3 Communication Stocks Likely to Brave the Testing Times

The Zacks Communication - Infrastructure industry appears mired in raw material price volatility due to elevated inventory levels amid a challenging macroeconomic environment, uncertain market conditions and sharp inflationary pressure. Moreover, high capital expenditure for infrastructure upgrades for 5G deployment, inflated equipment costs and margin erosion due to price wars have dented the industry’s profitability.

Nevertheless, CommScope Holding Company, Inc. COMM, DZS Inc. DZSI and Wireless Telecom Group, Inc. WTT are likely to benefit from higher demand for scalable infrastructure for seamless connectivity amid the wide proliferation of IoT, transition to cloud and related next-gen technologies and accelerated 5G rollout.

Industry Description

The Zacks Communication - Infrastructure industry comprises firms that provide various infrastructure solutions for the core, access and edge layers of communication networks. Leveraging proprietary modeling and simulation techniques to optimize networks, the firms offer high-speed network access solutions across Internet protocol, asynchronous transfer mode and time division multiplexed architecture in both wireline and wireless network applications. Their product portfolio encompasses optical fiber and twisted-pair structured cable solutions, infrastructure management hardware and software, network racks and cabinets, fiber-to-home equipment like hardened connector systems, wireless network backhaul planning and optimization products, couplers and splitters, indoor, small cell and distributed wireless antenna systems and hardened optical terminating enclosures.

What's Shaping the Future of the Communication - Infrastructure Industry?

Infrastructure Ramp-Up: With exponential growth in video and other bandwidth-intensive applications owing to the wide proliferation of smartphones and increased deployment of superfast 5G technology, the industry participants are considerably investing in LTE, broadband and fiber to provide additional capacity and ramp up the Internet and wireless networks. These companies are rapidly transforming from legacy copper-based telecommunications firms to technology powerhouses with capabilities to meet the growing demand for flexible data, video, voice and IP solutions. The industry participants are also focusing on leveraging wireline momentum, expanding media coverage, improving customer service and achieving a competitive cost structure to generate higher average revenue per user while attracting new customers.

Demand Erosion: Efforts to offset substantial capital expenditure for upgrading network infrastructure by raising fees have reduced demand, as customers prefer to switch to lower-priced alternatives. Moreover, efforts to build resilient infrastructure facilities to withstand natural catastrophes such as hurricanes and floods add to operating costs. In addition, the latent Sino-U.S. tension relating to trade restrictions imposed on the sale of communication equipment to firms based in the communist country has dented the industry’s credibility and will likely lead to a loss of business. The industry is battling hard-to-mitigate operating risks stemming from volatility in demand, an unpredictable business environment led by the virus outbreak and challenging geopolitical scenarios.

Network Convergence: With operators moving toward converged or multi-use network structures, combining voice, video and data communications into a single network, the industry is increasingly developing solutions to support wireline and wireless network convergence. Although these investments will eventually help minimize service delivery costs to adequately support broadband competition and expand rural coverage and wireless densification, short-term profitability has largely been compromised. Nevertheless, the industry players have enabled enterprises to rapidly scale communications functionalities to a vast range of applications and devices with easy-to-use software application programming interfaces. The firms support high user volumes without affecting deliverability and cost-effectively eliminate performance degradation.

Depleting Margins: Although the supply chain woes have declined progressively, the industry is facing a dearth of chips, which are the building blocks for various equipment used by telecom carriers. Moreover, high raw material prices due to inflation, the prolonged Russia-Ukraine war and the consequent economic sanctions against the Putin regime have affected the operation schedule of various firms. Although steps have been taken to address the global shortage of semiconductor chips and devise ways to increase domestic production, the demand-supply imbalance has crippled operations and largely affected profitability due to inflated equipment prices.

Zacks Industry Rank Indicates Bearish Trends

The Zacks Communication - Infrastructure industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #179, which places it in the bottom 28% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bleak prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1. The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate.

Before we present a few communication infrastructure stocks that are well-positioned to outperform the market based on a strong earnings outlook, let’s take a look at the industry’s recent stock market performance and valuation picture.

Industry Lags S&P 500 & Sector

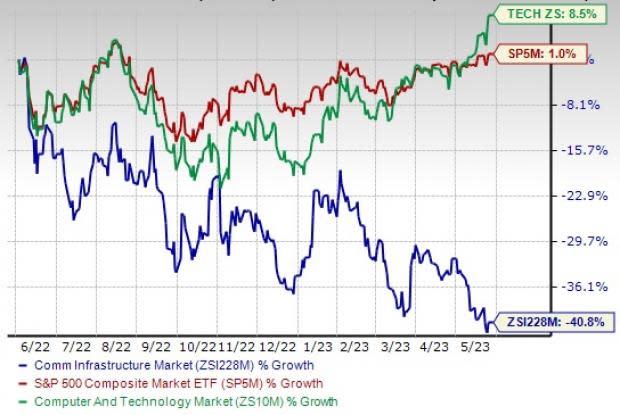

The Zacks Communication - Infrastructure industry has lagged the broader Zacks Computer and Technology sector and the S&P 500 composite over the past year.

The industry has lost 40.8% over this period against the S&P 500 and the sector’s growth of 1% and 8.5%, respectively.

One Year Price Performance

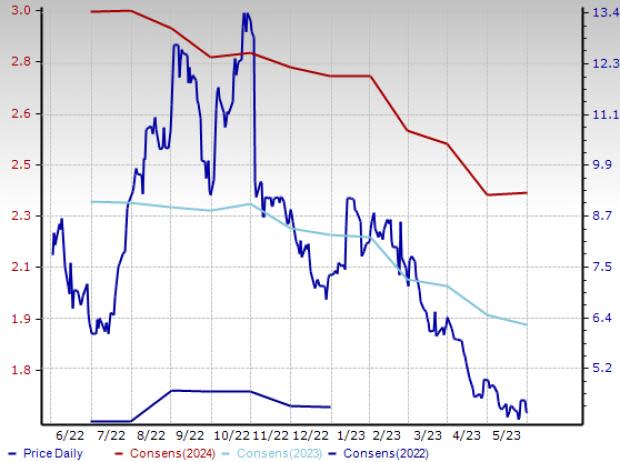

Industry's Current Valuation

On the basis of the trailing 12-month enterprise value-to-EBITDA (EV/EBITDA), which is the most appropriate multiple for valuing telecom stocks, the industry is currently trading at 6.64X compared with the S&P 500’s 12.75X. It is also below the sector’s trailing-12-month EV/EBITDA of 11.90X.

Over the past five years, the industry has traded as high as 12.05X, as low as 6.42X and at the median of 8.38X, as the chart below shows.

Trailing 12-Month enterprise value-to-EBITDA (EV/EBITDA) Ratio

3 Communication - Infrastructure Stocks to Keep a Close Eye on

CommScope: Headquartered in Hickory, NC, CommScope is a premier provider of infrastructure solutions, including wireless and fiber optic solutions, for the core, access and edge layers of communication networks. Since its inception in 1976, the company has created a niche for itself, helping customers scale network capacity, delivering better network response time and performance, and simplifying technology migration. CommScope expects to capitalize on industry tailwinds driven by the increased adoption of HELIAX SkyBlox, which helps operators to put reliable mobile networks in place. The CommScope NEXT initiative is expected to drive future growth that outpaces the market, optimize business processes and unlock shareholder value. The stock has a long-term earnings growth expectation of 17.2% and delivered an earnings surprise of 8.9%, on average, in the trailing four quarters. It has a VGM Score of A. CommScope carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: COMM

DZS Inc.: Founded in 1996 and based in Plano, TX, DZS offers network access solutions and communications platforms for service provider and enterprise networks in the United States, Canada, Latin America, Europe, the Middle East, Africa, Korea and other Asia Pacific countries. The company is likely to benefit from the secular trend of 5G deployment across the globe with healthy traction in the fiber LAN ecosystem. With better visibility and solid order trends, the company is aiming to gain cost efficiencies and introduce new products to the market. The stock carries a Zacks Rank #3.

Price and Consensus: DZSI

Wireless Telecom Group: Headquartered in Parsippany, NJ, Wireless Telecom manufactures advanced RF and microwave components, modules, systems and instruments. The company is likely to benefit from the secular trend of 5G deployment globally with healthy traction in the fiber LAN ecosystem and a robust portfolio of products and services in the wireless connectivity space. With customized solutions targeting niche segments of large and growing end markets, WTT is likely to benefit from the wide proliferation of 5G, network densification, private networks and satellite communications. The collaboration agreement with NXP Semiconductors further expands its scale of operations and reach with several monetization opportunities for the high-margin business of software stack for private LTE/5G networks. This Zacks Rank #3 stock has gained 43.7% over the past year.

Price and Consensus: WTT

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CommScope Holding Company, Inc. (COMM) : Free Stock Analysis Report

DZS Inc. (DZSI) : Free Stock Analysis Report

Wireless Telecom Group, Inc. (WTT) : Free Stock Analysis Report