach 19%.

Hormel

Hormel Foods Corporation (NYSE:HRL) is a leading manufacturer and distributor of meat and food products. The companys portfolio includes brands such as Hormel, Spam, Chi-Chis, Planters and Jennie-O. Hormel has a market capitalization of $26 billion and produced $11.4 billion of revenue in fiscal year 2021.

Hormel raised its dividend 6.1% for the Feb. 15, 2022 payment date, extending the companys growth streak to 56 consecutive years. Hormel, which also qualifies as a Dividend King, has a dividend growth streak going that surpasses nearly every company in the market. The dividend has a CAGR of 14% over the last 10 years as it, too, has seen a deacceleration in growth. On the other hand, the most recent increase is above the five-year CAGR of 5.5%.

Shares yield 2.2% using the new annualized dividend of 98 cents. Hormel has not typically been a high yielding stock, but the new yield is above the 10-year average of 1.9%.

With analysts expecting earnings per share of $1.96 for fiscal year 2022, Hormel has a projected payout ratio of 50%. This is close to the five-year average payout ratio of 48%, but higher than the average payout ratio of 41% since 2011.

At $48.17, Hormel trades at 24.6 times expected earnings at the moment, which isnt too far off the stocks 10-year average price-earnings ratio of 21.8.

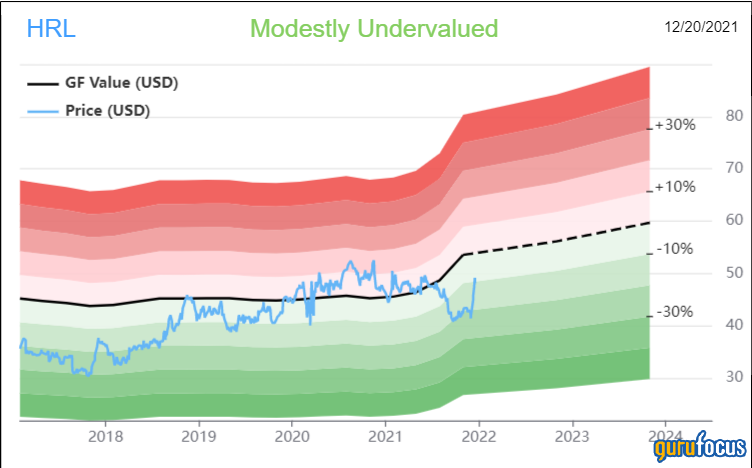

The stock might be on overvalued relative to its own historical average, but the GF Value chart shows upside potential.

2 Undervalued Dividend Champions Worth Considering With a GF Value of $53.90, Hormel has a price-to-GF-Value ratio of 0.89. Meeting the GF Value would result in an 11.9% return in the share price before the dividend yield is even considered - a solid return for a consumer packaged food company.

Final thoughts

The Dividend Champions are a good starting place for research on dividend-paying companies. Both Franklin Resources and Hormel have multiple decades of increasing payments to shareholders. These stocks are also providing a higher than usual dividend yield and trading at a discount to their respective intrinsic values. They offer a minimum of low double-digit total return potential and receive ratings of modestly undervalued from the GF Value chart, suggesting that investors looking for growth and income may find them attractive opportunities.

This article first appeared on GuruFocus.