3 Fast Growing Dividend Stocks Announce Payments

Crane Co (NYSE:CR), Simmons First National Corporation (NASDAQ:SFNC) and Becton, Dickinson, and Company (NYSE:BDX) announced dividends after the closing bell on Monday, Jan. 28. These fast-growing dividend stocks have also been paying dividends for about three decades.

Crane

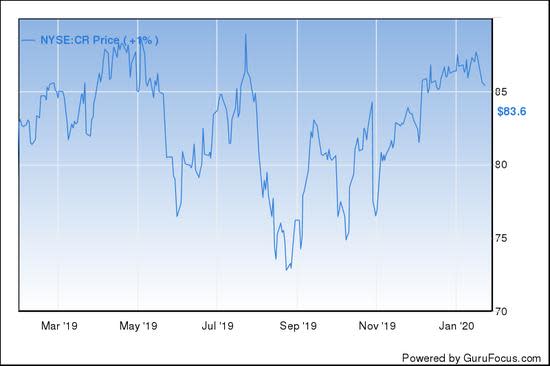

Shares of Crane Co were up 5.11% to a price of $87.85 per share in after-hours trading on Monday after the company announced a 10.3% rise in the quarterly cash dividend to 43 cents per common share, up from the previous dividend of 39 cents.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Crane will pay its shareholders on March 11. In order to benefit, investors must be on the company's books no later than Feb. 28. The ex-dividend date is scheduled for Feb. 27.

Based on Monday's closing share price of $83.58, the quarterly cash dividend generates a yield of 1.87% for both the forward dividend and the trailing 12-month dividend. As of Jan. 27, the industry median yields 2.11% for the forward dividend and 1.92% for the trailing 12-month dividend, while the S&P 500 offers a dividend yield of 1.80%.

The Stamford, Connecticut-based manufacturer and seller of engineered industrial products has paid quarterly dividends since March 1986. Crane has increased the dividend by 6.91% over the past 10 years.

The company funds the quarterly dividend with $394 million cash available on hand. The last 12 months of activities through the final quarter of 2019 produced an operating cash flow of $394 million.

The stock price was almost flat in the past year. The 52-week range is $72.57 to $91.23.

The stock has a market capitalization of $5.01 billion, a price-book ratio of 2.95 and a price-sales ratio of 1.55.

Wall Street sell-side analysts have issued an overweight recommendation rating with an average target price of $94 per share.

Simmons First National

Shares of Simmons First National Corp closed slightly down 0.28% to a price of $24.73 per unit in after-hours on Jan. 27 following the announcement of a 6.3% hike in the quarterly cash dividend to 17 cents per common share, up from the previous dividend of 16 cents.

Simmons will pay the quarterly dividend to its shareholders on April 6. Investors must be registered on the company's books no later than March 16 if they want to receive the payment. The ex-dividend date is scheduled for March 13.

Based on Monday's closing share price of $24.80, the quarterly dividend produces a yield of 2.58% for both the forward dividend and the trailing 12-month dividend. The industry median has a forward dividend yield of 3.11% and a trailing 12-month dividend yield of 3.04%.

The Pine Bluff, Arkansas-based regional bank has paid quarterly dividends since December 1984. The company has grown its dividend by 5.4% over the past decade.

Simmons financially supports the payment of the quarterly dividend with $1.4 billion in cash available on hand and in short-term investments. Plus, the company generated nearly $300 million cash flow from operations over the last 12 months through the most recent quarter ended Dec. 31, 2019.

The stock was flat in the past year. The 52-week range is $22.08 to $27.87.

The stock has a market capitalization of $2.82 billion, a price-earnings ratio of 10.25, a price-book ratio of 0.9 and a price-sales ratio of 3.14.

Sell-side analysts in Wall Street issued a hold recommendation rating for shares of Simmons First National Corporation with an average target price of $29.20.

Becton, Dickinson, and Company

Shares of Becton, Dickinson, and Company were unchanged in after-hours trading on Jan. 27 after the company announced the payment of a quarterly dividend of 79 cents, which is in line with the previous distribution.

The payment will be sent to the company's shareholders on March 31. In order to receive the payment, investors need to be on the company's records not later than March. 10. The ex-dividend date is scheduled for March 9.

Based on Monday's closing share price of $279.75, the quarterly dividend generates a forward dividend yield of 1.13% and a trailing 12-month dividend yield of 1.11%. The industry median yields 1.2% for the forward dividend and 1.12% for the trailing 12-month dividend.

Becton, Dickinson, and Company has paid quarterly dividends since Jan. 2, 1986. The company has grown the dividend by 8.6% in the past 10 years.

The Franklin Lakes, New Jersey-based developer, manufacturer and seller of medical instruments worldwide supports the quarterly dividend with $566 million in cash and cash equivalents. Further, yearly operating activities produced cash flows totaling $3.33 billion through the third quarter of 2019.

The stock price has risen 16% in the past year. The 52-week range is $221.47 to $282.94.

The stock has a market capitalization of $75.84 billion, a price-earnings ratio of 71.75, a price-book ratio of 3.59 and a price-sales ratio of 4.43.

Sell-side analysts in Wall Street issued an overweight recommendation rating for shares of Becton, Dickinson, and Company with an average target price of $285.14.

Disclosure: I have no positions in any securities mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?