3 Growth Stocks I'd Buy Right Now

The stock market is historically expensive and the current bull market is historically long, but the economy shows few signs of slowing. Whether the economic boost experienced in 2018 is the result of short-term factors such as tax cuts or perhaps a sign of more durable strength from America's increasingly dominant position in energy, it's important to remember that there are stocks worth buying in any market.

Three growth stocks I'd buy right now are animal health leader Zoetis (NYSE: ZTS), ready-mix concrete specialist U.S. Concrete (NASDAQ: USCR), and leading biodiesel producer Renewable Energy Group (NASDAQ: REGI). Here's why.

Image source: Getty Images.

Animals need medicine, too

The animal health industry is largely overlooked by market participants, but it has been a great investment for investors that bought Zoetis following its spinoff from Pfizer in 2013. The animal health stock has put up a total return (stock performance plus dividends) of 201% since its debut, compared to 113% for the S&P 500 in that span. Turns out selling vaccines, medicines, and diagnostics for livestock, cats, and dogs can be pretty lucrative.

Despite climbing to a valuation of more than $43 billion, the business has shown no signs of slowing. In the first half of 2018, the company reported revenue growth of 11% and income before taxes growth of 25% compared to the year-ago period. That prompted management to raise its full-year 2018 guidance by lifting the lower end of its revenue range and boosting its expectations for GAAP earnings per share. Investors that have followed Zoetis lately will see other reasons for optimism.

At the end of July, the company closed its $2 billion acquisition of Abaxis, which wields a leading portfolio of veterinary point-of-care diagnostics. It will add to one of Zoetis' fastest-growing businesses, which has experienced a compound annual growth rate of 10% in the last three years. Throw in R&D pacts with leading human biopharma companies -- such as a five-year collaboration with Regeneron Pharmaceuticals to develop monoclonal antibodies for livestock and pets for a range of ailments -- and it's easy to see there are many untapped opportunities available.

Image source: Getty Images.

Can investors overlook a short-seller report?

Earlier this year Spruce Point Capital issued a short-seller report claiming that U.S. Concrete was up to no good. Right or wrong -- or somewhere in between -- investors and Wall Street panicked and exited the infrastructure stock in droves. It's down over 40% since the beginning of 2018.

While the stench from the report is still lingering, I think investors that keep an open mind will see a great long-term opportunity. For instance, the main argument in the report was that U.S. Concrete was "becoming more dependent on shady acquisitions." That may be a stretch. Although one acquired company had historical ties to organized crime (an unfortunate but small piece of the urban cement industry's past), the company's main goal is to consolidate the hyper-fragmented urban cement industry across the United States. After all, there are an estimated 2,200 producers operating 6,500 manufacturing facilities in the $30 billion industry. Gobbling up smaller players -- sometimes much smaller than publicly traded companies are accustomed to announcing -- is not the same thing as "shady".

The public dispute may only be settled by continued execution of the company's growth strategy. In the second quarter of 2018, U.S. Concrete reported record quarterly revenue of $404 million, marking 19% growth from the year-ago period. Ready-mix concrete sales -- the company's bread and butter -- represented $350 million of that total. The company's aggregate subsidiary Polaris -- another key part of the short-seller report -- delivered record revenue and volume for the quarterly period, too.

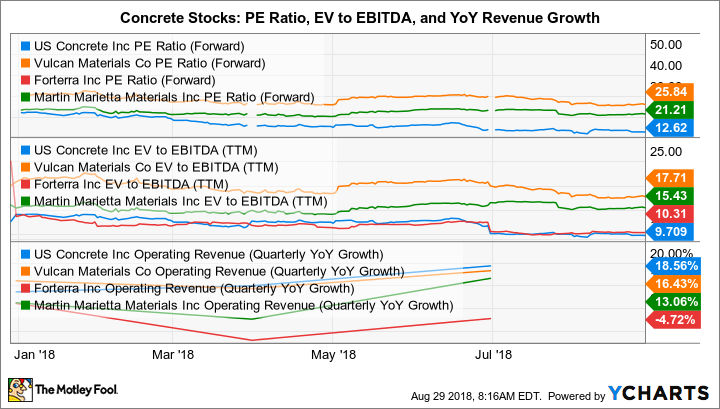

Considering the company's double-digit growth shows no sign of slowing, and the fact that U.S. Concrete stock is now embarrassingly undervalued compared to infrastructure peers, long-term investors may be tempted to give this one a closer look.

USCR PE Ratio (Forward) data by YCharts

Shares are up over 120% -- and still pretty cheap

Renewable Energy Group stock has gained roughly over 120% since the beginning of 2018, but it's still attractively valued. Shares trade at 0.4 times sales, 1.3 times book value, five times trailing earnings, and have an enterprise value-to-EBITDA ratio of 3.2. So, um, what's the catch?

Well, there isn't one. The stock has been chronically undervalued because Renewable Energy Group is a renewable fuels manufacturer that historically has been dependent on federal subsidies for profits. But that appears to have changed for the U.S.' largest biodiesel manufacturer, which in the second quarter of 2018 posted triple-digit growth for gross profit, operating income, and adjusted EBITDA compared to the prior-year period. Wall Street is taking notice by bidding up the stock but, as current valuation metrics suggest, there's still a ways to go.

How can investors be sure that the company is on a sustainable path? This year Renewable Energy Group posted positive net income for the first six months of a year for the first time ever. Importantly, it did so without federal tax credits for renewable fuels, which expired at the end of 2017. The business achieved the milestone thanks to years of steadily growing production volumes and operating efficiency, diversifying by selling petroleum-based diesel fuels through its nationwide network, and building relationships with major transportation fleets looking (or soon to be required) to consume cleaner-burning fuels.

Here's the best part: The currently expired federal tax credits for biodiesel fuels could be retroactively reinstated at a later date. If that occurs, then Renewable Energy Group estimates first-half 2018 adjusted EBITDA would rise from the $59.8 million it actually reported to approximately $168.5 million. Considering the tax credit has in fact been reinstated each time it's lapsed in the past, the potential windfall makes the stock worth a closer look.

Image source: Getty Images.

Growth stocks for long-term investors

One important takeaway from this trio of growth stocks is that stock charts alone don't really tell investors if a company is worth buying or not. For instance, shares of both Zoetis and Renewable Energy Group have soared higher in 2018, but that shouldn't be a signal that investors have missed out on an opportunity to join in the growth. Similarly, U.S. Concrete's collapsing stock price doesn't change the fact that it has a fast-growing business that continues to execute on its strategy to consolidate the fragmented ready-mix concrete market. No matter the recent stock history, I think these three growth stocks are buys.

More From The Motley Fool

Maxx Chatsko has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.