3 Financially Strong Oil Companies to Consider as Price War Ends

In an online meeting on Thursday, April 9, Saudi Arabia, Russia and OPEC+ agreed to cut crude oil production by 10 million barrels per day, which is roughly 10% of estimated production levels at the time. This marks the end of the weeks-long oil price war between Russia and Saudi Arabia, in theory if not yet in practice.

Following the news, the price of Brent crude rose 12% to $28.36 during intraday trading before falling back to $23.52, while West Texas Intermediate traded up 11% to $36.40. Considering that Brent crude traded around $50 per barrel on Feb. 28, these gains reflect that the market has little hope of the cuts either happening or producing the desired effects on the profitability of oil companies.

However, there is now more incentive for oil companies to cut production than there was last month, meaning that these cuts are likely to stick. As Saudi Arabia and Russia ramped up production to compete for market share, oil producers around the world found themselves near or below break-even levels, which is particularly unsustainable in a global economic downturn.

This may have been most evident in debt-ridden U.S. shale oil companies, which are known to survive mostly on borrowed money and government subsidies. It's not just the U.S. oil companies that are in debt, though, and as demand for corporate loans increases due to the ongoing Covid-19 crisis, banks are quietly trying to dump the debt of producers even as producers try to tap additional credit lines.

For example, JPMorgan Chase & Co. (JPM) recently marketed at least $50 million worth of the loans that it has made to Saudi Arabian sovereign wealth funds, offering to sell them for around 98.75 cents on the dollar according to Reuters.

"Generally the expectation this year is there will be a lot of asks for the region ... so you make room ahead of that," an anonymous source from the Persian Gulf told Reuters. The source reported that several other international banks have also been trying to sell down exposure to the Gulf in light of an increase in demand for loans.

Thus, as oil prices have the potential to show moderate increases, investors who are interested in the sector's rock-bottom stock valuations may want to stick to the companies that have high financial strength, as these companies are better able to pay their debt and avoid taking out new loans at a time when the market for debt is increasingly clogged up.

According to the GuruFocus All-in-One Screener, a Premium feature, Adams Resources & Energy Inc. (AE), CVR Energy Inc. (NYSE:CVI) and ConocoPhillips (NYSE:COP) are among the few companies in the energy sector with GuruFocus financial strength and profitability ratings of at least 6 out of 10, a cash-debt ratio of 0.5 or above and a price-earnings ratio below 15.

Adams Resources & Energy

Adams Resources & Energy primarily operates in the niche businesses of crude oil marketing and tank trunk operation. Through its GulfMark Energy subsidiary, the company provides marketing, transportation and financial services to oil companies. It is headquartered in Houston.

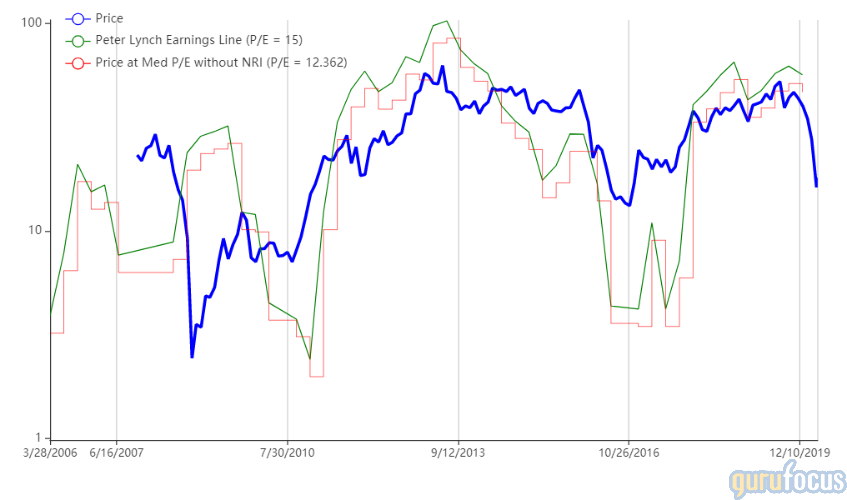

On April 9, shares of Adams traded around $23.32 for a market cap of $98.77 million and a price-earnings ratio of 12.02. According to the Peter Lynch chart, the stock trades below its fair value after declining 42% year to date.

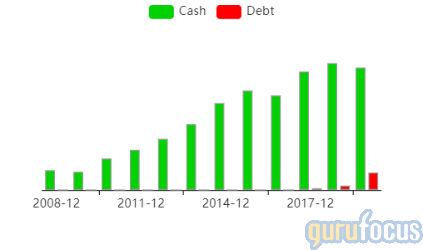

GuruFocus gives the company a financial strength rating of 8 out of 10 and a profitability rating of 6 out of 10. The cash-debt ratio of 7.01 and Altman Z-Score of 6.8 indicate that the company is financially stable in the short term and long term.

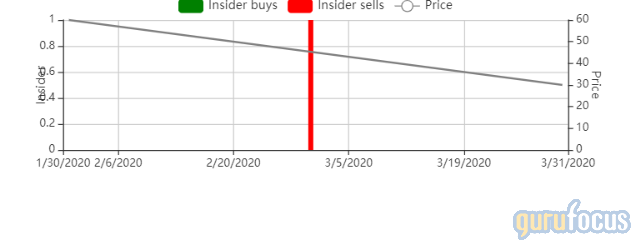

The company has 19.8% institutional ownership and 48.61% insider ownership, with three insider buys in March 2020. The top guru shareholder is Jim Simons (Trades, Portfolio)' Renaissance Technologies with 7.51% of shares outstanding.

CVR Energy

Based in Sugar Land, Texas, CVR energy is a holding company that operates a petroleum refining business and a nitrogen fertilizer business through its wholly owned subsidiaries. Most of its operations are in petroleum refining and marketing.

On April 9, shares of CVR Energy traded around $18.03 for a market cap of $18.03 and a price-earnings ratio of 4.77. The Peter Lynch chart indicates that the stock is trading below its fair value after its 53% drop year to date.

CVR has a GuruFocus financial strength rating of 6 out of 10 and a profitability rating of 7 out of 10. The cash-debt ratio of 0.54, current ratio of 2.17 and Altman Z-Score of 2.81 indicate that the company is able to sustain operations with a comfortable margin of safety.

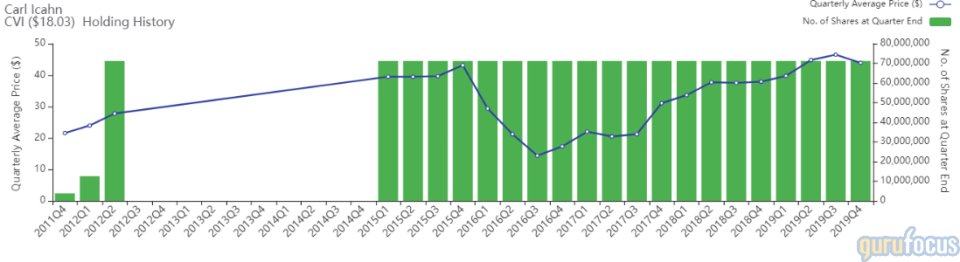

The company has institutional ownership of 14.98% and insider ownership of 0.42%. GuruFocus data indicates that there have been no significant insider transactions recently. Activist Investor Carl Icahn (Trades, Portfolio) owns 70.82% of shares outstanding after first investing in the company in the fourth quarter of 2011. Icahn was rumored to be considering finding a buyer for the company at the height of the 2019 bull market, though this has not yet come to pass.

ConocoPhillips

ConocoPhillips is a multinational energy company headquartered in Houston. As one of the world's largest explorers and producers of oil and natural gas and one of the "Big Five" U.S. oil giants, it enjoys benefits such as government subsidies while also having the strongest balance sheet among its large-cap peers.

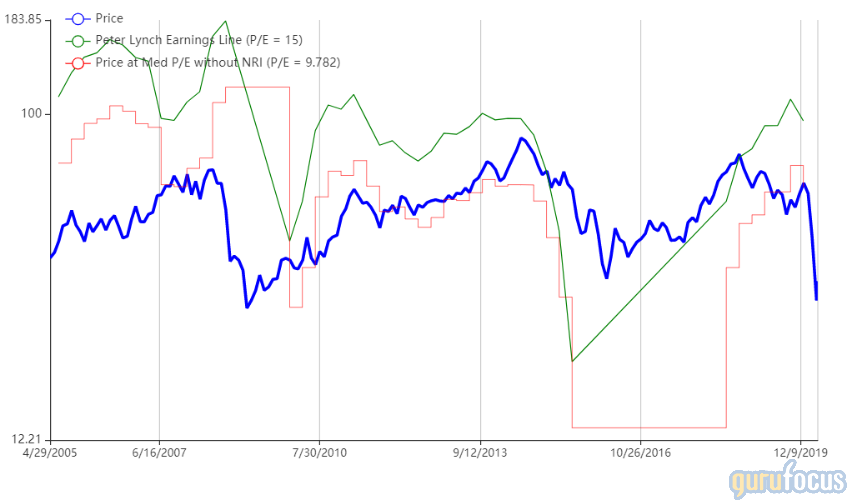

On April 9, ConocoPhillips shares traded around $34.73 for a market cap of $36.47 billion and a price-earnings ratio of 5.44. The Peter Lynch chart estimates that the stock is trading below its fair value after falling 45% year to date.

GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rating of 7 out of 10. The cash-debt ratio of 0.69, current ratio of 2.4 and Altman Z-Score of 2.55 indicate that the company is safe from bankruptcy for at least the next couple of years.

In terms of ownership, 50.11% of the company's shares are owned by institutions, while 0.28% are owned by insiders. GuruFocus data records one significant insider sell in 2020.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research or consult registered investment advisors before taking action in the stock market.

Read more here:

Wells Fargo Could Catch a Break as Asset Cap Is Lifted

Peter Lynch Stocks to Consider on Temporary Setbacks

Why You Might Want to Avoid 'Virus Stocks'

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.