3 Dividend Stocks I'd Buy Right Now

While the dog days of summer have many of us pouring iced coffees and teas to keep us cool, there's another type of flow that investors may actually be yearning for: the steady flow of dividends. With the S&P 500 climbing more than 20% year to date -- and seeming to frequently hit new all-time highs -- it may feel like it's harder and harder to identify bargains in the marketplace. But don't despair -- there are always values to be found. And in this case, the attractive price tags are tied to three dividend-paying stocks.

Representing different industries, Brookfield Renewable Partners (NYSE: BEP), Covanta Holding (NYSE: CVA), and Southern Copper (NYSE: SCCO) are all dividend-paying stocks that I'd gladly add to my portfolio when I can.

Image source: Getty Images.

A renewable energy powerhouse

With a geographic footprint that extends onto four continents, Brookfield Renewable Partners is a limited partnership that has a portfolio of assets representing over 17,400 megawatts of capacity. And while the company proclaims itself as a global leader in hydroelectric power, investors shouldn't be fooled into thinking that the company's prowess ends there; wind, solar, distributed generation, and storage account for 25% of its portfolio.

There are several reasons Brookfield Renewable Partners currently seems attractive. For one, the stock has an enticing dividend yield of 5.74%. Often, a high yield can be a sign that a company's financial health is in jeopardy; in this case, it doesn't apply. In fact, Brookfield Renewable Partners has an investment-grade balance sheet, which should allay investors' concerns regarding the company's ability to safely reward shareholders while servicing its debt. From the stock's debut in 2011 through 2019, the company has raised its annual distribution at a 6% compound annual growth rate, and according to an investor presentation, it has targeted future distribution growth at 5% to 9%. Currently, the stock appears attractively priced at 5.6 times operating cash flow, a bargain versus its five-year average multiple of 6.4, according to Morningstar.

Turning trash into cash

Covanta is an industry leader in environmental solutions. It develops, owns, and operates a network of solid- and liquid-material processing and recycling sites and 40 energy-from-waste (EfW) facilities across the United States.

On the other side of the Atlantic, Covanta has an EfW facility in Dublin, with several more in varying phases of development throughout the United Kingdom. Demonstrating its industry-leading position, Covanta estimates that the U.S. produces about 400 million tons of waste annually, 7% of which ends up in EfW facilities. And of this 7%, Covanta controls about 75% of the market.

Why would I be so eager to pick up shares of Covanta? In 2018, the company generated $100 million in free cash flow, and management forecasts the company will generate free cash flow of about $133 million in 2019, rising to $250 million annually in the mid-2020s. This strong cash flow growth provides management with the potential to cover and grow its dividend in the coming years. Already attractive, Covanta's dividend currently offers a 5.80% yield. And on the recent Q2 conference call, management reaffirmed its pledge to reward shareholders through its dividend policy.

Trading at a price-to-operating cash-flow ratio of 8.4, Covanta may not appear that compelling, considering its five-year average ratio is also 8.4, according to Morningstar. But the stock seems attractively priced by other metrics. For one, it trades at 15.5 times earnings, which is well below its five-year average of 37.4. And it trades at 1.2 times sales -- a shade below its five-year average of 1.3.

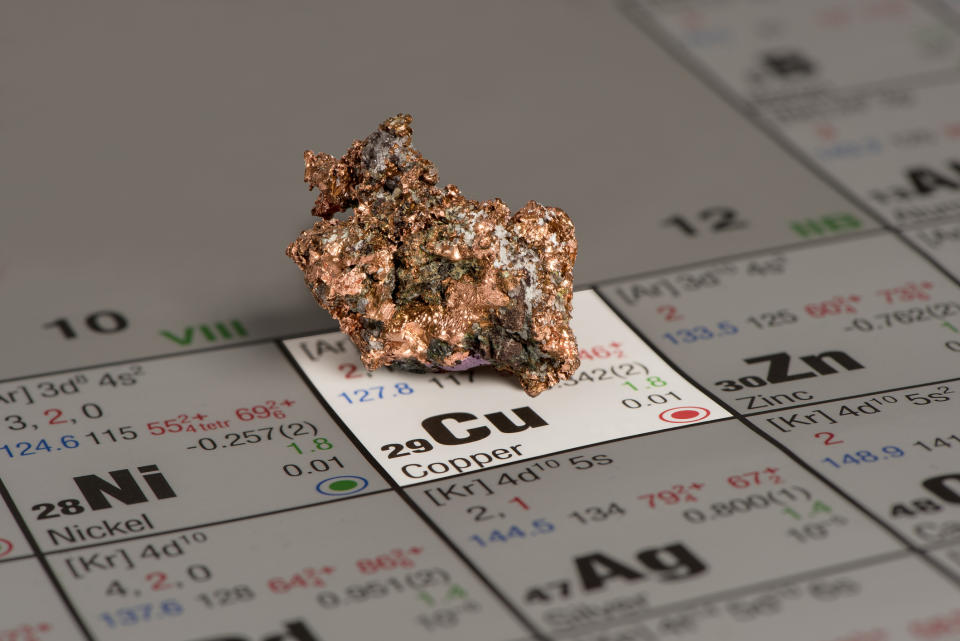

Cop a look at this copper stock

With the price of copper falling steadily over the past several months, many investors may be reluctant to consider a producer like Southern Copper. Its stock has dipped more than 4.7% over the past three months, but if being greedy when others are fearful is good enough for Mr. Buffett, well, it's good enough for me. With the largest copper reserves -- approximately 70 million tons -- among publicly traded stocks, Southern Copper represents a compelling option for investors looking to gain metals exposure. And while copper accounted for 80% of the company's revenue in 2018, it mitigates the risk of a precipitous decline in the copper market by producing other metals: molybdenum, zinc, and silver.

Image source: Getty Images.

Offering investors a 4.32% dividend yield, Southern Copper's stock represents the highest yield among copper stocks -- and one of the higher yields among metal producers in general. Any suspicions that this may raise should be tempered by the fact that the company has maintained an investment-grade balance sheet since 2005. Most recently, the company received a Baa2 rating from Moody's in March 2019, while it earned BBB+ ratings from both Standard & Poor's Rating Services and Fitch Ratings in late 2018.

Perusing the price tag, we find that the bearish sentiment surrounding Southern Copper bodes well for dividend-hungry investors with longer time horizons. Currently, the stock trades at 14.6 times cash flow, a discount to the five-year average multiple of 20.9. Moreover, it represents a bargain in terms of earnings. Whereas the stock's five-year average earnings multiple is 28.4, it currently has a P/E of only 19.7.

A Fool's final takeaway

While I'd be glad to pick up all three of these stocks for my portfolio, Brookfield Renewable Partners and Southern Copper may appeal to more-conservative investors, since both maintain investment-grade balance sheets. For more-aggressive investors, Covanta represents a compelling option.

More From The Motley Fool

Scott Levine has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

This article was originally published on Fool.com