3 High-Performing Stocks

- By Alberto Abaterusso

These stocks have outperformed the S&P 500 index over the past month, year and three years. The benchmark for the U.S. stock market increased 1.76% over the past month, 15.88% so far this year, 7.87% over the past year and 40.7% over the past three years.

Wall Street issued a buy recommendation rating for all of them.

Warning! GuruFocus has detected 4 Warning Sign with OTCPK:PNGAY. Click here to check it out.

The intrinsic value of OTCPK:PNGAY

In addition, the following stocks are ranked high in their industries on forward rate of return, which GuruFocus defines as the yield that investors can expect to receive in the future from the stock they are purchasing today. The forward rate of return encompasses normalized free cash flow yield, real growth and inflation.

Ping An Insurance (Group) Company of China Ltd. (PNGAY) has gained 7.6% over the last month, 39.2% so far this year, 17.2% over the past 52 weeks and 150% over the last three years through April 18.

The share price was $24.22 on Thursday for a market capitalization of $226.21 billion. The stock has a price-earnings ratio of 14.03 versus the industry median of 13.25, a price-book ratio of 2.7 versus the industry median of 1.18 and a price-sales ratio of 1.69 compared to the industry median of 0.82.

Based in Shenzhen, China, the insurance, banking and financial services company has a price target of $32.31 reflecting 33% growth from the share price at close on Thursday.

The stock has a forward rate of return of 25.39%, topping 74.6% of the 63 companies that operate in the Insurance - Life industry. The industry has a median of 18.57% for the forward rate of return. The stock also has a forward dividend yield of 2.73% versus the industry median of 3.5%. The company has paid dividends for 11 years (y ields are as of April 18).

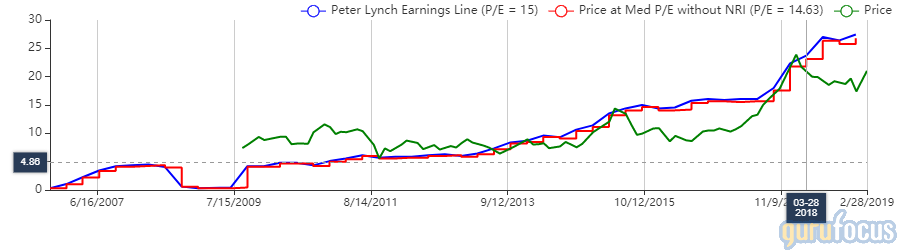

The Peter Lynch chart suggests the stock is cheap.

GuruFocus assigned a financial strength rating of 4 out of 10 and a profitability and growth rating of 5 out of 10.

Techtronic Industries Co. Ltd. (TTNDY) has climbed 14.7% over the last month, 42.3% year to date, 32.3% over the last 52 weeks and 93.4% over the past three years through April 18.

The Hong Kong-based power tools and electronic equipment producer was trading around $37.36 per share on Thursday for a market capitalization of $13.56 billion. The stock has a price-earnings ratio of 24.71 versus the industry median of 17.65, price-book ratio of 4.43 versus an industry median of 1.54 and price-sales ratio of 1.95 compared to an industry median of 1.07.

The stock has a price target of $40.63, reflecting 9% upside from the share price at close on Thursday.

The stock has a forward rate of return of 15.54%, exceeding 75.06% of the 1,227 companies that operate in the Tools & Accessories industry. The industry has a median of 6.3% for the forward rate of return. The company has also paid dividends since 2007 for a forward dividend yield of 1.75% versus 2.2%.

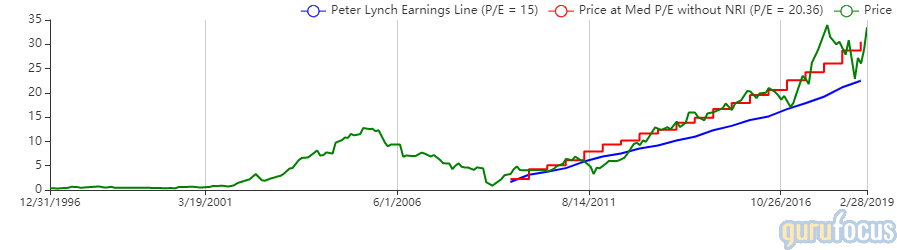

The Peter Lynch chart suggests the stock is not cheap.

GuruFocus assigned a financial strength rating of 7 out of 10 and profitability and growth rating of 8 out of 10.

Envestnet Inc. (ENV) has gained 6.7% over the last month, 41.6% year to date, 26.6% over the last 12 months and 120.1% over the past three years through April 18.

Based in Chicago, Illinois, the company provides financial advisors and institutions with wealth management technology. The stock was trading around $69.67 per share on Thursday for a market capitalization of $3.4 billion. The stock has a price-earnings ratio of 580.6 versus the industry median of 24.79, a price-book ratio of 5.25 versus an industry median of 2.93 and a price-sales ratio of 4.01 versus the industry median of 2.86.

The stock has a price target of $71.75, reflecting a 3% increase from the share price at close on Thursday.

The stock has a forward rate of return of 17%, surpassing 93.93% of the 939 companies that operate in the Software - Application industry. The industry has a median of 10.12% for the forward rate of return. The company does not pay a dividend.

According to the Peter Lynch chart, the stock is not cheap.

GuruFocus assigned Envestnet a financial strength rating of 5 out of 10 and a profitability and growth rating of 7 out of 10.

Disclosure: I have no positions in any securities mentioned.

Read more here:

Dundee Precious Metals Is a Buy

3 Large Industrials Announce 1st-Quarter Results

3 Companies Announce Quarterly Dividends

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Sign with OTCPK:PNGAY. Click here to check it out.

The intrinsic value of OTCPK:PNGAY