3 Growth Stocks for In-the-Know Investors

Investors looking for growth stocks often get stuck in just a few sectors of the market, forgetting that growth can take place in just about any industry and at nearly any time. Here's a trio of growth stocks for in-the-know investors who are willing to look in the obvious areas and beyond for opportunity: Adverum Biotechnologies Inc (NASDAQ: ADVM) hails from a sector known for growth, while industrial concern A.O. Smith Corp (NYSE: AOS) and retailer Best Buy Co Inc (NYSE: BBY) are slightly off the beaten growth path.

Image source: Getty Images.

A monstrous opportunity in gene therapy

George Budwell (Adverum Biotechnologies): Gene therapy stocks have been a hot commodity over the past year as innovations have overcome some of the field's biggest obstacles to efficacy and safety. The small-cap player Adverum Biotechnologies, for instance, has seen a tremendous surge in its share price since the start of the year, and for good reason.

Specifically, the company recently initiated a combined Phase 1/2 clinical trial for its gene therapy, ADVM-043, as a treatment for the rare breathing disorder known as alpha-1 antitrypsin (A1AT) deficiency. And if successful, ADVM-043 could eventually achieve blockbuster status. Backing up this assertion, the current cohort of therapies indicated to treat the symptoms of A1AT generated over $1.2 billion in sales last year, according to Transparency Market Research.

Perhaps the most attractive part of this growth story, however, is that ADVM-043 is designed to be a functional cure for A1AT -- meaning that it has a real shot at rendering these older therapies completely obsolete.

While there's no telling whether ADVM-043 will hit the mark in this ongoing trial, the therapy's monstrous commercial opportunity is arguably enough reason for growth-oriented investors to look closer. After all, unlike traditional drugs and therapies, ADVM-043's efficacy might become readily apparent at an exceptionally early stage in development.

Another key issue is that Adverum has a fairly strong balance sheet for a company of its size and developmental state. After a recent $69 million capital raise, for example, the company is on pace to exit the first quarter of 2017 with over $220 million in cash and cash equivalents. That amount should be more than sufficient to see Adverum through to its next big clinical catalyst.

A boring business that's really exciting

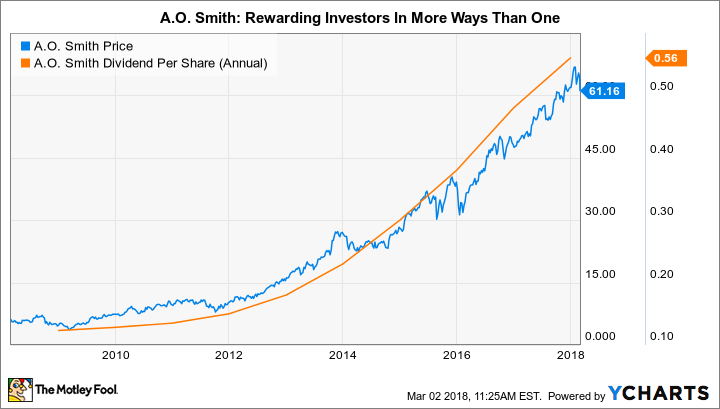

Reuben Gregg Brewer (A.O. Smith Corp): A.O. Smith makes lowly water heaters. These products are so common in the developed world that we don't even think about how incredible a hot shower is until our water heaters break. In the developing world, however, hot water is still a luxury that everyone wants as soon as they can afford it. And that's what's so exciting about A.O. Smith to in-the-know investors.

Over the past decade, A.O. Smith has grown its sales at roughly 21% a year in China as the nation has moved up the socioeconomic ladder. The company has recently begun using its China playbook to expand in India, which it sees as a similarly large growth opportunity. These two countries make up virtually all of A.O. Smith's foreign sales, a category that's roughly 36% of the top line and growing. Sure, growth in developed markets like North America is in the low single digits, but developing markets are expected to help push the company's overall growth rate to around 8% annually.

And then there's A.O. Smith's other businesses, including air purification and water filtration. These are equally exciting in developing nations like China and India, where clean air and water can't be taken for granted. All in all, it looks like A.O. Smith has years of growth ahead of it. And it has a long history of rewarding investors, having strung together 25 years worth of annual dividend hikes (with an incredible compound annual growth rate of 17% over the past decade). If you can appreciate how boring businesses can be exciting growth opportunities in developing markets, then A.O. Smith is a growth stock you'll want to get to know a little better.

An unlikely growth stock

Tim Green (Best Buy): Consumer electronics retailer Best Buy may not seem like a growth stock, but consider the company's results. During the fourth quarter, Best Buy produced comparable sales growth of 9%. Online sales rose 17.9% year over year, comparable domestic appliance sales soared 20.7%, and adjusted earnings per share jumped 25%. It was a blockbuster quarter by any measure.

The company sees comps rising by as much as 2% this year, so don't expect 9% growth to be the new norm. However, earnings should continue to march higher. The company expects adjusted earnings per share to reach a range of $5.50 to $5.75 by fiscal 2021, which wraps up three years from now. That implies annualized growth of about 9.2% at the high end -- not too shabby for a company once thought to be following in the footsteps of Circuit City.

Where will Best Buy's growth come from? The company is working to grow its services business, and signs of progress were evident in the fourth quarter. Comparable domestic services sales jumped 6.7% year over year. The company wants to sell not only gadgets like security cameras and smart home devices, but also security monitoring and home automation services. Becoming a seller of solutions, not just products, is the path forward.

Best Buy stock isn't all that cheap, trading for nearly 17 times fiscal 2018 adjusted earnings. But with solid earnings growth likely over the next few years, Best Buy is a stock you should consider.

Huge gains can happen in any sector

A biotech like Adverum is the kind of company that springs to mind when you hear the words "growth stock," and its prospects back that up. Industrial A.O. Smith and retailer Best Buy, on the other hand, are from areas that you might not think of as growth-oriented today -- but now that you're in the know, you might just want to do a deep dive on these two companies.

More From The Motley Fool

George Budwell has no position in any of the stocks mentioned. Reuben Gregg Brewer has no position in any of the stocks mentioned. Timothy Green owns shares of Best Buy. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.