3 High-Return Guru Stocks Trading Below the GF Value Line

- By Margaret Moran

GuruFocus has recently developed the GuruFocus Fair Value Line, a unique method of estimating the intrinsic value of a stock. Building off of the popular Peter Lynch chart, which compares a stock's current price to how much its earnings per share would be worth if it traded at a price-earnings ratio of 15, the GF Value Line seeks to take more than price alone into account when attempting to determine value. This new metric considers the following three categories of information:

Historical price-earnings, price-book, price-sales and price-to-free cash flow ratios.

A GuruFocus adjustment factor based on the company's past returns and growth.

Future estimates of the business' performance.

GuruFocus users can now use the All-in-One Screener to screen for stocks based on how their current share prices compare to the intrinsic value estimated by the GF Value Line. If the ratio of the price to the GF Value Line is less than 1, the stock is likely to be undervalued.

For this analysis, I searched the All-in-One Screener for guru-owned stocks that were trading at a price-to-GF value ratio between 0.4 and 0.9. Making use of two other new GuruFocus valuation tools, I also screened for stocks that have maintained financial strength and profitability ratings of at least 4 out of 10 for the past 10 years using the historical screener and stocks with a return on capital (as defined by Joel Greenblatt (Trades, Portfolio)) of at least 16%. According to the GuruFocus Filter Ranking, stocks with a higher return on capital have outperformed the broader market significantly over the past year. Among the results, Perdoceo Education Corp. (NASDAQ:PRDO), China Mobile Ltd (NYSE:CHL) and Kimball International Inc. (NASDAQ:KBAL) were rated as undervalued.

Perdoceo Education

Perdoceo Education is a for-profit career education group headquartered in Schaumburg, Illinois. It offers both in-person and online programs for customers to obtain associate's, bachelor's, master's and doctoral degrees as well as certificate programs in career-focused disciplines. The company operates through American Intercontinental University Colorado Technical University.

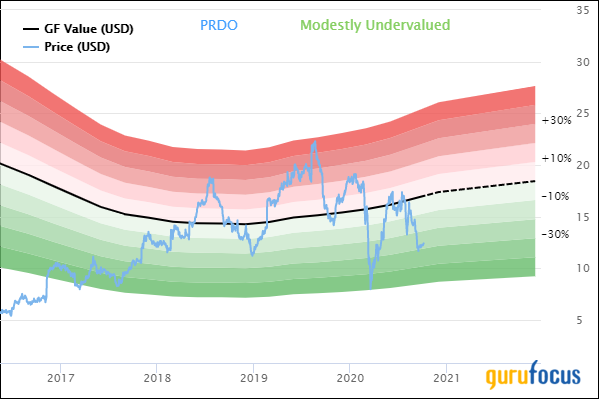

On Oct. 5, shares of Perdoceo traded around $12.40 for a market cap of $857.21 million and a price-earnings ratio of 8.62. According to the GF Value chart, the stock is modestly undervalued.

The company has a financial strength rating of 9 out of 10 and a profitability rating of 4 out of 10. The cash-debt ratio of 5.65 and Altman Z-Score of 5.25 indicate solid financial conditions. The return on capital of 180.63% is higher than 92.34% of competitors. While revenue has declined in recent years as the company divested of its non-core colleges, Ebitda has increased:

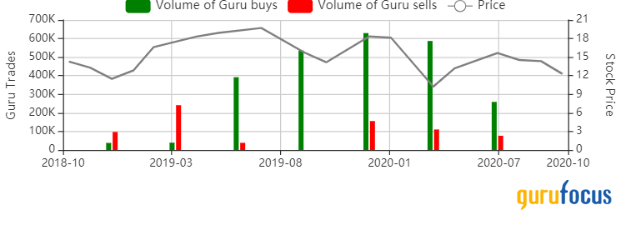

Jim Simons (Trades, Portfolio)' Renaissance Technologies is the largest guru shareholder of the company with 7.29% of shares outstanding, followed by Pioneer Investments (Trades, Portfolio) with 0.64% and Jeremy Grantham (Trades, Portfolio) with 0.54%. By volume, more gurus have been buying the stock than selling it in recent quarters.

China Mobile

China Mobile is one of the three state-run telecommunications companies that dominate the Chinese market. Founded in 1997, it is China's leading telecommunication services provider, with over 950 million customers and operations in all 31 provinces.

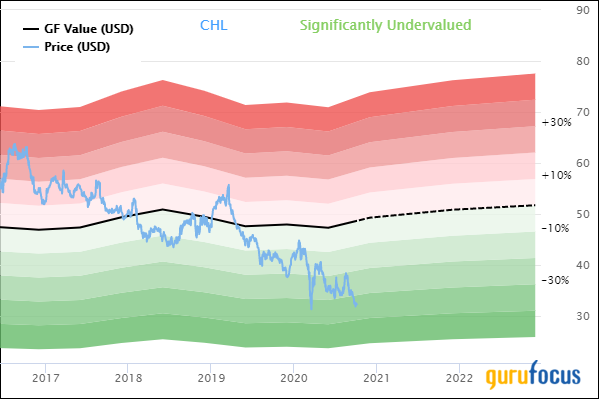

On Oct. 5, China Mobile traded around $32.28 per share for a market cap of $132.19 billion and a price-earnings ratio of 8.68. The GF Value chart ranks the stock as significantly undervalued.

The company has a financial strength rating of 8 out of 10 and a profitability rating of 7 out of 10. The Piotroski F-Score of 7 out of 9 and interest coverage ratio of 39.58 indicate financial stability, while the return on capital of 17.38% is beating 65.51% of competitors. The three-year revenue growth rate is 1.5%, while the three-year Ebitda growth rate is 4.7%.

With 0.23% of shares outstanding, Simons' firm is the guru with the largest chunk of the company, followed by Charles Brandes (Trades, Portfolio) with 0.02% and Sarah Ketterer (Trades, Portfolio) with 0.02%. However, gurus have been selling the stock in 2020 after mostly buying in 2019.

Kimball International

Kimball International is a furniture design company that manufactures products under the Kimball, National and Kimball Hospitality brand names. Based in Jasper, Indiana, the company focuses its designs on productivity, group collaboration, design and sustainability.

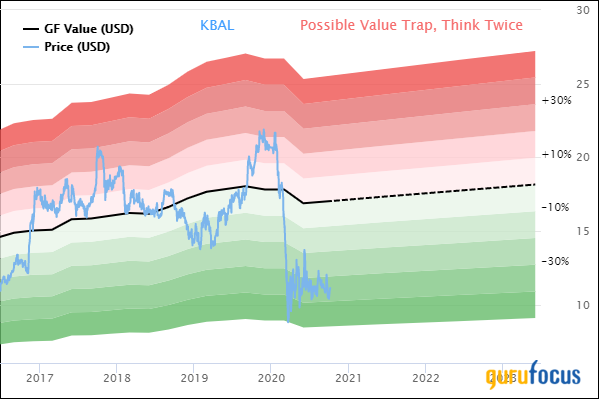

On Oct. 5, shares of Kimball traded around $11.12 for a market cap of $408.99 million and a price-earnings ratio of 10. According to the GF Value chart, the stock is a possible value trap, though the price drop that put it into value trap territory was during the Covid-19 market crash.

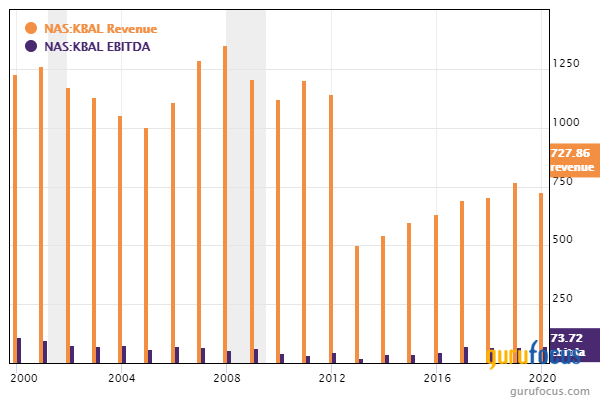

The company has a financial strength rating of 9 out of 10 and a profitability rating of 7 out of 10. The interest coverage ratio of 795.9 and Altman Z-Score of 5.55 indicate that the stock is in strong financial standing. The return on capital is 46.43%, which is higher than 90.12% of other companies in the industry. The three-year revenue growth rate is 2.4%, while the three-year Ebitda growth rate is 0.7%.

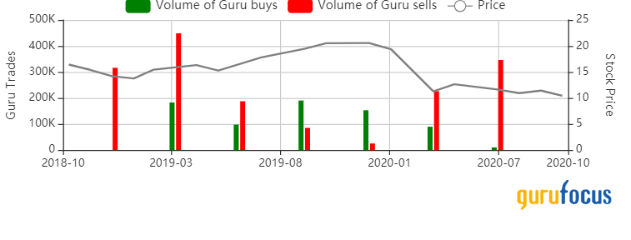

Simons' firm owns the largest stake in the company with 6.76% of shares outstanding, followed by Chuck Royce (Trades, Portfolio) with 4.98% and Grantham with 0.91%. After buying the stock at the end of 2019, more gurus have been selling the stock in 2020.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research and/or consult registered investment advisors before taking action in the stock market.

Read more here:

Video: Mastering the GuruFocus Site, Episode 10

Bed Bath & Beyond Skyrockets on Comparable Sales Gain

Boeing: Nearing Agency Approval for the 737 Max

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.