3 Big Stock Charts for Monday: Western Union, BorgWarner and Apache

A rough Friday ensured a relatively ugly week for stocks. The S&P 500’s 0.55% dip on the last trading day of last week translated into a setback of just under 1% for the five-day streak … the worst weekly performance since June. And yet, the bears still haven’t pushed the market past the point of no return.

General Electric (NYSE:GE) was the big winner, up 4.1% in response to the unveiled pay package for new CEO Larry Culp. The plan links a huge portion of his total compensation to the stock’s performance, suggesting shareholders finally have someone directly looking out for their interest. GE’s gain wasn’t enough to offset the impact of losing stocks though, which outnumbered advancers by more than two to one. Dishing out the most damage was (once again) Advanced Micro Devices (NASDAQ:AMD), down another 1.5% as investors rethink the huge advance it’s seen this year.

None of those names are predictable enough to plug into as trading prospects here as the new week begins, however. Rather, take a look at the stock charts of Western Union (NYSE:WU), BorgWarner (NYSE:BWA) and Apache (NYSE:APA), as they’re at or near key technical inflection points.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

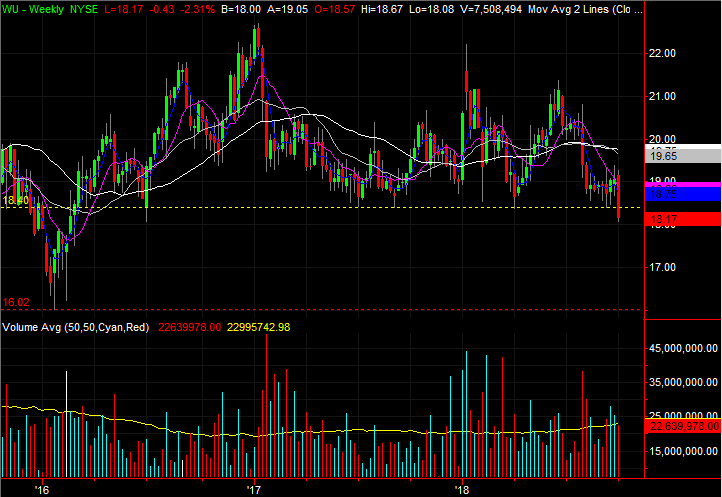

Western Union (WU)

If Western Union rings a bit familiar, there’s a reason. It was one of the stock charts put under the trading microscope back on Sept. 27. At the time, WU shares were trapped in a sideways trading range. Though they were hinting at a bullish breakout, a move out of that range in either direction was possible.

As it turns out, the bears won the battle. Western Union broke below its floor, and as a result may have put a prolonged selling effort into motion.

• The make-or-break line was the $18.38 level, plotted with a yellow, dashed line on the daily chart. Friday’s close of $18.17 was decidedly under that level.

• The next plausible floor is at right around $16, where the stock made a major low in early 2016.

• Though now in technical trouble, don’t be surprised if WU bounces a bit from here. Also don’t read too much into it. The bears’ second effort may be the one that really pushed Western Union over the edge.

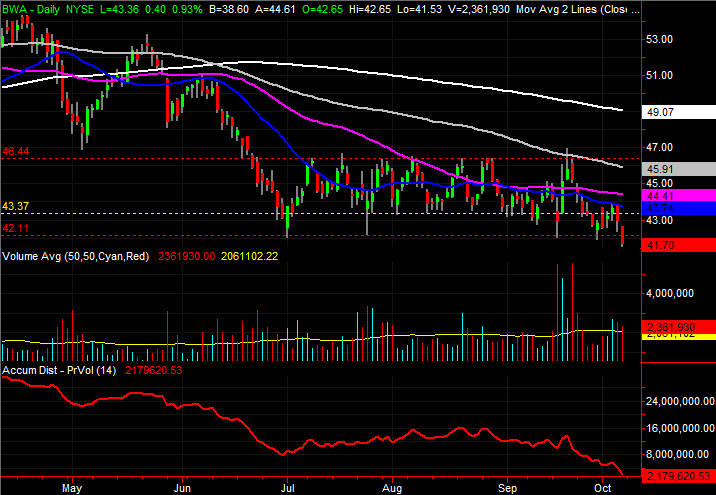

BorgWarner (BWA)

BorgWarner is another name we’ve looked at of late. Back on Sept. 19, it was pointed out that it, like Western Union, was trapped in a sideways trading range. And, like WU, BWA just broke under its last likely floor, setting the stage for what could turn into a sizeable selloff.

• The last of those floors was $42.11. BorgWarner closed at $41.70 on Friday after a failed attempt to work its way back above the blue 20-day moving on the daily chart.

• The next most likely floor is $37.50, where BWA saw a major low in early 2017. Beyond that, the 2016 bottom near $27.50 is the most likely downside target … though a move to that mark is unlikely.

• Note that there has been plenty of bearish and growing volume of late to get the downtrend going in earnest.

Apache (APA)

Finally, it’s a budding trend that is not just closely linked to the rising price of crude oil, but dependent on it. Nevertheless, Apache is knocking on the door of a major technical ceiling. If it can move above it, there’s little left to stand in its way.

• The ceiling in question is $49.60, plotted with a white, dashed line on both stock charts. Last week’s high was the third test of that resistance since the beginning of the year.

• Zooming out to a weekly chart of APA, one can see something of an upside-down head and shoulders pattern. Better still, the second shoulder was formed by support at the 200-day moving average line. That support is highlighted on the daily chart.

• Once past the $50 area, there’s not another prior peak that would make for a good ceiling until on gets to the late-2016 peak near $69. Getting there, of course, largely depends on crude prices remaining firm.

As of this writing, James Brumley did not hold a position in any of the aforementioned securities. You can follow him on Twitter, at @jbrumley.

More From InvestorPlace

The post 3 Big Stock Charts for Monday: Western Union, BorgWarner and Apache appeared first on InvestorPlace.