3-High Earnings Yield Stocks

- By Alberto Abaterusso

To find more value opportunities, investors should look for stocks with returns that at least double 20-year high-quality market corporate bonds.

These bonds represent corporate loans issued by triple-A, double-A and single-A rated companies, which means they are unlikely to have financial problems.

The most recent observation of the Federal Reserve Bank of St. Louis indicates the monthly average spot rate of the 20-year bond is 4.26%.

Warning! GuruFocus has detected 2 Warning Sign with CHL. Click here to check it out.

The intrinsic value of CHL

Thus, the following stocks have price-earnings ratios of less than 11.74 as of May 20 ( the price-earnings ratio is the inverse of the earnings yield) .

Wall Street issued an overweight recommendation rating for all of them, suggesting their share price will head higher in the coming weeks. In contrast, the U.S. stock market is expected to fall nearly 2% over the same period.

Additionally, GuruFocus assigned them a high rating for both financial strength and profitability and growth, indicating a solid balance sheet and profitable business.

China Mobile Ltd. (CHL) traded around $46 per share on Monday for a market capitalization of $190.7 billion. The Hong Kong telecommunication services company has an earnings yield of 9.4% versus the industry median of 5.2% and a price-earnings ratio of 10.68 versus the industry median of 19.33.

GuruFocus assigned a financial strength rating of 9 out of 10 and a profitability and growth rating of 7 out of 10.

The average target price of $54.97 per share reflects 19.5% upside from the closing price on Monday.

The company has a price-book ratio of 1.25 compared to the industry median of 2.07 and a price-sales ratio of 1.78 versus the industry median of 1.5.

Shares of China Mobile Ltd. declined 4.2% over the past year. The closing price on Monday fell within a 52-week range of $43.25 to $55.84.

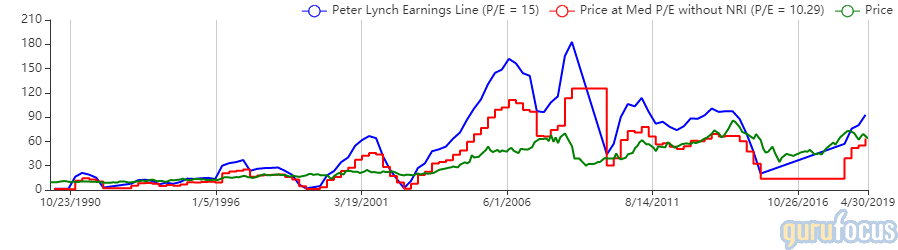

The Peter Lynch chart suggests the stock is cheap.

ConocoPhillips (COP) was trading around $62.45 on Monday for a market capitalization of $70.58 billion. The Houston, Texas-based oil and gas exploration and producing company has an earnings yield of 9.9% versus the industry median of 8.5% and a price-earnings ratio of 10.08 compared to the industry median of 11.83.

GuruFocus assigned a financial strength rating of 7 out of 10 and a profitability and growth rating of 6 out of 10.

The stock has an average target price of $79.18 per share, reflecting 26.6% growth from Monday's closing price.

ConocoPhillips also has a price-book ratio of 2.17 versus the industry median of 1.3, a price-sales ratio of 1.98 compared to the industry median of 2.73 and an enterprise value-Ebitda ratio of 4.35 versus the industry median of 7.99.

The stock was almost flat so far this year. The share price at close Monday fell within a 52-week range of $56.75 to $80.24.

According to the Peter Lynch chart, the stock appears to be fairly priced.

Novatek PJSC (NOVKY) traded around $191 on Monday with a market capitalization of $57.3 billion. The Russian oil and gas operator has an earnings yield of 13.6% versus the industry median of 8.5% and a price-earnings ratio of 7.38 compared to the industry median of 11.83.

GuruFocus assigned 8 out of 10 rating for the financial strength and 9 out of 10 rating for the profitability and growth.

Novatek has an average target price of $194.23 per share, reflecting 1.7% upside from the closing price on Monday.

The stock has a price-book ratio of 2.97 versus the industry median of 1.3, a price-sales ratio of 4.18 versus the industry median of 2.73 and an enterprise value-Ebitda ratio of 5.94 compared to the industry median of 7.99.

Over the past year through May 20, shares of Novatek climbed nearly 18%. The share price at close Monday fell within the 52-week range of $129.9 to $196.00.

Based on the Peter Lynch chart, the stock appears to be cheap.

Disclosure: I have no positions in any securities mentioned.

Read more here:

Consider These 3 Steel Companies

3 Stocks With High Forward Dividend Yields

3 Long-Term Payers Declare Dividends

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here .

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 2 Warning Sign with CHL. Click here to check it out.

The intrinsic value of CHL