3 Generic Drug Stocks to Watch Amid Inflation Pressures

Despite the easing of COVID restrictions and continued recovery of sales momentum of generic drugs in 2022, generic drugmakers in the United States continue to suffer from macroeconomic headwinds like high inflation and pricing pressures. The strengthening of the U.S. dollar against almost every other currency is causing unfavorable currency fluctuations. Nonetheless, these drugmakers are focusing on new product launches and existing products (which will yield higher gross margins) to support their top line.

Companies like Dr. Reddy’s Laboratories RDY, Amphastar Pharmaceuticals AMPH and Sol-Gel Technologies SLGL are poised to beat the macroeconomic headwinds on the back of continued demand for their existing products, product launches and other favorable macro factors.

Industry Description

The Medical - Generic Drugs industry comprises companies that develop and market chemically/biologically identical versions of a brand-name drug once patents, providing exclusivity to branded drugs, expire. These drugs can be divided into two categories - generic and biosimilar - based on their composition. The generic segment is controlled by a few large generic drugmakers and generic units of large pharma companies. However, several smaller companies also develop generic versions of branded drugs. These drugs are significantly cheaper than the original drugs. Competition in this segment is stiff, resulting in thin margins for manufacturing companies. A few companies in this industry also have some branded drugs in their portfolio, which help them to tap a higher-margin market.

3 Trends Shaping the Future of the Generic Drugs Industry

Loss of Patent Exclusivity of Branded Drugs: Generic drugmakers mainly rely on the loss of patent exclusivity of branded drugs. They apply to the FDA to approve their generic or biosimilar version of branded drugs, which have lost patent protection. Patent loss of blockbuster drugs like AbbVie’s Humira provides significant opportunities for generic drugmakers. Several companies like Amgen, Biogen and Novartis have already received FDA approvals for a Humira-biosimilar. Still, commercialization in the United States is expected to start at different dates after the loss of exclusivity for Humira early next year. However, these generic drugmakers may have to face litigation to market the generic version of these drugs. They may have to wait for several years before being able to launch an approved generic drug. A company may launch an authorized generic version of a branded product, gaining exclusivity for several months over other generic versions of the same drug. Although developing biosimilars is a complex process, the generic players have already launched a few.

Stiff Competition: The generic drug industry provides stiff competition to the original branded drugs. Once a branded drug loses patent exclusivity and generic versions of the same are available in the market, it helps induce competition as these generic competitors set generic prices well below the brand price. Moreover, the competition amongst multiple generic drugmakers to market the same generic drug pulls generic drug prices down, benefiting the consumer. As a result, the generic drugmakers eye for first-to-file (FTF) status for the generic medicines. The current generic market is already crowded, with many drugmakers having several generic filings pending before the FDA. With several biosimilar drugs set for launch over the next couple of years, the top line of the industry players is likely to improve greatly.

Patent Settlements: The successful resolution of patent challenges continues to be an important catalyst for the growth of generic drugmakers, as these can lead to product launches. The settlement of these challenges accelerates the availability of low-cost generic products and removes uncertainties associated with litigation. However, active patent challenges require litigation, thereby leading to higher costs.

Zacks Industry Rank Indicates Sunny Prospects

The Zacks Medical – Generic Drugs industry is a small 17-stock group housed within the broader Zacks Medical sector.

The group’s Zacks Industry Rank is basically the average of the Zacks Rank of all the member stocks. The Zacks Medical – Generic Drugs industry currently carries a Zacks Industry Rank #55, which places it in the top 22% of the 250 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Against this backdrop, we will present a few noteworthy stocks. But before that, it’s worth looking at the industry’s stock market performance and current valuation.

Industry Underperforms S&P 500 and Sector

The Zacks Medical – Generic Drugs industry has underperformed the broader Zacks Medical sector and the S&P 500 Index in the past year.

The industry has declined 34.5% over this period compared with the broader sector’s 16.6% decrease. Meanwhile, the S&P 500 has declined 16.4% in the said time frame.

One-Year Price Performance

Industry's Current Valuation

On the basis of forward 12 months price-to-earnings (P/E F12M), which is a commonly used multiple for valuing generic companies, the industry is currently trading at 8.23X compared with the S&P 500’s 17.79X and the Zacks Medical sector’s 22.69X.

Over the last five years, the industry has traded as high as 13.61X, as low as 7.21X, and at the median of 9.58X, as the charts below show.

Price-to-Earnings Forward Twelve Months (P/E F12M) Ratio

3 Generic Drug Stocks to Keep an Eye On

Dr. Reddy's Laboratories: The company enjoys a strong position in the generics market. During the second quarter of fiscal 2023, Dr. Reddy's witnessed higher North America revenues due to the launch of new products, which helped to partially mitigate the impact of pricing erosion. During the same quarter, Dr. Reddy’s also launched seven new products in North America. As of Sep 2022-end cumulatively, 81 generic filings were pending approval from the FDA (78 abbreviated New Drug Applications [ANDAs] and three new drug applications). However, the decline in COVID product sales has significantly reduced the company’s gross margins.

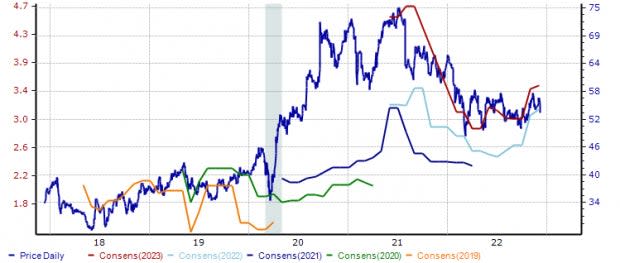

The consensus estimate for fiscal 2023 (year ending March 2023) earnings has improved from $3.09 to $3.16 over the past 30 days. The stock has declined 18.6% in the year so far.

Dr. Reddy's has a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Price & Consensus: RDY

Amphastar: The company develops, manufactures, and markets generic and proprietary injectable, inhalation, and intranasal products, as well as an insulin-active pharmaceutical ingredient. The company is focused on expanding its portfolio of generics and biosimilars. Currently, the company has three generic drugs under review with the FDA. It is also developing three biosimilar drugs and eight generic drugs with significant market opportunity. The company is currently focusing on the sale of higher margin products, including new product launches of vasopressin and ganirelix in August 2022 and June 2022, respectively. The company is also focused on acquiring market share for its glucagon generic product following the discontinuation of branded glucagon products by competitors Lilly and Novo Nordisk.

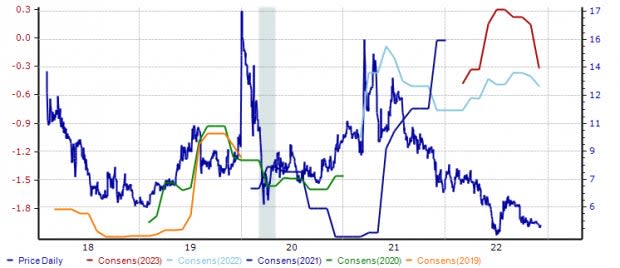

The stock has gained 23.7% in the year so far. The consensus estimate for 2022 earnings have reduced from $1.65 per share to $1.63 over the past 30 days. Amphastar carries a Zacks Rank #3 (Hold).

Price & Consensus: AMPH

Sol-Gel: It is a dermatology company engaged in developing generic topical drug products to treat skin diseases. Sol-Gel’s recently approvedtwo proprietary skin treatment drugs have shown robust uptake. It also sold its rights to certain generic collaborative programs for which it will be eligible to receive royalties. The company believes that its cash resources will fund its operational and capital expenditure requirements through first-quarter 2024.

The consensus estimate for 2022 loss per share has widened from 40 cents to 50 cents over the past 30 days. The stock has declined 37.7% in the year so far. Sol-Gel carries a Zacks Rank #3.

Price & Consensus: SLGL

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dr. Reddy's Laboratories Ltd (RDY) : Free Stock Analysis Report

Amphastar Pharmaceuticals, Inc. (AMPH) : Free Stock Analysis Report

SolGel Technologies Ltd. (SLGL) : Free Stock Analysis Report