3 Companies Using Artificial Intelligence to Their Advantage

Artificial intelligence (AI) is already affecting our lives in many ways. From intelligent video curation on Alphabet's (NASDAQ: GOOG) (NASDAQ: GOOGL) YouTube and Google web search to Apple's (NASDAQ: AAPL) Siri personal assistant, AI is already making our lives easier. AI can also help corporations and customers fight against rapidly evolving cyberthreats. For instance, FireEye's (NASDAQ: FEYE) Helix cybersecurity platform is able to automate threat detection and prevention with the help of this emerging technology.

The early adoption of AI by Alphabet, Apple, and FireEye could help them steal a march over rivals. Let's see how.

Image Source: Getty Images.

Alphabet

Alphabet has been leveraging the power of AI to improve services across the board. As already mentioned, AI is helping the company suggest YouTube content based on the viewer's history, as well as making Android devices smarter with the help of Google Assistant.

Meanwhile, Google's 2014 acquisition of DeepMind, which was then worth $500 million, is already helping the company increase data center efficiency. DeepMind's machine learning tech has helped Google reduce the power required to cool data centers by 40%, which should lead to lower operational costs.

But if I were to point out one specific area where AI could help Google improve its business, I need not look beyond the public cloud infrastructure market. As it turns out, Google is currently a laggard in the cloud computing space. Amazon leads the market by a wide margin, while Microsoft is a distant second. Google's share of the public cloud market is just 6%.

But Google's Tensor Processing Unit (TPU) AI chip and TensorFlow algorithm, which is becoming the basis of its cloud infrastructure, could tilt the momentum in its favor. The company claims that its second-generation TPU is 15 to 20 times faster than the competing graphics processing units (GPUs) used to power AI applications in the cloud.

Google has traditionally used NVIDIA GPUs to power its data centers, just like the majority of its cloud rivals. But it will soon start offering cloud services based on the TPU to customers. The company has already made a smart move by giving developers free access to the TensorFlow algorithm so that they can create apps for Google's cloud platform, so it should be able to offer a wide range of cloud-based services to customers on launch.

In fact, Google believes that its cloud services revenue will overtake its advertising revenue in the next couple of years, which is a big deal, as advertising currently supplies 80% of its total revenue. In all, Google parent Alphabet could win big if its TPU and TensorFlow prove successful as the public cloud market is expected to generate $521.8 billion in revenue in 2026 as compared to $138.4 billion last year.

Apple

Smartphone bellwether Apple has been losing ground thanks to the emergence of Chinese players such as Huawei. As it turns out, Huawei had overtaken Apple as the world's second-largest smartphone seller a few times in 2017, and it could do better in 2018 as it reportedly plans to enter the U.S. market with its flagship Mate 10 device.

This could be a thorn in the flesh for Apple as Huawei has drummed up a lot of hype around the AI capabilities of its latest smartphone. It can translate languages by simply pointing a camera at written text, shoot better photos by automatically adjusting settings, and even manage app launches based on notification and user behavior. In fact, Huawei eventually wants to use its artificial intelligence engine to help smartphone users automate thousands of decisions every day.

Now, Apple has been lagging in the AI game so far, with its rivals lapping up start-ups to bolster their position or launching AI-enabled products already. But the good news is that Cupertino is now looking to step on the gas in this space, and the recently launched iPhone X is a step in this direction.

The iPhone X's A11 Bionic processor is equipped with Apple's neural engine that can perform 600 billion operations per second to enable AI features. In simpler words, Apple claims that the iPhone X has 25% more processing power than the iPhone 7, as well as 30% faster graphics performance.

Apple has used the bump in this processing power to seamlessly power AI features such as Face ID, sharing Animoji in messages, and enabling augmented reality (AR) gameplay. More importantly, Apple is looking to pack AI features on the device itself rather than on the cloud thanks to the increased processing power. This allows the company to better protect users' privacy.

Now, Apple is highly secretive about its research, so it is not surprising that there is a lack of advertising material and research papers about its advances in this technology. But Apple executive Phil Schiller has made it clear that its neural engine "is the beginning of the next 10 years for iPhone" to enable fluid user experiences.

More importantly, the new AI-enabled features of the iPhone X, such as Face ID, have been warmly received by customers and should boost demand.

FireEye

Hackers are becoming increasingly intelligent, coming up with new types of cyberattacks such as WannaCry and Petya that are known to lock users' screen so the hackers can unlock them for a ransom. In fact, hackers are known to monitor systems for as long as a year before executing attacks.

AI is the key to prevent such intelligent attacks, which is why FireEye has started relying on machine learning to make its cybersecurity platform more robust. The cybersecurity specialist had launched an end-to-end threat detection and response system in April last year, known as Helix. This platform uses machine learning and other related techniques to detect unseen threats and lowers the threat response time, as well as the time required to fix the flaw.

The good news is that the integration of AI features in FireEye's offerings has helped it boost customer growth and retention. The company added 234 new customers during the third quarter, up from 221 additions during the second quarter. What's more, 90% of FireEye's customers renewed their contracts last quarter. Additionally, its cross-sales increased as 38% of customers bought three or more of its product families.

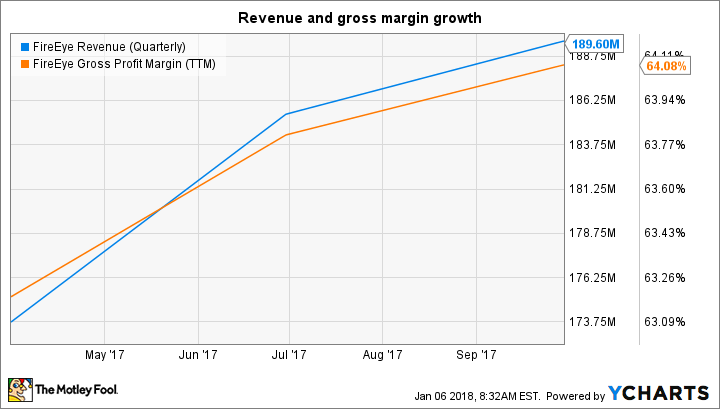

Not surprisingly, FireEye's revenue and gross margin have improved over the past year.

FEYE Revenue (Quarterly) data by YCharts

Now, the cybersecurity market is expected to hit $232 billion in revenue in 2022 as compared to $137.8 billion last year, according to Markets and Markets. So, FireEye should be able to maintain this momentum in the long run provided its execution remains top notch.

The Foolish takeaway

Alphabet, Apple, and FireEye are pulling the right strings by integrating AI into their core products and services. But investors shouldn't look at this space to make a quick buck, as AI is still in its early stages, and it will need time before hitting critical mass. Additionally, all three companies will keep figuring out how to best utilize AI to boost their businesses, so investors need to be patient to take advantage of this emerging tech trend.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Teresa Kersten is an employee of LinkedIn and is a member of The Motley Fool's board of directors. LinkedIn is owned by Microsoft. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Amazon, Apple, and Nvidia. The Motley Fool has the following options: long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool recommends FireEye. The Motley Fool has a disclosure policy.