Will 2018 Be American Outdoor Brands Corp.'s Best Year Yet?

Compared with last year, 2018 can't be any worse for American Outdoor Brands (NASDAQ: AOBC), right? The slowdown in gun sales wrecked its stock, which lost 40% of its value, and though data indicates industry weakness will persist, there are some very good reasons to be hopeful that this year will be better, though not its best.

Politics still matter

While the sense of urgency behind buying a gun was largely eliminated at the federal level with the election of President Trump and a Republican Congress, 2017 was a rather tumultuous year in Washington, and 2018 is shaping up as more of the same.

Image source: Getty Images.

There were six special elections held in 2017, five for the House of Representatives and one for the Senate. While the House seats didn't flip parties, the Senate seat did, meaning that Republicans now have just a one-vote margin of control. In 2018, there are four more special elections, all for the House, plus the regular congressional races in November, and early handicapping suggests there may be more turnover.

Not that the pundits haven't been spectacularly wrong in the past, but if the balance of power does shift, many gun owners and enthusiasts might feel more gun-control bills could be passed. Whether they're enacted is another matter, since no major legislative action occurred during the eight years of the previous administration that arguably favored more restrictive laws, yet it might cause gun buyers to rethink their complacency. If that happens, it could push gun sales higher once again.

Restocking still to come

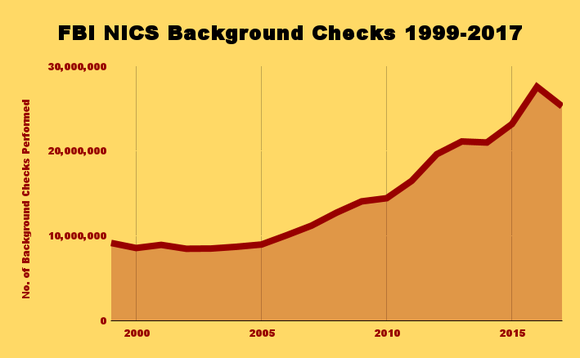

There was a big burst of gun sales just ahead of the Christmas holidays, when the FBI reported the number of background checks it conducted on potential gun buyers exploded to an all-time high on Black Friday.

Because firearms dealers still had a lot of inventory, they were pushing significant discounts on firearms, oftentimes backstopped by the manufacturers themselves to help move product. While that has undoubtedly pulled forward a lot of sales that would have occurred at least in the early part of 2018, meaning there will probably still be sluggishness for the first quarter or two of the calendar year, it should also help manufacturers when dealers need to restock their inventory.

Data source: FBI. Chart by author.

Last quarter, American Outdoor Brands said distributor inventory of its firearms dropped 8% from the prior quarter, or some 19,000 units. Previously, Sturm, Ruger (NYSE: RGR) had reported that distributor inventory had declined quarter-to-quarter some 12,200 units, but that had been well before the Black Friday sales, so inventories may be much lower today.

The great outdoors

Next to the decimation of the firearms industry last year, probably one of the biggest stories for American Outdoor Brands was its formal transition to a diversified company, still focused primarily on firearms but now also targeting the vastly larger rugged-outdoors market.

Although that space was hit with its own upheavals as numerous retailers went bankrupt or got bought out, the remaining players look much more financially stable, meaning the shakeout was probably necessary for the industry.

Last quarter, American Outdoor reported that revenue grew 23% entirely because of the numerous acquisitions it made, while organic growth was essentially flat. Yet that's actually not a negative, considering the retail tumult that occurred. It gives American Outdoor a platform to generate positive organic growth this year.

Better luck in the second half?

It's shaping up to be a mixed bag this year, with at least the first half providing the industry with more of the same challenges it faced last year, but likely turning more positive as the year progresses. We probably won't return to the highs previously seen for some time, though the long-term prognosis for both firearms and the rugged-outdoors market looks exceedingly positive.

With American Outdoor Brands trading at low multiples to its earnings and at a fraction of its sales, investors with a long-term outlook should consider this a chance to pick up shares cheaply with an eye toward considerable appreciation in the future.

More From The Motley Fool

Rich Duprey has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.