3 Dividend Stocks With Better Yields Than Coca-Cola

If you're looking for a good dividend stock, the three things that probably matter the most are the company's yield, its ability to maintain the payout, and its prospects for raising its dividend regularly. These three big things have made The Coca-Cola Co (NYSE: KO) a dividend-investing stalwart for decades. Coca-Cola offers a solid payout, plenty of earned cash to support its payouts, and sports a history of dividend growth every year for decades -- and it yields 3.2% at recent share prices, .

But Coke is facing challenges as consumers move away from soda, cutting into the company's profits and putting pressure on its ability to continue growing payouts. That's not to say the company is in trouble, but there are better investments to be found. Three that our contributing investors particularly like are energy midstream-giant Magellan Midstream Partners, L.P. (NYSE: MMP), utility stalwart Dominion Energy Inc (NYSE: D), and a real estate investment company banking on a huge trend, Caretrust REIT Inc (NASDAQ: CTRE).

Not only do all three offer higher yields than Coca-Cola, but they're also in better positions to grow their dividends.

Image source: Getty Images.

Higher yield, more dividend growth

Reuben Gregg Brewer (Magellan Midstream Partners, L.P.): It might seem odd to suggest an oil and natural gas midstream partnership like Magellan as an alternative to a beverage company -- but not if you're an income investor. Magellan's yield is 5.3% today, significantly more than you'll get from owning Coca-Cola.

Yield alone, however, isn't a good reason to pick one stock over the other. Coca-Cola has a long history of success and has rewarded dividend investors very well for decades. For example, the average annualized dividend increase was 8.5% over the past decade, 7.7% over the trailing three years, and 6.1% over the past year. Even the lowest number there is twice the historical rate of inflation.

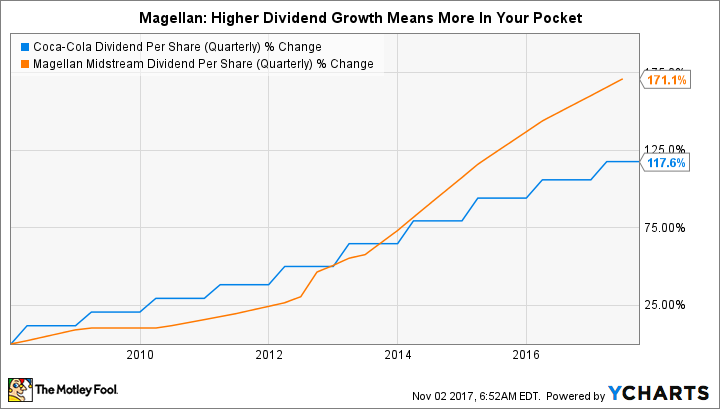

Magellan has done even better, increasing its distribution by 11% annually over the past decade, 15% on average the past three years, and 11% last year. It's currently targeting 8% annual dividend growth over the next few years, far better than the most recent hike at Coca-Cola.

KO Dividend Per Share (Quarterly) data by YCharts.

While Coca-Cola's dividend increased by an impressive 117% over the past decade, Magellan unitholders did even better, with a 170% increase. Clearly, there's more to know about Magellan than this, but you get the idea -- income-focused investors have done better with this oil and gas partnership.

But there's still one more fact worth noting. Magellan has increased its distribution every quarter since it came public in 2001. That's well shy of Coca-Cola's 55 years of consecutive annual dividend hikes, but shows a clear commitment to rewarding investors with regular distribution increases. If you haven't heard about Magellan before, I suggest you do some research today.

A utility stock offering double-digit dividend growth

Neha Chamaria (Dominion Energy): While Coca-Cola still may be able to grow its dividend, there are other companies not only paying higher yields, but offering greater visibility into their dividend growth. Case in point: Dominion Energy.

Dominion is one of the largest electricity and gas utilities in the U.S., with a customer count of more than 6 million. Dominion has increased its dividend for 14 straight years, and currently yields 3.7%. While its dividend streak pales in comparison to Coca Cola's and its yield is only slightly higher, Dominion's path to earnings and dividend growth sets it apart going forward.

Dominion aims to grow its earnings per share at a compounded average rate of 6%-8% between 2017 and 2020 and "at least 5%" beyond 2020. Even better, management is targeting annual dividend growth of 10% through 2020, higher than the 8% growth that the company grew its payout between 2014 and 2017. It's hard to find a utility stock offering double-digit growth in dividends.

Dominion's confidence in its financial goals stems from the investments it made in recent years that are about to bear fruit. As an example, Dominion's Cove Point liquefaction project, which will serve as a key natural-gas export point to serve high-growth regions like the Asia-Pacific and already has service agreements with a Japanese and Indian company, is set to start in coming weeks. This is just one example, and Dominion has several such mega projects under construction, all of which should drive growth and dividends in coming years.

A company on the right side of a long-term trend

Jason Hall (Caretrust REIT): After decades of growing sales and profits largely on the popularity of Coke and Diet Coke, Coca-Cola is now losing share to new beverages that consumers want. Coke will remain a hugely popular brand, and a profitable company for years, but its best growth days ended when the trend of soda consumption shifted away from growth.

There's a growth trend just getting started that investors should take advantage of: The aging of America's baby-boomer generation. Over the next several decades, the 65-plus population in the U.S. is going to double from around 47 million today to almost 100 million. It's going to take significant expansion in senior housing and healthcare facilities to meet the needs of this older population.

Caretrust is one of several companies set to play a big role in this shift. The company has almost doubled its property count and significantly boosted its profits in the past few years, but with a decades-long trend just getting started, the best looks like it's yet to come. Yielding almost 4% at recent prices, it has a better payout than Coke's today. And since it's on the right side of the trend that will drive its growth, Caretrust should be able to grow its payout at a higher rate for many years to come, while Coca-Cola is seeing its most popular products wane in demand.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Jason Hall owns shares of CareTrust REIT and Coca-Cola. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool recommends Dominion Resources and Magellan Midstream Partners. The Motley Fool has a disclosure policy.