3 High Yield Stocks for the Dividend Investor

- By Alberto Abaterusso

The following companies may attract the attention of dividend investors, as their stocks are granting more than the S&P 500 index, which is the benchmark for the U.S. market, in terms of higher dividend yields. The index grants a dividend yield of 1.73% as of Tuesday, Aug. 25.

Also, Wall Street recommends positive ratings for these stocks, suggesting their share prices are foreseen to continue to perform well over the upcoming months.

Kinder Morgan Inc

The first company that tops the benchmark is Kinder Morgan Inc (NYSE:KMI), a midstream oil and gas operator headquartered in Houston, Texas.

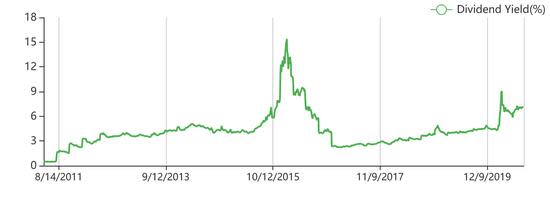

Based on Tuesday's closing price of $13.96 per share, Kinder Morgan Inc grants a trailing 12-month dividend yield of 7.35% and a forward dividend yield of 7.52%. Currently, the company pays a quarterly dividend of 26.3 cents per common share. Kinder Morgan Inc has distributed dividends for about nine years.

The current dividend yield is a little higher than average compared to its historical values, as the below chart illustrates.

GuruFocus assigned the company a low score of 3 out of 10 for its financial strength rating and a positive score of 6 out of 10 for its profitability.

The stock has an overweight recommendation rating and an average target price of $17.57 per share on Wall Street.

The share price has fallen 30.32% over the past year for a market capitalization of $31.60 billion and a 52-week range of $9.42 to $22.58.

The stock is neither oversold nor overbought, as indicated by a 14-day relative strength index of 41.

Williams Companies Inc

The second company that is topping the benchmark is Williams Companies Inc (NYSE:WMB), an oil and gas operator headquartered in Tulsa, Oklahoma.

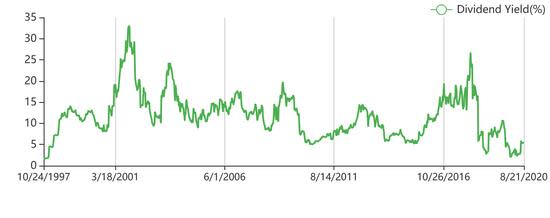

Based on Tuesday's closing price of $21.39 per share, Williams Companies Inc grants a trailing 12-month dividend yield of 7.31% and a forward dividend yield of 7.49%. The company currently distributes a quarterly dividend of 40 cents per common share with the next payment scheduled for Sept. 28. Williams Companies Inc has paid dividends for more than 30 years.

According to below chart, the company's current dividend yield is above average compared to its historical values.

GuruFocus assigned the company a low financial strength rating of 3 out of 10 and a positive profitability rating of 5 out of 10.

The stock has a buy recommendation rating with an average target price of $24.22 per share on Wall Street.

The share price has declined by nearly 7% over the past year for a market capitalization of $25.96 billion and a 52-week range of $8.41 to $25.29.

The stock seems to be neither overbought nor oversold according to the 14-day relative strength index of 56.

Nordic American Tankers Ltd

The third company that tops the benchmark is Nordic American Tankers Ltd (NYSE:NAT), a global operator of a fleet of 23 crude oil double-hull tankers headquartered in Bermuda.

Based on Tuesday's closing price of $4.51 per share, Nordic American Tankers Ltd grants a trailing 12-month dividend yield of 5.31% and a forward dividend yield of 12.41%. Currently, the company distributes a quarterly dividend of 14 cents per common share. Nordic American Tankers Ltd has paid dividends for more than 30 years.

Nordic American Tankers Ltd.'s current dividend yield is below average according to the below chart.

GuruFocus assigned the company a moderate financial strength rating of 4 out of 10 and a low profitability rating of 2 out of 10.

The stock has an overweight recommendation rating and an average target price of $5.21 per share on Wall Street.

The share price has increased by 150.6% over the past year, determining a market capitalization of $664 million and a 52-week range of $1.66 to $9.

The stock is neither overbought nor oversold as indicated by a 14-day relative strength index of 55.

Disclosure: I have no positions in any securities mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.