3 Dividend Stocks Gurus Like

- By Robert Abbott

The Dividend Stocks screener at GuruFocus finds 616 dividend stocks held by the gurus as of the writing of this article. Another 19 are listed as over-the-counter stocks.

The output from the screener can be sorted in several ways. I've sorted by the largest number of gurus buys in the previous quarter. According to this search, Wells Fargo & Co (NYSE:WFC), Pfizer Inc (NYSE:PFE) and AbbVie Inc (NYSE:ABBV) are the most popular dividend stocks among gurus. In other words, these are the three companies with good dividends that had the highest number of guru buys in the quarter ended Sept. 30.

Warning! GuruFocus has detected 4 Warning Sign with WFC. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Wells Fargo

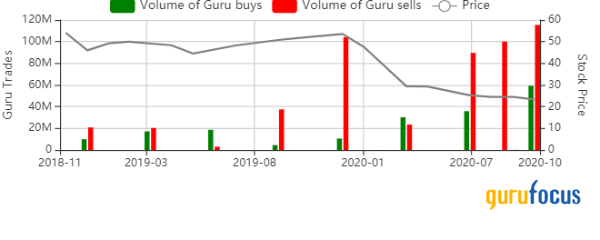

Altogether, 38 gurus hold positions in Wells Fargo, and during the third quarter, 19 bought while 17 sold. However, the sellers were moving more volume than the buyers:

The biggest stakes at quarter's end were held by:

Dodge & Cox with 130,976,235 shares, after adding 26.72% during the quarter

Warren Buffett (Trades, Portfolio) of Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) with 127,380,440 shares, after a reduction of 46.38%

PRIMECAP Management (Trades, Portfolio) with 46,148,380 shares, after a reduction of 1.21%.

The big news here is that Buffett no longer owns the biggest stake in the bank major after holding that position for years. As Sydnee Gatewood pointed out in her article, "Warren Buffett Continues to Cash Out of Wells Fargo," there are several possible reasons for the guru's exit. Those possibilities include a lack of capital gains despite many years of ownership - his average cost per share was about $24 and that was where the share price was in 2017. At the close of trading on Nov. 20, the price was $25.48.

Gatewood also noted that Buffett was unhappy about management's response to the false accounts scandal that became public in 2016 and continues to drag on. In his view, management made mistakes and shareholders are paying the price. The bad news and scandals that have engulfed Wells Fargo will cost shareholders billions of dollars.

However, so far, that hasn't affected the dividends per share. The current dividend yield is 4.79%, the dividend payout ratio is low at 4.18%, the three-year dividend growth rate is 8.20% and the five-year yield-on-cost is 6.47%.

Pfizer

This pharmaceutical company has become a household name in recent weeks because it was the first U.S. firm to announce positive results for a vaccine for Covid-19. The next challenge for Pfizer will be to distribute the vaccine successfully because it must be stored at an extremely low temperature.

Twenty-four gurus had stakes in the drugmaker at the end of the third quarter. Of the gurus, 11 were buyers and 13 were sellers during the quarter. In this case, the buyers had an edge:

The three biggest holdings were those of:

Vanguard Health Care Fund (Trades, Portfolio) with 72,936,910 shares, good for a 5.65% stake after increasing its holding by 0.94%.

Pioneer Investments (Trades, Portfolio), which added 17.22% to finish the quarter with 9,210,653 shares

Diamond Hill Capital (Trades, Portfolio), which reduced its count by 1% to wind up with 8,711,358 shares

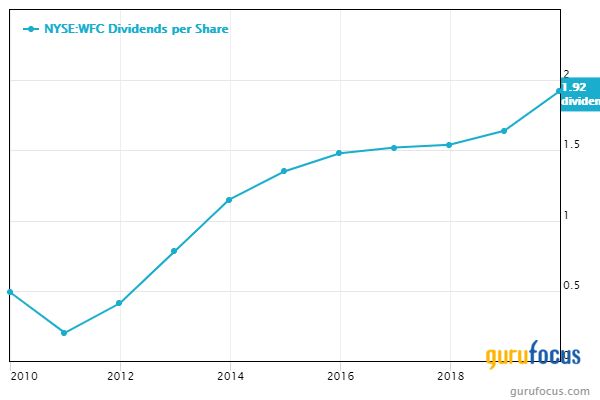

This GuruFocus table below shows the dividend data for Pfizer:

It has steadily increased its dividend payments over the years:

AbbVie

Like Pfizer, AbbVie is a drug company. It is best known for HUMIRA (adalimumab). The North Chicago, Illinois-based firm has specialized in immunology and oncology products but recently acquired another drugmaker, Allergan. That purchase diversifies AbbVie, with new interests in medical aesthetics, women's health and eye care.

This is a relatively young company that has grown rapidly since being spun off from Abbott Laboratories (NYSE:ABT) in 2013. Despite having only an eight-year history so far, it is building a reputation as a dividend stock.

In its annual report for 2019, the company observed:

"A growing dividend is an enduring hallmark of AbbVie's investment identity and in 2019, we increased our quarterly cash dividend 10 percent to $1.18 per share. Since our inception, we have increased our dividend by 195 percent and have been a member of the S&P Dividend Aristocrat Index since 2013."

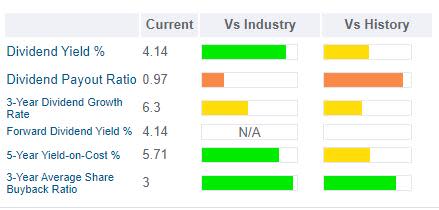

Clearly, the dividend is a major part of its strategy to attract and keep investors. As this dividend table shows, it also rewards shareholders through share repurchases:

The following chart shows consistent growth in the dividend payment:

At the end of the third quarter, the stock was owned by 23 of the gurus and they have been buying more than they have been selling for almost two years:

The top three positions on Sept. 30 were held by:

Warren Buffett (Trades, Portfolio) with 21,264,316 shares, good for a 1.20% stake in AbbVie and representing 0.81% of Berkshire Hathaway's assets

Jim Simons (Trades, Portfolio) of Renaissance Technologies had 13,470,803 shares, after reducing his share count by 39.18% during the quarter

Pioneer Investments (Trades, Portfolio) finished the quarter with 4,987,894 shares, after a reduction of 1.11%.

Conclusion

If you want to invest in dividend stocks, the activity of the investing gurus can help. It never hurts to look at the trades of the best investors. As always, investors should do their own due diligence to ensure they are getting quality companies in addition to above-average dividend yields.

Disclosure: I do not own shares in any of the companies named in this article.

Read more here:

3 New, Undervalued Predictable Stocks

Comparing Total Returns of 3 Auto Groups

An Insurance Holding Company With Promising Returns

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.