3 Big Stock Charts for Tuesday: Ventas, Verizon and Viacom

All things considered, a 0.56% gain from the S&P 500 the day before a monumental election is actually pretty impressive. Most traders would normally be on the sidelines. Perhaps last week’s bounce was a subtle sign that most traders have tacitly decided the outcome is somehow going to be bullish regardless of Tuesday’s voting particulars.

Berkshire Hathaway (NYSE:BRK.B, NYSE:BRK.A) did most of the heavy lifting. Despite a couple of potentially expensive hurricanes ripping across the U.S. coastlines, the company’s insurance operations weren’t hit too hard. Between that good news and word that the investment fund would be using its big profit growth to buy back nearly $1 billion worth of its own shares, Berskhire stock advanced over 4.4%.

At the other end of the spectrum was the 6.7% setback from video game publisher Activision Blizzard (NASDAQ:ATVI). The stock tanked as the latest entry of its “Diablo” franchise — a mobile version this time around — was viewed as a flop among gamers. There were four rising stocks for every three losers though, washing out the adverse impact that ATVI and other bearish names made on the overall market.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

None of those names are compelling trading prospects headed into Tuesday’s action, however. Rather, stock charts of Ventas (NYSE:VTR), Verizon Communications (NYSE:VZ) and Viacom (NASDAQ:VIAB) are shaping up as your best bets. (And yes, it’s a complete coincidence that all three start with the letter ‘V’.)

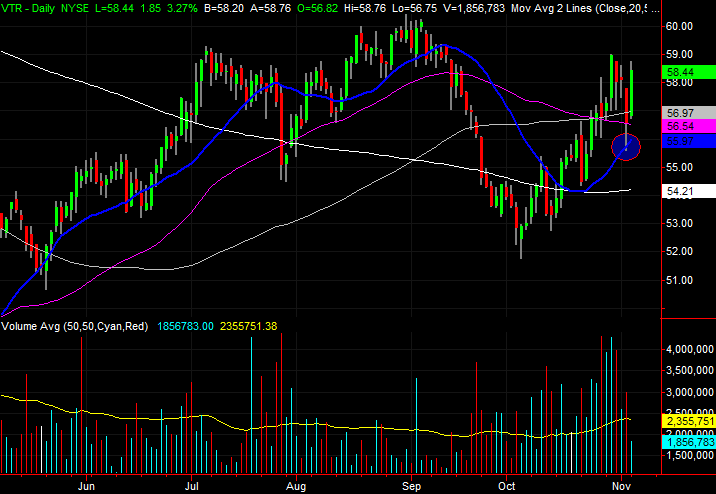

Ventas (VTR)

Healthcare REIT Ventas had a pretty good day on Monday, gaining 3.3% other than a continuation of a rally that began in earnest back in mid-October. But, the gain may mean more than it seems on the surface.

With that one big push, VTR shares are back within striking distance of a huge resistance line that could get things going higher in a much bigger way … and fast.

• Though it’s the less meaningful of the two stock charts of Ventas in view, there is a bullish clue on the daily chart. That is, VTR only had to kiss the blue 20-day moving average line on Friday to rekindle the uptrend that has now carried the stock back above all the key moving averages.

• It’s the weekly chart, however, that serves as the show-stopper. VTR is one good day away from blasting above the falling resistance line that has been holding it back since last year.

• We just got a fresh bullish MACD divergence, and we’re on the verge of seeing the Chaikin line cross above zero, telling us the volume trend has turned net-bullish.

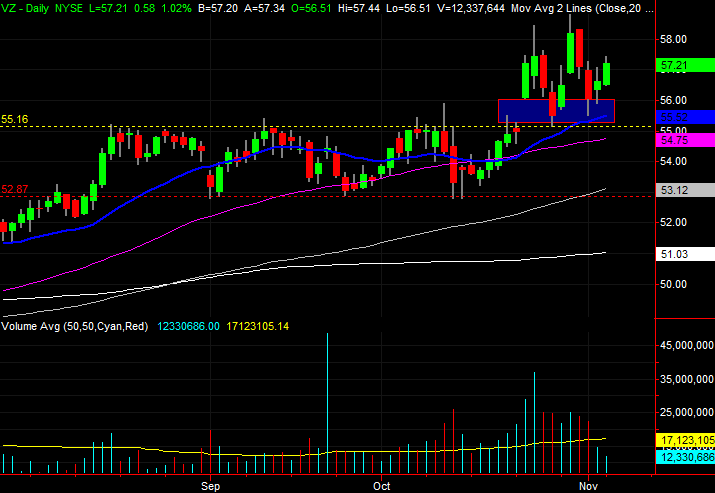

Verizon Communications (VZ)

Verizon shares have made their way onto our trading radar more than once of late, with the most recent look being taken back on Oct. 11. That’s when VZ stock was testing a technical ceiling around $55 … again.

It took one more slide and renewed momentum for shares to finally punch through that ceiling, but they did so a little too well. They left behind a gap on Oct. 23, beckoning the stock lower again. The good news is, that gap has since been closed and the uptrend has been renewed.

• The gap range between $55.27 and $56.09 is plotted in blue on the daily chart. It was filled in on Oct. 26, but the bulls haven’t been shy about buying on the dip.

• Zooming out to the weekly chart, we can get a feel for how much momentum is really behind the move that has carried the stock above the key technical ceiling around $55.

• The one thing missing the past couple of trading days has been solid trading volume, but would-be buyers may only be waiting for the election to be put on the books.

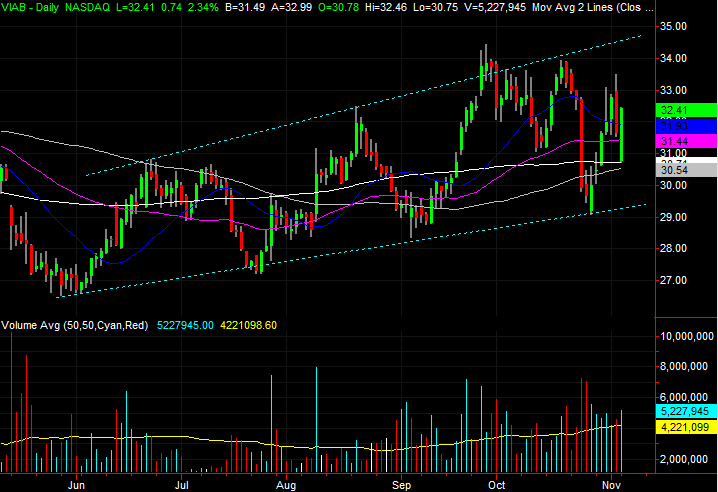

Viacom (VIAB)

Last but not least, Viacom shares have been edging their way higher since June, but in a very erratic fashion. There’s been a method to the madness though, turning an ugly advance into a more stable one from a bigger-picture point of view.

If things go well from here, though, VIAB stock could quietly clear a major ceiling and really put the rally into a higher gear.

• The daily chart plots the expanding trading range that’s guiding Viacom higher. Pay particular attention to the way the buying volume has been growing since the middle of last month.

• On the weekly chart of VIAB, the former floor around $34.60 has since become a ceiling. But, the rising support line continues to force tests of that technical resistance.

• If the ceiling around $34.60 is unable to keep the bulls from charging, the next established ceiling is around $47, where VIAB peaked a couple of times before imploding last year.

As of this writing, James Brumley did not hold a position in any of the aforementioned securities. You can follow him on Twitter, at @jbrumley.

More From InvestorPlace

The post 3 Big Stock Charts for Tuesday: Ventas, Verizon and Viacom appeared first on InvestorPlace.