3 High-Growth Stocks That Could Soar

The recent market sell-off caused many investors to take profits in their high-growth plays and retreat to more conservative investments. However, avoiding growth stocks completely could cause investors to miss out on some big gains. So today, a trio of our Motley Fool contributors will highlight three growth stocks that could still soar: Momo (NASDAQ: MOMO), NextEra Energy (NYSE: NEE), and iQiyi (NASDAQ: IQ).

The "Tinder of China"

Leo Sun (Momo): Momo is often called the "Tinder of China" because its two core apps -- Momo and Tantan -- are usually used for online dating. Momo generates most of its revenue from its namesake app. Together, the two apps had a combined monthly active user base of 113.3 million at the end of 2018, representing 14% growth from 2017.

Image source: Getty Images.

Momo lets its users buy gifts for their favorite live video broadcasters (on Momo) and unlock dating perks with subscription fees. Its total number of paying users rose 67% annually to 13 million, thanks to its acquisition of Tantan last year and the growth of Momo's live video streaming platform.

Momo recently suffered two major setbacks: the removal of Tantan from China's app stores and the suspension of news feed posts for both Tantan and Momo. Those setbacks, along with the broader sell-off of Chinese tech stocks, caused Momo to lose about 20% of its value over the past three months.

However, that sell-off reduced Momo's forward P/E to about 8, which is a ridiculously low valuation for a company that posted 51% sales growth and 35% earnings growth last year. Analysts expect Momo's revenue and earnings to rise 24% and 19%, respectively, this year.

Those forecasts could be trimmed due to the suspensions, but Momo says its apps will return once they're cleared by regulators. I don't recommend buying Momo until its apps return, but its stock could surge once that happens.

A different kind of growth

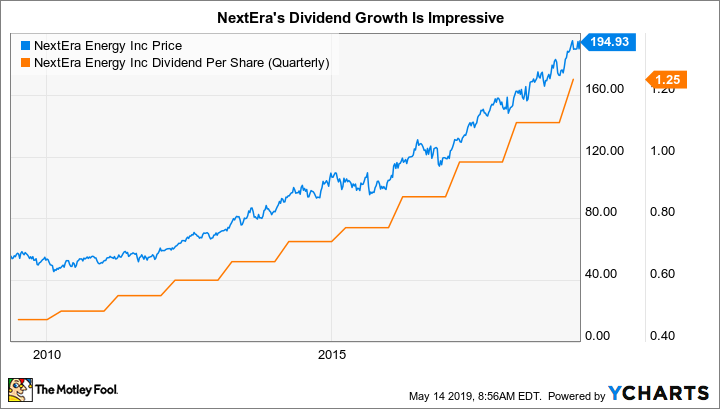

Reuben Gregg Brewer (NextEra Energy): When most people think about growth, they envision earnings or sales. But for dividend investors, growth is usually about a swiftly expanding dividend payment. And on that front, electric utility NextEra Energy stands out. Since 2005 the company's dividend has increased at a compound annual rate of 9% -- that's huge growth for a utility. It has already upped the dividend 12.6% this year, and expects growth of as much as 14% in 2020.

It's worth noting that the payout ratio was less than 60% in 2018. And that's based on adjusted earnings, which were actually lower than GAAP earnings. The payout ratio was similarly low in the first quarter, as well, though it's usually better to look at the annual figure for a utility since results tend to be seasonal. In other words, there's plenty of room to live up to its dividend growth target... even after the 2019 hike.

The most exciting thing about NextEra, however, may actually be that it's like buying two companies in one. The "first" company is a boring old utility based out of Florida. That state is seeing a net inflow of customers as baby boomers retire. More customers means more demand. This is the foundation on which NextEra is building the "second" company, NextEra Energy Resources. That somewhat nondescript name is what the company calls its renewable energy division -- which happens to be one of the largest renewable players in the world. The division has over 7 gigawatts of solar and wind projects planned for 2019 and 2020, with more likely thereafter. It's the growth engine for earnings and, in turn, dividends.

If you are looking for growth (in dividends), utility NextEra should be on your short list.

Grab this Chinese stock while it's still "small"

Steve Symington (iQiyi): iQiyi isn't exactly a familiar name to most people here in the United States. But with nearly 97 million subscribers at the end of last quarter -- up 58% from just over 61 million a year earlier -- this so-called Netflix of China is a massively popular force in the Chinese media-streaming landscape.

For perspective, Netflix ended last quarter with just under 149 million paid global streaming members, and commands a market capitalization of roughly $156 billion as of this writing. But if iQiyi is able to command the attention of China's enormous population of more than 1.4 billion people -- versus around 330 million people in the U.S. -- its $13.6 billion valuation should easily grow to rival our stateside streaming leader.

But iQiyi's ambitions extend far beyond streaming video and related original content creation. CEO Dr. Yu Gong has previously suggested the company's approach is most similar to that of Disney, and involves building an IP ecosystem of products, from literature to comics, novels, and video games -- the last of which took a big leap forward last summer with the company's $190 million acquisition of Chinese mobile gaming studio Skymoons.

With iQiyi stock now trading at only a modest premium to its 2018 IPO price of $18 per share, I think the stock has enormous potential to create life-changing gains for patient, long-term investors willing to watch as its growth story plays out.

More From The Motley Fool

Leo Sun owns shares of Walt Disney. Reuben Gregg Brewer has no position in any of the stocks mentioned. Steve Symington owns shares of iQiyi. The Motley Fool owns shares of and recommends Netflix and Walt Disney. The Motley Fool recommends iQiyi, Momo, and NextEra Energy. The Motley Fool has a disclosure policy.