Can These 3 Auto Parts Retailers Survive the Industry Woes?

The prospects of Zacks Automotive- Retail and Wholesale- Parts industry look lackluster at the moment amid stubborn inflation, aggressive rate hikes and economic uncertainty. Additionally, commodity cost inflation, supply chain snafus and escalating operational expenses may dent earnings of the industry participants. The industry is undergoing a radical change with evolving customer expectations and technological innovation acting as game changers. While the shift to green vehicles may create new opportunities for the industry in the form of more supplicated products and services, there may be some temporary issues that need to be addressed to stay ahead of the game. Stocks like O'Reilly Automotive ORLY, AutoZone Inc. AZO and CarMax KMX seem better positioned to navigate the rough waters of the industry.

Industry Overview

The Zacks Automotive - Retail and Wholesale - Parts industry players execute several functions. These include manufacturing, retailing, distribution, and installation of vehicle parts, equipment as well as accessories. Vehicle parts and accessories include seat covers, antifreeze, engine additives, wiper blades, batteries, brake system components, belts, chassis parts, driveline parts, engine parts as well as fuel pumps. Consumers have two options. They can either opt for repairing vehicles on their own (the ‘do-it-yourself’ or ‘DIY’ segment) or take the assistance of a professional repair facility (the ‘do-it-for me’ or ‘DIFM’ segment). The industry is a highly competitive one and undergoing a radical change, with evolving customer expectations and technological innovation acting as game changers.

What's Influencing the Industry's Outlook?

Economic Challenges Raises Concern: Macro headwinds such as soaring interest rates, stubborn inflation and looming economic uncertainty have muted the prospects of the industry. With inflation at levels not seen in decades, the Fed has been forced to become more aggressive, cranking up borrowing rates. With the Fed set to maintain its hawkish stance, chances of an economic slowdown are on the rise. Amid economic uncertainty, consumers are likely to put off discretionary purchases like cars, in turn, resulting in low demand for vehicles. This is likely to put pressure on the near-term prospects of the auto retail and wholesale parts industry.

Supply Chain Woes Persist: Supply chain disruptions — a byproduct of the COVID-19 pandemic that only got aggravated by the Russia-Ukraine war — are leading to temporary hiccups for the industry. Logistical challenges are likely to continue in the near term, resulting in lost revenues for auto retail parts companies. Additionally, rising commodity costs are expected to put pressure on the margins of the industry participants.

Challenges and Opportunities with Tech Advancement: The introduction of more complex and high-tech vehicles has led consumers to take more professional help, thereby opening up new opportunities for the industry participants. At the same time, capex requirements and R&D costs are on the rise owing to the development of superior technological platforms and sophisticated tools. The auto retail parts industry needs to chalk out a detailed roadmap to make the most out of the opportunities amid the changing market scenario. Omnichannel marketing and digitization ramp up are also escalating operational costs, which may further limit profits.

Zacks Industry Rank Depicts Gloomy Scenario

The Zacks Auto Retail & Wholesale Parts industry is a four-stock group within the broader Zacks Auto-Tires-Trucks sector. The industry currently carries a Zacks Industry Rank #213, which places it in the bottom 15% of around 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates grim near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are pessimistic about this group’s earnings growth potential. Since August, the industry’s earnings estimate for 2022 has decreased 3.1%.

Despite the bleak prospects of the industry, we will present a few stocks that may hold their ground despite challenges. But it’s worth taking a look at the industry’s shareholder returns and current valuation first.

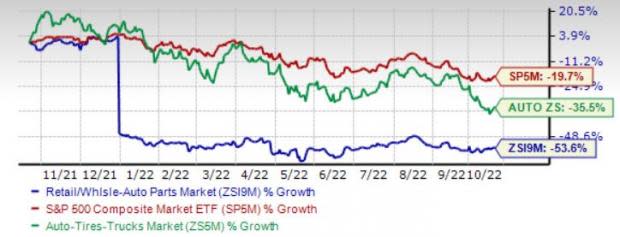

Industry Underperforms Sector and S&P 500

The Zacks Auto Retail and Wholesale Parts industry has underperformed the Auto, Tires and Truck sector as well as the Zacks S&P 500 composite over the past year.

The industry has declined 53.6% over this period compared with the S&P 500 and sector’s decline of 19.7% and 35.5%, respectively.

One-Year Price Performance

Industry's Current Valuation

Since automotive companies are debt-laden, it makes sense to value them based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio.

Based on trailing 12-month enterprise value to EBITDA (EV/EBITDA), the industry is currently trading at 35.53X compared with the S&P 500’s 11.31X and the sector’s 13.26X.

Over the past five years, the industry has traded as high as 39.24X and as low as 15.87X, with the median being at 23.07X, as the chart below shows.

EV/EBITDA Ratio (Past 5 Years)

3 Stocks to Watch

O'Reilly: O'Reilly is one of the noted retailers of automotive aftermarket parts, tools, supplies, equipment and accessories in the United States. The company has been generating record revenues for 29 consecutive years on the back of growth in the auto parts market. ORLY is poised to benefit from store openings and distribution centers in profitable regions. Strong cash flow generation supports the firm’s robust buyback program, thereby boosting investors’ confidence.

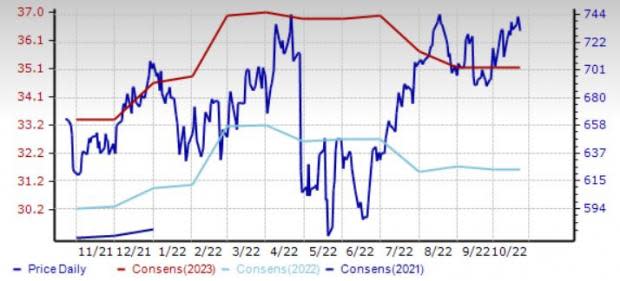

O’Reilly, which currently carries a Zacks Rank #3 (Hold), has a long-term expected EPS growth rate of 12.6%. The Zacks Consensus Estimate for its 2022 earnings and sales indicates a year-over-year uptick of 1.7% and 6%, respectively. ORLY pulled off earnings beat twice in the last four quarters for as many misses, the average surprise being 9.3%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price & Consensus: ORLY

AutoZone: AutoZone is one of the leading specialty retailers and distributors of automotive replacement parts as well as accessories in the United States. It has been generating record revenues for 24 straight years and the trend is expected to continue. The company’s high-quality products, store-expansion initiatives and omni-channel efforts to improve customer shopping experience are boosting its market share.

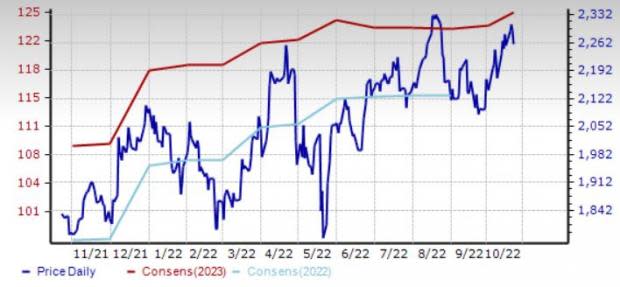

AutoZone, which currently carries a Zacks Rank #3, has a long-term expected EPS growth rate of 13.3%. The Zacks Consensus Estimate for fiscal 2022 earnings and sales indicates a year-over-year uptick of 6.9% and 4.9%, respectively. AZO’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 16.6%.

Price & Consensus: AZO

CarMax: CarMax operates as a specialty retailer of used vehicles. The acquisition of Edmunds has solidified CarMax’s position in the used auto ecosystem. It has enhanced CarMax’s digital capabilities and bolstered long-term prospects. Store expansion initiatives, fast delivery and high-quality products are improving CarMax’s market share. Efforts to leverage data science, automation and AI to improve efficiency and effectiveness within customer experience centers are yielding positive results.

CarMax, which currently carries a Zacks Rank #3, has a long-term expected EPS growth rate of 6.3%. The Zacks Consensus Estimate for fiscal 2023 and 2024 sales indicate a year-over-year uptick of 1% and 2%, respectively. The consensus mark for fiscal 2024 earnings sales indicates a year-over-year uptick of 16.2%.

Price & Consensus: KMX

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

O'Reilly Automotive, Inc. (ORLY) : Free Stock Analysis Report

AutoZone, Inc. (AZO) : Free Stock Analysis Report

CarMax, Inc. (KMX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research