3 Growth Stocks to Buy and Hold for the Next 50 Years

In theory, buying a growth stock and holding it for 50 years sounds straightforward. In reality, it's a white-knuckle experience: There are bound to be ups and downs, and you have to be willing to hold a 10-bagger and not lock in your gains day after day. Emotionally, it can be a minefield.

To help you identify growth stocks worth holding for that time frame, we asked three Motley Fool contributors to pick such a stock. Read below to find out why Amazon (NASDAQ: AMZN), Walmart (NYSE: WMT), and Shopify (NYSE: SHOP) all fit the bill.

Image source: Getty Images.

One company; three growth businesses

Jamal Carnette, CFA (Amazon): It's rare to find a company at the forefront of a business with a long runway for growth. Amazon, however, has three such businesses. While investors are well aware of Amazon's e-commerce operations -- in which it boasts a 50% U.S. market share -- with only 10% of all retail sales and Black Friday sales posting 24% yearly growth, e-commerce has a much longer growth trajectory than many investors think.

In-the-know investors understand that e-commerce isn't Amazon's true profit center. Instead, that is Amazon Web Services, the company's cloud-computing division. It is still posting strong growth rates and is now locking large enterprise clients into longer-term commitments, which will allow it to fend off challengers, most notably Microsoft's Azure, and continue to command this industry.

However, the true growth opportunity may be neither business above and instead the company's nascent digital advertising division. Although it currently lacks the scale of Facebook and Alphabet, it's posting growth rates greater than 100% in this high-margin business and is now the third-largest digital advertising platform in the United States. Digital advertising will continue to post strong growth rates as marketers shift ad spending from television, and Amazon will benefit from missteps by the two incumbents, particularly Facebook.

Fifty years is a long time, and it's likely each of these businesses will mature during this time frame. However, at some point, investors need to understand that Amazon's strong performance in three unrelated industries is a by-product of a culture that truly understands its core customer. That's less likely to change over the next half century.

Still the reigning king of retail

Nicholas Rossolillo (Walmart): I know what you're thinking: Walmart is not a growth company. Its days of fast expansion are well behind it, and the big-box store is facing a sea change in the retail industry brought about by the online shopping movement. While that has given the world's largest retailer headaches in the past, that doesn't mean Walmart isn't making hay off of the fast-growing digital economy.

Let's go back in time a few years. Many pundits were skeptical of Walmart's $3 billion purchase of Jet.com in 2016, and criticism mounted as the retail king went on a buying spree of other smaller digital shopping start-ups in 2017. The acquisition trail continued in 2018 -- most notably when Walmart took control of Flipkart, India's leading e-commerce platform. That price tag was a hefty $16 billion.

Walmart is throwing its weight around in other geographies, too. The company has partnerships with JD.com (NASDAQ: JD) and Tencent Holdings (NASDAQOTH: TCEHY) in China's fast-developing digital marketplace. Then there was the quiet acquisition of Cornershop, a grocery delivery start-up in Latin America, helping Walmart strengthen its presence in its second-largest market after North America.

Image source: Getty Images.

In short, though Walmart isn't showing much top-line growth, it has lots of irons in the fire, with the potential of big payoff down the road. Due in large part to all of those expensive investments, the bottom line has been under pressure; trailing price to earnings is at 55.5. There are signs of initial success, though. U.S. online retail sales were up 33%, 40%, and 43% in the first, second, and third quarters of 2018, respectively. That's proof that Walmart can keep pace with digital revolution and that the company can prosper for the long haul in the global retail industry. It may not be the most exciting company, but this is a stock with growth potential worth holding for the long term.

Catching the big fish before they're big

Brian Stoffel (Shopify): If a small or medium-sized business wants to set up an e-commerce presence -- and they'd be silly not to -- there's increasingly one place for them to go: Shopify. The company's platform not only helps you set up a website but also manages your social media accounts and can handle payments and deliveries -- all from the same spot.

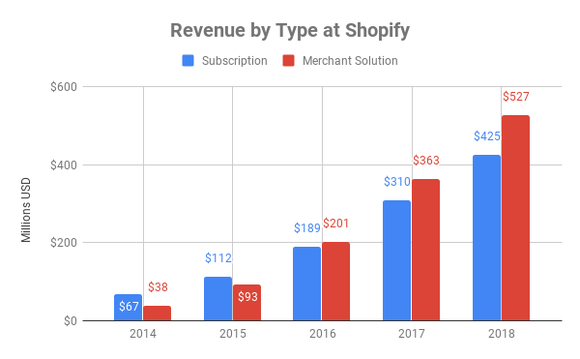

Over the past three years, Shopify has proven its growth chops: Sales have jumped an average of 86% per year. That growth has been split between the company's two services:

Subscription services -- a high-margin software-as-a-service that sets up your website, stores your files, and creates reports and analytics. Service options come in five tiers.

Merchant solutions -- a lower-margin business that helps with shipping and payments.

Since 2014, here's what the breakdown looks like:

Data source: SEC filings. 2018 results are for trailing 12 months as of Sept. 30, 2018.

As you can see, these lower-margin solutions have been a major source of growth. Some have balked at this -- but I think it only adds to the company's moat.

Shopify adds thousands of merchants every year. Some of them will go bust -- this is the nature of small businesses. But those that survive will eventually move to the highest tiers of the subscription service, and the merchant solutions will contribute more and more. Shopify is in the business of catching black swans -- businesses that you don't expect to boom that do anyway.

And as those businesses grow, the switching costs of leaving Shopify will get higher. I expect that -- 50 years from now -- those forces will make this an excellent investment.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Brian Stoffel owns shares of Alphabet (A shares), Alphabet (C shares), Amazon, Facebook, JD.com, Shopify, and Tencent Holdings. Jamal Carnette, CFA owns shares of Alphabet (C shares), Amazon, and Shopify. Nicholas Rossolillo owns shares of Alphabet (C shares), Facebook, Shopify, and Tencent Holdings. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Amazon, Facebook, JD.com, Shopify, and Tencent Holdings. The Motley Fool has a disclosure policy.