2 Video Game Stocks to Target in May

Investors should keep their eyes on Take-Two Interactive Software, Inc (NASDAQ:TTWO) and Electronic Arts Inc. (NASDAQ:EA). Despite entering a historically bearish season, both video game stocks landed on Schaeffer's Senior Quantitative Analyst Rocky White's list of best S&P 500 Index (SPX) stocks to own this month.

Per White's data, TTWO averaged a one-month return of 10.8% in May over the last 10 years. Take-two Interactive stock was last seen down 2.1% at $121.48, so a move of similar magnitude would put TTWO near levels note seen since August 2022. The equity's 40-day moving average has provided support since a November pullback to three-year lows. Year-to-date, the shares are up nearly 16%.

An unwinding of pessimism could give the stock additional tailwinds. Over at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), TTWO's 10-day put/call volume ratio of 2.43 stands higher than 90% of readings from the last year. Echoing this, the security's Schaeffer's put/call open interest ratio (SOIR) of 1.06 ranks higher than 81% of annual readings.

TTWO is overdue for upgrades as well; 11 of the 21 brokerages rate the stock a tepid "hold," which leaves ample room for bull notes in the future.

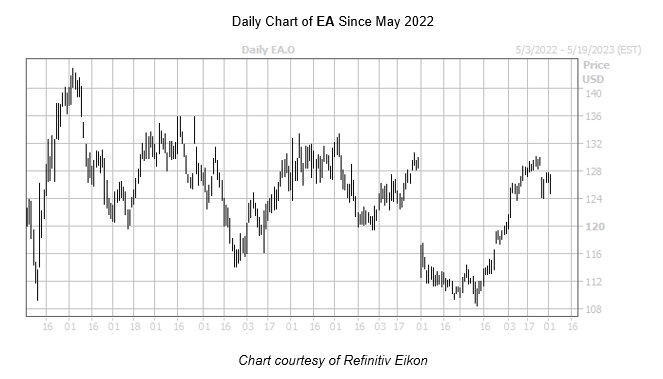

Meanwhile, sector peer EA averaged a 14.1% gain in nine out of the last 10 years. Electronic Arts stock is down 1.9% to trade at $125.01 at last glance, so a comparable to previous years would put EA at its highest level since June 2022. Year-over-year, the equity boasts a 4% lead.

Electronic Arts stock could also benefit from a shift in the options pits. The security's 10-day put/call volume ratio of 1.60 at the ISE, CBOE, and PHLX ranks in the 88th percentile of the last 12 months.