3 High-Growth Stocks That Are Just Getting Started

Growth investing can be hard. It's not uncommon for what looked like a "can't-miss" company to fall flat and cost investors a lot of money. But it can also generate enormous returns for patient investors, with the best high-growth stocks more than making up for the losers.

Three of these Motley Fool contributors' favorite high-growth stocks are Control4 Corp. (NASDAQ: CTRL), Axon Enterprise Inc. (NASDAQ: AAXN), and NV5 Global Inc. (NASDAQ: NVEE). Over the past few years, these three stocks have absolutely crushed the market, delivering returns of 272%, 179%, and 284%, beating the S&P 500's total returns of 46% over the same period.

Image source: Getty Images.

And they're just getting started, with big opportunities to grow much larger in the years ahead, and that should lead to even more market-beating returns for investors. Three Motley Fool contributors explain why.

A massive addressable market

Daniel Miller (Control4): This leading provider of automation and networking systems for smart homes and businesses has been on fire. With its focus on helping connect the dots between a growing number of smart devices, the company has seen its stock rise 232% over the past three years. But when you look at its market penetration, you can see that this company is just getting started.

There are a few simple keys to understanding Control4 and where it's going. First, there are its smart-home products that consumers typically pay for per device -- think small products ranging in cost from $100 to $500. Then there are systems -- think subscription security services -- that generally cost consumers between $500 and $1,000 annually. Then there are professionally installed systems that control between 25 and 125 smart-home devices and help connect everything seamlessly. That's the market Control4 operates in, and those premium solutions can cost anywhere from $1,000 to over $50,000.

That's the high-end smart-home solution Control4 operates in, and it's a lucrative business that not all consumers can afford. That's why Control4 targets households with more than $150,000 in annual income, and it believes it's only penetrated a modest 1.5% of that U.S. addressable market. And here's the kicker: Management believes the international opportunity is even larger.

Control4 has a premium solution in a lucrative addressable market with plenty of growth ahead of it. It also has a pristine balance sheet with no debt, enabling it to pounce on potential acquisitions that may develop in the years ahead. This is an intriguing growth stock, and it's only getting started.

The growth stock in law enforcement

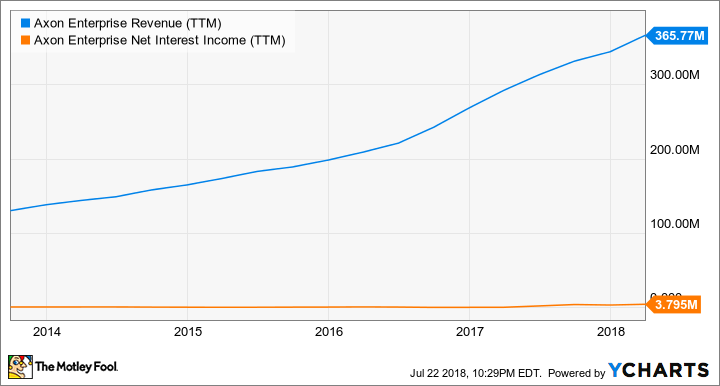

Travis Hoium (Axon Enterprise): There aren't many stocks as hot as Axon Enterprise in 2018, which is up 179% this year. But the stock's run may just be getting started. Axon's revenue has surged over the past five years, while net income has been near zero:

AAXN Revenue (TTM) data by YCharts

But that's about to change. Management's focus in 2018 is improving the company's operating margin by 300 to 400 basis points over 2017 (or 8.1%). In the first quarter, operating margin was 13.4%, up from 6.8% a year ago, so the company is on its way to hitting full-year goals.

On top of the operating-margin improvement, Axon expects to grow revenue 18% to 20% as legacy products grow and new products hit the market. On the legacy side, body cameras are driving growth. The segment's revenue was up 75% in the first quarter to $37.7 million. But new products are starting to hit the streets, with a fleet product now on the market and a records-management system due out later this year.

These products will only fuel Axon's growth and drive long-term value. For now, Axon is tough to value with traditional metrics such as P/E ratio or book value, but as margins expand and revenue grows, the value will emerge. And that's why I think this stock is just getting started.

This upstart infrastructure company is growing fast

Jason Hall (NV5 Global): Since going public in 2014, infrastructure consulting and engineering company NV5 Global has seen its sales increase almost 500%, while its stock price has skyrocketed an incredible tenfold:

Yet even with all of this growth and incredible returns, the company still expects to generate only around $425 million in revenue this year and has a market capitalization of barely $1 billion at recent prices.

Here's the kicker: Infrastructure is a multitrillion-dollar industry on a global basis, and worth hundreds of billions annually in the United States. There's a substantial amount of room for NV5 Global to continue growing.

And the company surely is: It just reported second-quarter results, delivering 24% revenue growth and 63% adjusted earnings-per-share growth. That was well ahead of expectations and led management to raise full-year guidance for the second time this year.

While the company's long-term prospects remain very good, it's certainly not a cheap stock. At current prices, NV5 shares trade for between 35 and 40 times 2018 earnings guidance. It has also proved to be quite volatile; while the share price is up 68% so far this year, at one point it fell more than 25% before surging in early March.

So long as management continues to execute well on the growth strategy, however, it's a high-growth stock worth thinking about starting a position in, and potentially buying more of if the market gives you a better price point.

More From The Motley Fool

Daniel Miller has no position in any of the stocks mentioned. Jason Hall owns shares of Control4 and NV5 Global. Travis Hoium owns shares of Axon Enterprise. The Motley Fool owns shares of and recommends Axon Enterprise. The Motley Fool owns shares of Control4 and NV5 Global. The Motley Fool has a disclosure policy.