3 Big Stock Charts for Thursday: Alibaba Group Holding Ltd, Intel Corporation and Boeing Co

The bulls and bears continue to pull the market in varying directions as we head into year-end trading. While the bears appear to have a grip on the technology sector, the bulls continue to push industrial stocks higher.

Today’s three big stock charts look at the numbers and indicators for Alibaba Group Holding Ltd (NYSE:BABA), Intel Corporation (NASDAQ:INTC) and Boeing Co (NYSE:BA) as three stocks that represent this bull/bear tug-of-war.

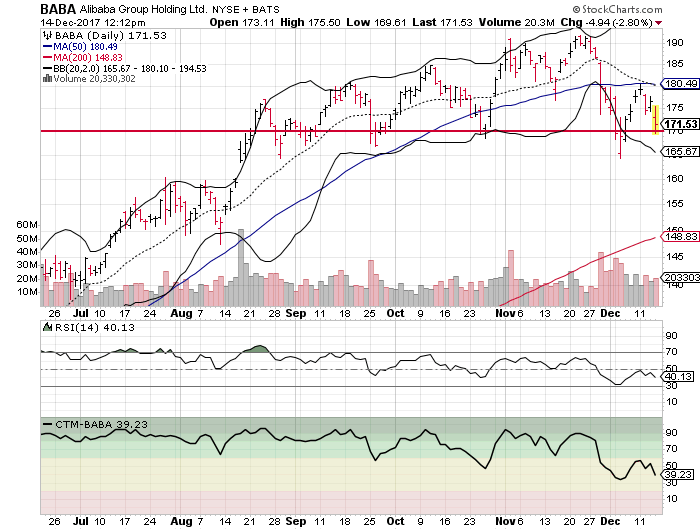

Alibaba Group Holding Ltd (BABA)

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Alibaba has spent much of the last month breaking its trend into a bearish pattern as BABA stock is lacking in technical strength and breadth. Now, shares are sitting at a key price test again, which will determine the next 5-10% move over the next three weeks.

Once again, Alibaba shares find themselves at the $170-level, which has served as round-numbered chart support for BABA stock. The last test of this mark resulted in a short-term rally that has since reversed on heavier selling volume. This time around, there is more concern over $170 holding as BABA stock’s RSI was indicating an oversold condition during the last test of this critical price point. The resulting “dead cat bounce” resulted in a lower high, indicating a strengthening bearish trend with lower highs and lower lows. Alibaba stock’s 50-day moving average is now rolling over, indicating that the intermediate-term outlook for BABA stock is turning negative. Traders will begin selling into the strengthening negative momentum on the stock pushing shares even lower.

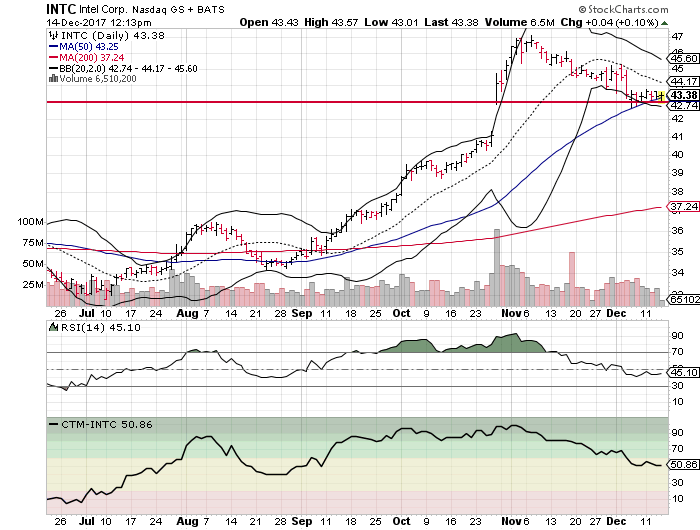

Intel Corporation (INTC)

Intel, along with many of the semiconductor stocks, has been exposed to selling pressure as technical traders have been migrating to the industrial stocks from high-flying tech issues in the fourth quarter. As we’ve mentioned, this follows a seasonal trend so its not unexpected to see INTC slumping.

That said, the chip giant is sitting at a critical technical test that will likely set the course for January’s trading.

For the first time since August, shares of Intel are testing their 50-day moving average as the stock has endured seasonal selling. A break below $43 will trigger a technical selling signal as INTC stock breaks below its 50-day. Momentum has turned negative on Intel shares, resulting in the Chande Trend Meter to slip into neutral territory. This indicates that INTC stock is likely to trade sideways with a negative bias through the end of the year. As we’ve pointed out, the tech sector tends to see strong seasonality in January. In Intel’s case, the stock posts positive returns in January 55% of the time over the last 20 years. A break below the 50-day will reduce the probability that INTC will rally in January along with the rest of the tech sector.

Boeing Co (BA)

Industrial stocks have been booming lately as all indications of the economy’s strength are pointing to continued growth and strength. BA shares have gone parabolic lately as the Boeing’s vision for the future has combined with some strong technical indications.

The charts answer whether its time to buy or sell BA stock as it soars higher.

Boeing shares are trading 10% higher in December. The rally has resulted in an overbought signal from the stock’s RSI, but there are other momentum indicators that continue to suggest that BA is a “buy,” even at this price. The Chande Trend Meter continues to flash buy signals as readings of the momentum/stochastic indicator are forecasting even higher prices for Boeing. BA shares are still riding a volatility rally as the stock remains above its top Bollinger Bands. This activity, along with a relatively low volatility level for the rally, maintain that Boeing stock’s outlook includes prices that are likely to move above $300 within the next week. Given the technical strength and momentum, traders will take any opportunity that BA stock provides to buy at lower prices as a “buy the dip” situation. Watch for fast support to kick-in on Boeing shares on any dip of more than 3%.

As of this writing, Johnson Research Group did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The post 3 Big Stock Charts for Thursday: Alibaba Group Holding Ltd, Intel Corporation and Boeing Co appeared first on InvestorPlace.