3 Auto Stocks Likely to Zoom Past Q2 Earnings Estimates

The Auto-Tires-Trucks sector is almost halfway through the Q2 earnings season. So far, seven major S&P 500 sector components — Tesla TSLA, Ford F, Genuine Parts, PACCAR PCAR, O’Reilly Automotive ORLY, Cummins and LKQ Corp — have reported quarterly numbers. A host of auto companies are set to unveil quarterly results by the end of this week, including two S&P 500 sector components.

Picture Thus Far

U.S. auto giants Tesla and Ford breezed past the Zacks Consensus Estimate for earnings, and witnessed significant growth in sales and profits on a year-over-year basis. While trucking giant PACCAR delivered mixed results, with earnings topping estimates and revenues lagging the same, specialty retailer of automotive parts O’Reilly posted a comprehensive beat for the second quarter and raised its 2021 guidance. Aftermarket auto parts distributor LKQ and auto replacement parts supplier Genuine Parts also put up a stellar Q2 show, and boosted their full-year projections. Engine maker Cummins, which reported quarterly results today, outpaced earnings and sales mark as well as recorded significant year-over-year growth in both the metrics.

Factors Shaping the Sector’s Q2 Results

Well, despite the chip crisis that has been plaguing the auto market, second-quarter auto sales in the United States grew more than 50% from the prior year — a period heavily impacted by COVID-induced shutdowns. Additionally, the sales figure was slightly higher than the same period in 2019, when adjusted for selling days. Pent up demand for SUVs, preference for personal mobility, easier credit terms, and gradual economic recovery — thanks to stepped up vaccination drive as well as massive fiscal stimulus — resulted in strong sales of vehicles.

Meanwhile, vehicle sales in China — the world’s largest auto market — rose year over year in April, but snapped the 13-month winning streak in May. Vehicle sales dipped more than 12% year over year in June, following May’s decline. Sale of new energy vehicles (NEV) was the bright spot in the China auto market in second-quarter 2021. In fact, NEV sales in China witnessed triple-digit percentage growth in April, May and June. Soaring popularity of electric vehicles (EVs) also contributed toward rising vehicle sales in the United States. On a further encouraging note, passenger and commercial vehicle registrations in the European Union (EU) also witnessed a year-over-year rise during the June-end quarter.

Industry participants are thus anticipated to gain from the EV frenzy and rising vehicle demand, particularly in the United States and EU region. Firms’ focus on operational efficiency is also likely to have paid off. Consequently, second-quarter results are expected to be much stronger than the comparable year-ago period, when consumer demand was shattered and dealerships were shuttered amid pandemic woes.

Per the latest Zacks Earnings Trends report, the auto sector is set to generate earnings of $5.2 billion for second-quarter 2021, reversing the loss of $1.2 billion incurred in the year-ago quarter. The sector’s revenues are expected to grow more than 58% year over year to $85.3 billion.

Selecting Potential Winners

With a wide range of auto firms thronging the investment space, it is by no means an easy task for investors to select stocks having the potential to deliver better-than-expected earnings.

While it is impossible to be absolutely sure about such outperformers, our proprietary methodology — Earnings ESP — makes it relatively simple. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

A positive Earnings ESP is a chief ingredient of our proven quantitative model for identifying stocks with maximum chances of pulling off an earnings beat. It shows the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate. You can further narrow down the list of choices by picking stocks carrying a favorable Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold). Our research shows that for stocks with the above-mentioned combination, chances of an earnings beat are as high as 70%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Our Choices

Below we list three auto stocks that have the right combination of elements to pull off earnings beat for the second quarter:

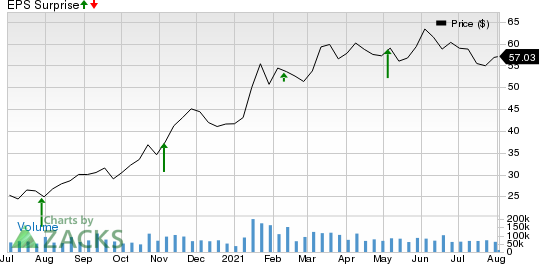

General Motors GM: The U.S. auto biggie has an Earnings ESP of +19.83% and a Zacks Rank #1. It is slated to report quarterly results on Aug 4, before the opening bell. The Zacks Consensus Estimate for the quarter’s earnings and revenues is pegged at $1.89 per share and $29 billion, respectively. General Motors’ retail sales in the United States, its most significant market, jumped to 688,236 vehicles in second-quarter 2021, marking a year-on-year rise of 40%, thanks to strong demand of SUVs and pickups. Sales of NEVs across the company’s brands are also likely to have contributed to robust performance. Importantly, the consensus mark for operating income from the North American segment is $2,229 million, indicating a reversal from a loss of $101 million in the prior-year quarter. Lear surpassed earnings estimates in each of the trailing four quarters, with the average being 75.8%.

General Motors Company Price and EPS Surprise

General Motors Company price-eps-surprise | General Motors Company Quote

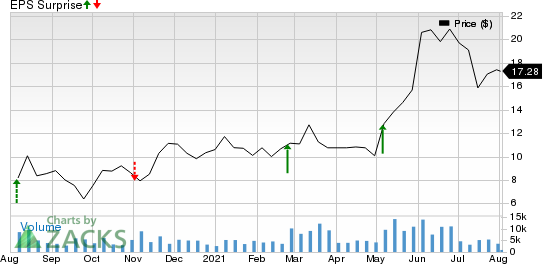

Tenneco TEN: Auto equipment supplier Tenneco has an Earnings ESP of +1.20% and a Zacks Rank #3. It is slated to report quarterly results on Aug 5, before the opening bell. The Zacks Consensus Estimate for the company’s quarterly earnings and revenues is pegged at 79 cents per share and $4.4 billion, respectively. High demand across all the segments — including Clean Air, Powertrain, Performance Solutions and Motorparts — is expected to have driven Tenneco’s second-quarter earnings. Additionally, its focus on cost savings, disciplined capex reductions and other strategic efforts along with Accelerate+ program aimed at enhancing operational efficiency are likely to have stoked the company’s performance during the to-be-reported quarter. Over the trailing four quarters, Tenneco surpassed the Zacks Consensus Estimate on three occasions and missed on the other, with the average surprise being 33.5%.

Tenneco Inc. Price and EPS Surprise

Tenneco Inc. price-eps-surprise | Tenneco Inc. Quote

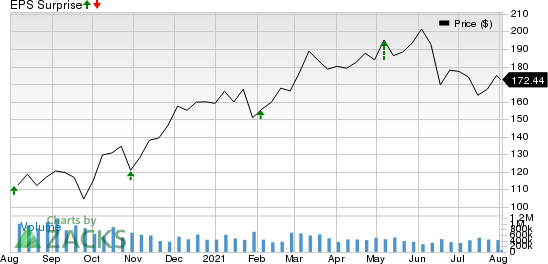

Lear Corporation LEA: Auto equipment provider Lear has an Earnings ESP of +3.05% and a Zacks Rank #3. It is slated to report quarterly results on Aug 6, before the opening bell. The Zacks Consensus Estimate for the company’s quarterly earnings and revenues is pegged at $2.38 per share and $4.8 billion, respectively. Acquisitions of Xevo and M&N Plastics have bolstered the firm’s market share and top-line prospects. Rising consumer demand for vehicle content — requiring signal, data and power management — as well as increasing electrification efforts are expected to have driven demand for Lear’s products. The Zacks Consensus Estimate for revenues from E-Systems and Seating segments is pegged at $1,171 million and $3,670 million, indicating a year-over-year jump of 69.7% and 109%, respectively. It surpassed earnings estimates in each of the trailing four quarters, with the average being 17.1%.

Lear Corporation Price and EPS Surprise

Lear Corporation price-eps-surprise | Lear Corporation Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

OReilly Automotive, Inc. (ORLY) : Free Stock Analysis Report

Tenneco Inc. (TEN) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research