3 Canadian Energy Giants Worth Betting On Now, Says RBC Capital

Energy firms are some of the biggest players on the Canadian stock exchange. Here we turned to RBC Capital to pinpoint three of the most compelling energy stocks out there right now. These stocks all received recent buy ratings from the firm as well as price targets that indicate robust upside potential lies ahead.

And as you will see, all three stocks also score a bullish Strong Buy consensus from the Street based on all the ratings received over the last three months. TipRanks tracks the ratings of over 6,800 analysts to pinpoint the stocks analysts are most excited about. Let’s take a closer look at these three top stock picks now:

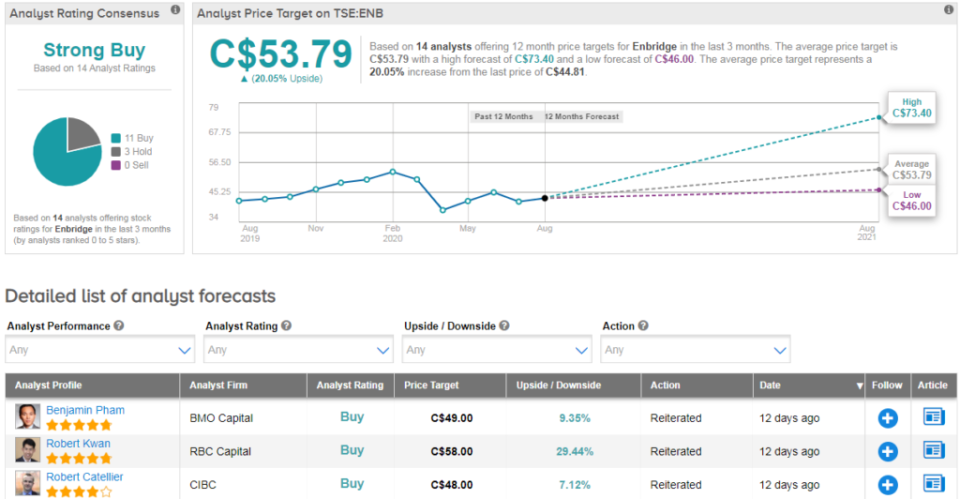

Enbridge (ENB)

RBC Capital’s Robert Kwan has just reiterated his buy rating on Enbridge Inc, following better-than-expected Q2/20 results. His bullish call comes with a C$58 price target, indicating 29% upside potential lies ahead. “We believe that the resiliency and stability of Enbridge's business have been proven by H1/20 results and we think this sets the company apart from many North American peers” the analyst cheered on July 30.

Indeed, on guidance, the company re-affirmed its previously disclosed 2020 DCF/share range of $4.50-4.80 with first-half 2020 results that "exceeded [its] expectations" being tempered by headwinds in the second half of 2020. “At a minimum, [the results] provide a buffer to help Enbridge achieve its 2020 DCF/share guidance that was provided in December 2019 (i.e., before the impact of COVID-19)” commented Kwan.

He believes that Enbridge benefits from a low-risk business model coupled with a strong funding position. On top of the self-funding model for equity, Enbridge is at the low-end of its 4.5-5.0x debt/ EBITDA target range, points out Kwan, adding that the company has enough liquidity to fund its 2020 capital plan more than two times, which mitigates exposure to dislocations in the capital markets.

Overall ENB, which owns and operates the world’s longest crude oil and liquids transportation system, scores a bullish Strong Buy Street consensus thanks to 11 recent buy ratings vs 3 hold ratings. That’s alongside an average analyst price target of C$53.79 (20% upside potential).

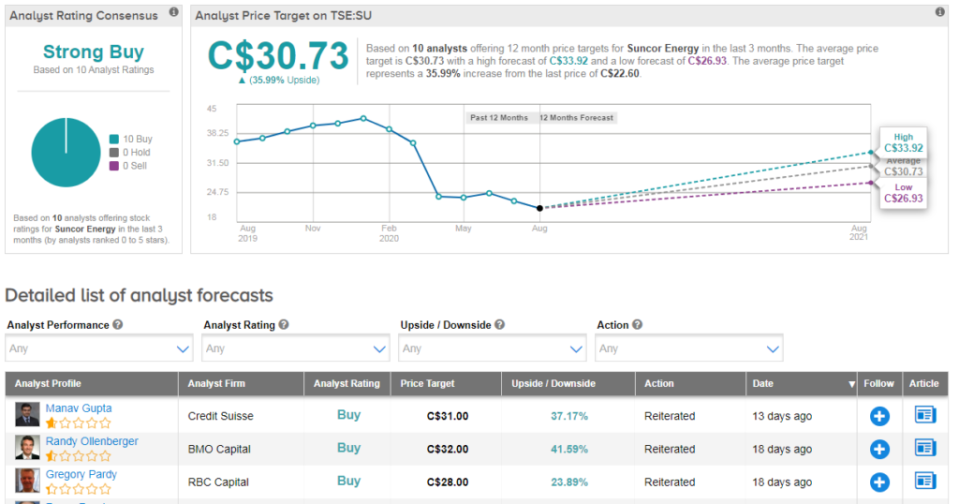

Suncor Energy (SU)

The second-largest oil refiner in Canada, Suncor has just received a buy rating and C$28 price target (24% upside potential) from RBC Capital’s Gregory Pardy- as well as a coveted place on the firm’s Best Energy Ideas List.

“Suncor’s integrated model fueled favorable second-quarter results and reinforced our confidence in its game plan” commented the analyst. Despite gut-wrenching upstream-downstream market conditions in the April–May time frame, Suncor still delivered substantial costs savings as well as a jumbo downstream cash flow contribution of $475 million.

Plus Suncor affirmed its incremental annual free cash flow target of $1.0 billion in 2023 and the full $2.0 billion goal in 2025. “The company’s operating and financial momentum in the second half should fuel debt reduction while the Syncrude bi-directional pipelines and AHS trucks at Fort Hills move into sharper focus” Pardy continued.

He points out that SU is making good headway toward its $1 billion cost-reduction target, with operating, selling & general costs down $643 million year/year and $811 million sequentially in the second quarter. “Some of these cost savings will return as the company ramps up operations, but the direction of cost improvements seems unmistakable to us” he wrote on July 23.

The rest of the Street shares Pardy’s confident outlook. With 10 back-to-back buy ratings Suncor shows a Strong Buy analyst consensus alongside an average analyst price target of C$30.73 (36% upside potential).

TC Energy (TRP)

Based in Calgary, TC Energy’s assets include natural gas pipelines, oil pipelines, power generation, and natural gas storage. The company boasts over 92,600km of natural gas pipelines, 4,900km of oil pipelines, 650 Bcf of gas storage, and 4,000 MW of power generation.

It has also recently scored the thumbs up from RBC’s Robert Kwan, who published a buy rating on TRP on July 31 with a C$81 price target (24% upside potential). With a valuation that sits near its 15-year low on a P/E basis and a core business that the analyst views as "utility-like", he argued that attractive upside potential lies ahead.

“While there may not be a re-rating higher until after the U.S. elections, we highlight the newly-disclosed Columbia Gas rate case that could help with investor sentiment” Kwan wrote. TRP is now filing a rate case for its Columbia Gas system with the proposal for interim refundable rates to come into effect on February 1, 2021. Kwan notes that if this rate case is anything like the ANR rate settlement in 2016 where transportation rates increased 35%, the impact in 2021 could be a material positive.

At the same time, the White House has now issued a revised Presidential Permit for the existing Keystone system (i.e., not Keystone XL), amending a specific throughput restriction. TC Energy now anticipates being able to ramp up throughput in 2021 to accommodate the June 2019 open season for 50,000 b/d.

Net-net TC Energy also shows a Strong Buy Street consensus, with 11 recent buy ratings and 3 hold ratings. Meanwhile the average analyst price target of C$73.97 indicates upside potential of 14%.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment