3 Graham-Style Stocks to Consider

- By Alberto Abaterusso

To enhance the effectiveness of screening for value stocks, one method is to consider stocks whose "Graham blended multiplier" is less than 22.5. Developed by Benjamin Graham, the father of value investing, the multiplier equals the stock's price-earnings ratio multiplied by its price-book ratio.

Thus, value investors may want to have a look at the following stocks, since their Graham blended multipliers are below 22.5.

Everest Re Group Ltd

The first stock investors should have a look at is Everest Re Group Ltd (NYSE:RE), a Bermuda-based seller of reinsurance and insurance products in Bermuda, the U.S. and internationally.

The stock has a Graham blended multiplier of 13.5, as the price-earnings ratio is 15.5 (versus the industry median of 12) and the price-book ratio is 0.9 (versus the industry median of 1).

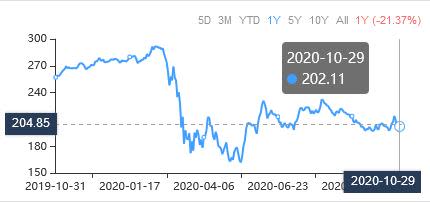

Everest Re Group Ltd's stock traded at $202.11 per share at close on Oct. 29 for a market capitalization of $8.08 billion.

The share price has fallen 21.4% over the past year for a 52-week range of $157.32 to $294.31.

The stock offers trailing 12-month and forward dividend yields of 3.06% as of Oct. 29. The most recent payment, a quarterly cash dividend of $1.55 per common share, was made on Sept. 16.

GuruFocus assigned a score of 6 out of 10 to both the company's financial strength and profitability.

As of October, sell-side analysts on Wall Street recommend two buys, seven holds and only one underperform rating for an average target price of $254.22 per share.

Mylan NV

The second stock investors should have a look at is Mylan NV (NASDAQ:MYL), a United Kingdom-based manufacturer of generic, brand-name and over the counter pharmaceutical products in Europe and internationally.

The stock has a Graham blended multiplier of 17.1, as the price-earnings ratio is 27.1 (versus the industry median of 23.6) and the price-book ratio is 0.6 (versus the industry median of 2.2).

Mylan NV's stock traded at $63.96 per share at close on Oct. 29 for a market capitalization of $2.11 billion.

The share price has fallen by 25% over the past year, determining a 52-week range of $12.75 to $23.11.

The company is currently not paying dividends to its shareholders as the last distribution was made in July 2007.

GuruFocus assigned a rating of 4 out of 10 to the company's financial strength and a rating of 8 out of 10 to its profitability.

As of October, sell-side analysts on Wall Street recommend four strong buys, nine buys and seven hold ratings for an average target price of about $22 per share.

Lincoln National Corp

The third company investors should consider is Lincoln National Corp (NYSE:LNC), a Radnor, Pennsylvania-based life insurance company.

The stock has a Graham blended multiplier of 11.1, as the price-earnings ratio is 34.7 (versus the industry median of 12) and the price-book ratio is 0.3 (versus the industry median of 1).

Lincoln National Corp traded at $34.02 per share at close on Oct. 29 for a market capitalization of $6.57 billion.

The share price has fallen nearly 40% over the past year for a 52-week range of $16.11 to $62.95.

GuruFocus assigned a score of 4 out of 10 to the company's financial strength rating and a score of 6 out of 10 to its profitability rating.

As of October, sell-side analysts on Wall Street recommend two strong buys, four buys, six holds and only one underperform rating for an average target price of $44.55 per share.

Disclosure: I have no positions in any securities mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.