3 Cybersecurity Stocks to Watch Amid Rising Cyber Attacks

Cybersecurity companies are benefiting from rising demand for IT security solutions owing to the surging number of data breaches. Last month’s ransomware attack on Colonial Pipeline Co. has resurfaced the rising threat that cybercrime poses worldwide. This followed the December 2020 hacking incident at SolarWinds Corporation SWI supply chain.

Accelerated Digitization Boosts Cybersecurity Demand

Increasing requirement for privileged access security on the back of digital transformation and cloud migration strategies are also fueling demand for cybersecurity solutions. The COVID-19 pandemic further prompted the incidence of cyber onslaughts as businesses of all sizes are transitioning their operations to various online platforms.

Now from education to entertainment, working to spending, and even healthcare and much more went virtual causing high technology percolation in everyday lives. This puts not only businesses but also schools, hospitals and other organizations at the receiving end of online assaults.

While public institutions and large companies have always been the target of hackers, smaller organizations with lower security standards are also reaching their radars.

Further, the advent of 5G will enable other devices to connect to the Internet, thereby expanding the scope for Internet of Things (IoT) and artificial intelligence (AI). While IoT and AI will simplify things, it will also aggravate the rate of cybercrime with accessibility of wider options as more and more activity becomes technology reliant.

Investors Should Bank on This Opportunity

Though billions of dollars and data are lost due to cybercrime, there is a positive side to it. Cyber-security companies stand to gain from data breaches as the chances of security-related purchases shoot up.

Furthermore, with rapid technological advancement, organizations are increasingly adopting the Bring Your Own Device (BYOD) policy to enhance employee productivity, with anytime/anywhere access. This trend, in turn, calls for stricter data security measures.

We believe the urgency for tighter security measures will compel enterprises, as well as governments to increase spending on cyber-security software.

Furthermore, besides corporates and government agencies, even individuals are being increasingly exposed to cyberattacks as their personal information is being hacked. This is because the shift to digitization also means that individuals now store their personal and financial details on cloud-based servers. This has resulted in increased threat of such information being hacked and sold online at the cost of the safety of the individual.

Reflective of these developments, a report by Grand View Research stated that the global cybersecurity market is expected to witness a CAGR of 10.9% from 2021 to 2028. Moreover, the report stated that growth of the market will be driven by factors like the rising sophistication of cyberattacks.

Stocks to Focus On

Considering the above-discussed factors, it makes sense to stay invested in this hot industry group as cybersecurity players are likely to witness sturdy growth in the near term.

Here we focus on three stocks that are anticipated to benefit from this elevated spending.

Fortinet Inc. FTNT solutions provide multiple levels of security protection. Demand for the company’s products, such as firewall, virtual private networking (VPN), antivirus, intrusion prevention (IP), web filtering, anti-spam and wide area network (WAN) acceleration has gained momentum amid the pandemic.

Per IDC, in terms of revenues, Fortinet ranks third in Unified Threat Management (UTM) and is one of the fastest growing segments in Network Security. The company’s focus on enhancing its UTM portfolio will boost its market share as well as maintain the leadership position.

Also, the growing uptake of Software-Defined Wide Area Network (SD-WAN) solutions is likely to be a key catalyst for Fortinet in the long run. The buyouts of AccelOps, Meru Networks, Coyote Point, XDN, ZoneFox and Bradford Networks will stoke long-term growth.

Fortinet’s huge customer base of more than 450,000 helps it upsell products within its installed user base. It is currently focusing on selling more subscription-based services, which will generate stable revenues and bolster its margins as well.

The firm’s robust balance sheet with ample liquidity position and no debt obligations is very impressive, which, in turn, will support business growth.

The stock carries a Zacks Rank #3 (Hold), at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The consensus mark for 2021 earnings has been revised upward to $3.74 per share from $3.69 in the past 60 days.

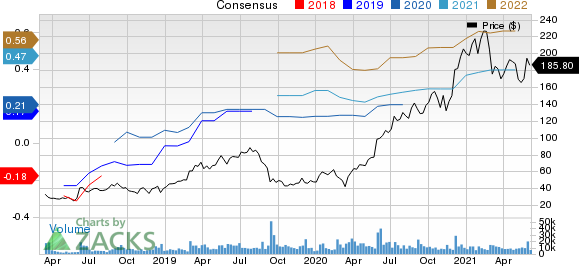

Fortinet, Inc. Price and Consensus

Fortinet, Inc. price-consensus-chart | Fortinet, Inc. Quote

Zscaler Inc. ZS offers a full range of enterprise network security services and the company is benefiting from the pandemic-buoyed demand for its products and services. Growing adoption of SD-WAN solutions could be a key driver for Zscaler over the long run as it is one of the few vendors offering this solution.

Its acquisitions of Smokescreen and Trustdome bode well for the long haul. Additionally, Zscaler’s inherent strength, reflected by a strong balance sheet with ample liquidity position and less debt obligations, will help it record long-term growth.

The consensus mark for fiscal 2021 earnings is pegged at 47 cents per share, having been raised 17.5% over the past 30 days. The stock currently holds a Zacks Rank of 3.

Zscaler, Inc. Price and Consensus

Zscaler, Inc. price-consensus-chart | Zscaler, Inc. Quote

Check Point Software Technologies Ltd. CHKP offers a comprehensive range of software and combined hardware and software products aimed at IT security. The company is riding on the rising demand for security and networking products amid the coronavirus mayhem.

Moreover, surging demand for network security gateways to support higher capacities is aiding the adoption of its remote access VPN solutions. Several Infinity deals in various industries, including government, telecommunication and industrial, are positives.

The consensus mark for the ongoing-year earnings has been revised upward to $6.76 per share from $6.70 in 60 days’ time. Check Point presently carries a Zacks Rank #3.

Check Point Software Technologies Ltd. Price and Consensus

Check Point Software Technologies Ltd. price-consensus-chart | Check Point Software Technologies Ltd. Quote

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Check Point Software Technologies Ltd. (CHKP) : Free Stock Analysis Report

SolarWinds Corp. (SWI) : Free Stock Analysis Report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Zscaler, Inc. (ZS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research