3 Hydrogen Fuel Cell Stocks to Keep a Tab on 2022

Carbon emission is a serious global problem that results from energy use and the production of electricity. The usage and burning of fossil fuels release harmful chemicals into the atmosphere, causing global warming. The Paris Agreement was signed to work on long-term low greenhouse gas emission development strategies.

Various clean burning alternate sources have been developed through research and development (R&D), and the hydrogen fuel cell technology represents one of the solutions for clean sources. Fuel cell works like batteries and continues to produce clean electricity. The fuel cell technology, through a chemical reaction instead of combustion, converts hydrogen molecules into clean energy and water.

The importance of hydrogen fuel cell stocks is rising globally due to their ability to produce a large volume of clean electricity in a small space compared with conventional fossil fuel sources. Hydrogen fuel cells can provide power to electric grid or utility substations, increasing grid resiliency and making the grid less dependent on large pollution-generating plants.

The demand for portable and stationary fuel cells is on the rise across the globe. Per the findings of BlueWeave Consulting, the global fuel cells market was worth $264.2 million in 2020. It is estimated to witness a CAGR of 26.2% and generate revenues of $1,341.9 million by 2027-end. It is quite evident from these figures that there are huge prospects for fuel cell stocks in 2022 and beyond.

The cost of the overall fuel cell system compared with conventional sources and the efficiency and performance of hydrogen fuel cell modules are some of the concerns. Yet, the ongoing R&D activities are making these modules cost effective.

Hydrogen fuel cells are now utilized in various applications and can replace conventional batteries. Fuel cells can be utilized for transportation, material handling, and stationary and provide support to the electric grid as backup power. The North American market witnesses the maximum demand for fuel cells, while the Asia-Pacific is also an emerging market for fuel cell business.

Stocks to Watch Out in 2022

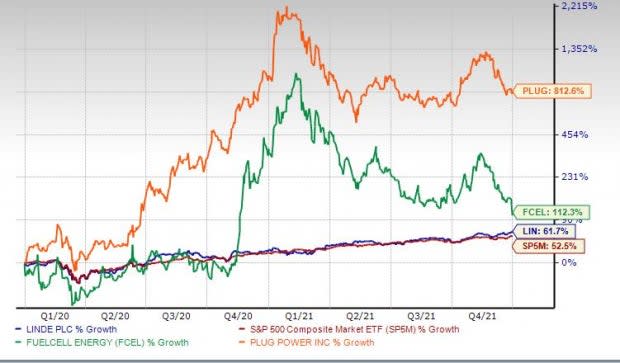

Investors who are interested to foray into the fuel cell space can consider FuelCell Energy FCEL, Plug Power Inc. PLUG and Linde plc. LIN. In the past two years, shares of FuelCell Energy, Plug Power Inc., and Linde have returned 812.6%, 112.3%, and 61.7%, respectively, compared with the Zacks S&P 500 Composite’s 52.5%.

Price Performance (Two Years)

Image Source: Zacks Investment Research

Linde plc. is a very important operator in the hydrogen fuel cell business. LIN builds and supplies hydrogen refueling stations globally. It has also started to build the world's first hydrogen refueling station for passenger trains in Germany, which is set to begin commercial operation in 2022. LIN currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The long-term (three to five years) earnings growth of Linde is currently pegged at 10%. The Zacks Consensus Estimate for 2022 revenues and earnings per share is pegged at $33.1 billion and $11.92, which indicates year-over-year growth of 9.03% and 12.4%, respectively. LIN delivered an average surprise of 6.3% in the last four reported quarters.

Plug Power Inc. provides hydrogen fuel cell turnkey solutions for electric mobility and stationary power markets. PLUG focuses on proton exchange membrane fuel cell and fuel processing technologies, and fuel cell/battery hybrid technologies as well as related hydrogen and green hydrogen generation, storage, and dispensing infrastructure.

Plug Power recently closed the buyout of Applied Cryo Technologies, Inc., which will assist PLUG to strengthen its green hydrogen ecosystem and reduce costs related to hydrogen infrastructure and logistics networks. The Zacks Consensus Estimate for 2022 revenues and earnings per share is pegged at $891.7 million and (0.25) cents, which indicates year-over-year growth of 80.2% and 56.1%, respectively.

FuelCell Energy, Inc., together with its subsidiaries, designs, manufactures, sells, installs, operates, and services stationary fuel cell power plants for distributed baseload power generation. FCEL also provides the SureSource Capture system that separates and concentrates carbon dioxide from the flue gases of natural gas, biomass, or coal-fired power plants, as well as industrial facilities; solid oxide fuel cell/solid oxide electrolysis cell stack technology.

FuelCell Energy exited fiscal 2021 with a backlog of $1.29 billion, which was unchanged year over year, reflecting continued execution of backlog and adjustments to generation backlog. The Zacks Consensus Estimate for 2022 revenues and earnings per share is pegged at $173.8 million and (0.12) cents, which indicates year-over-year growth of 57.8% and 17.9%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Plug Power, Inc. (PLUG) : Free Stock Analysis Report

FuelCell Energy, Inc. (FCEL) : Free Stock Analysis Report

Linde plc (LIN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research