3 Agriculture Stocks Poised to Continue Winning Streaks in 2022

The agriculture sector has been benefitting from escalating agricultural commodity prices, which are boosting farm income and encouraging farmers to invest in agricultural equipment and crop inputs. The constant need to nourish crops, replenish nutrients in the soil following a harvest and boost yields support the bullish case for fertilizers.

Investing in stocks like Nutrien NTR, Andersons ANDE and CF Industries CF, which are poised to capitalize on this trend, seems a prudent move.

Last year, the coronavirus pandemic affected U.S agriculture exports and impacted commodity prices. The livestock and dairy markets were hit hard by the overall disruption of the food supply chain and changes in consumption patterns. The sector emerged from the crisis on several COVID-19 aid packages announced by the U.S. Department of Agriculture (USDA) for U.S. farmers and livestock producers. Direct government farm payment is predicted at $27.2 billion for the current year.

Spike in commodity prices and government support have strengthened farm economics in the United States. Per the USDA’s latest farm income report, net farm income is anticipated to increase 23.2% from 2020 to $116.8 billion in 2021 — the highest level since 2013. This upbeat projection is primarily due to farmers and livestock producers benefiting from higher prices on account of tightening global stocks and strong import demand from China throughout the year. Prices of corn and soybean have rallied to multi-year highs this year. Higher agricultural commodity prices will drive crop nutrient demand over the near term. Cash receipts from the sale of agricultural commodities are projected to rise 17.8% to $427.3 billion, buoyed by expected higher revenues from corn, soybean and wheat.

Agricultural commodity prices are gaining traction from a rising demand environment amid limited supply. Further, strong grain and fertilizer demand and supply constraints are likely to push prices higher. These factors will continue to support farm income and farmers will spend more on farm equipment and other products — fertilizers and pesticides to improve yield. Replacement demand for age-old equipment will keep spurring farm equipment demand in the near term.

However, the companies manufacturing farm equipment are encountering rising production costs, owing to raw material cost inflation, particularly of steel, as well as increased transportation costs. Constraints on availability of raw materials, labor and logistical challenges have led to increased lead times for deliveries. These factors might hinder growth. Apart from this, the COVID Delta variant might unfavorably impact commodity prices, which would likely compel farmers to rein in their spending.

Innovation In Farming Technology

Customers are increasingly relying on advanced technology, smart farming solutions and mechanization to run their operations. The companies in the industry are, thus, accelerating investments in launching products equipped with advanced features to keep up with the evolving demands of customers. Initiatives to expand the precision agriculture technology will be a game changer for industry players, given its productivity-enhancing and sustainability benefits. Demand continues to grow for popular features, which automatically guide machines in the field and equipment that plants seeds and applies chemicals and fertilizers with exceptional accuracy. Favorable government policies, rising population and the consequent elevated global demand for food would fuel demand for the farm equipment and fertilizers over the long term.

3 Agricultural Stocks Set to Fly High Next Year

We have picked three Agricultural stocks, which are set to perform well in 2022 and are backed by a Zacks Rank #1. These stocks have been up more than 20% so far this year and witnessing positive revisions. You can see the complete list of today’s Zacks #1 Rank stocks here.

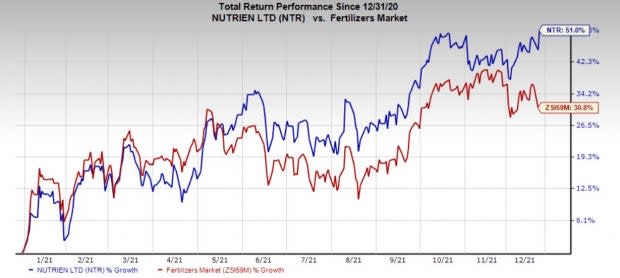

Nutrien: Canada-based Nutrien is a leading provider of crop inputs and services. The company is benefiting from solid demand and higher prices for crop nutrients. It is also gaining from acquisitions, cost efficiency and increased adoption of its digital platform. The company continues to expand its footprint in Brazil through acquisitions, including Tec Agro. These factors have contributed to its share price appreciation of 51% so far this year.

The Zacks Consensus Estimate for Nutrien’s next-year earnings has moved up 37.3% in the past 60 days.

Image Source: Zacks Investment Research

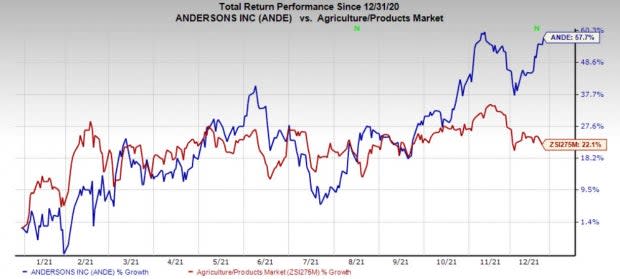

Andersons: Based in Maumee, OH, Andersons is a regional grain merchandiser with diverse businesses in agriculture, plant nutrient formulation and distribution, turf product production, railcar marketing and general merchandise retailing. The company is gaining from rising fertilizer prices on limited supply and a higher level of inventory. It is well-positioned to capture value and growth across its diverse portfolio in commodity markets on strong farm fundamentals. The company’s technological advancement also enables customer-centric innovation. In addition, positive pricing and cost-control initiatives will likely drive margins. ANDE’s shares have appreciated 57.7% year to date.

The Zacks Consensus Estimate for Anderson’s 2022 earnings has moved 29.3% north in the past 60 days.

Image Source: Zacks Investment Research

CF Industries: Illinois-based CF Industries is a leading global manufacturer of nitrogen and hydrogen products for fertilizer, clean energy, emissions reduction and other industrial applications. The company is gaining from higher nitrogen fertilizer demand stemming from healthy corn acres in the United States. Strong global demand and lower global supply availability will drive nitrogen prices higher. It is also committed to boosting shareholders’ value by leveraging strong cash flows. These factors have resulted in a share price rally of 81.3% year-to-date.

In the past 60 days, the Zacks Consensus Estimate for CF Industries’ next year earnings has moved up 95.7%.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research