3 Key Elements of Winning Stocks - This Trio Has Them

“Simplicity is the Ultimate Sophistication”

Thousands of years ago, revered Chinese military general and strategist Sun Tzu once said, “I have just three things to teach: simplicity, patience, and compassion.” Years later, Leonardo da Vinci came along and was a 16th-century “Renaissance Man”, known for his painting masterpieces, engineering, architecture, sculpting, and more. Despite his many achievements and high praise, da Vinci equated his success to not overcomplicating things but simplifying them, explaining, “Simplicity is the ultimate sophistication.”

With the advent of the internet, complex trading platforms, and tons of real-time information, traders can easily feel overwhelmed or suffer from “paralysis by analysis”.

For this reason, it can be helpful for traders to focus on the most important building blocks of what makes a stock move higher:

Supply and demand (price & volume).

Rising current earnings and estimates.

An easy-to-understand catalyst.

Today we will cover 3 stocks that have these qualities, including:

Airbnb

Short-term rental marketplace operator Airbnb (ABNB) holds the best possible Zacks Rank #1 (Strong Buy) and recently reported its most impressive quarter as a public company.

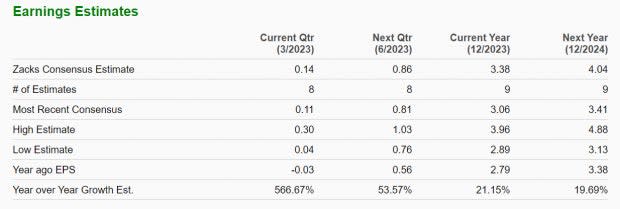

Current Earnings & Estimates: Airbnb smashed consensus estimates by 77.78%, while EPS jumped 500% on revenue growth of 24%, year-over-year. Zacks Consensus Estimates show that the blistering growth is likely to continue.

Image Source: Zacks Investment Research

Catalyst: The most significant driver of Airbnb’s growth is the unprecedented shift to remote work that is currently taking place. The COVID-19 pandemic forced a large portion of the workforce to move online. While the world has moved past lockdowns and has reopened, many employees and companies remain remote for two reasons:

First, from an employer perspective, studies are showing that remote workers tend to be more productive working from home versus when they are in the office. Also, employers can save money by allowing employees to continue to work remotely and can save money by downsizing or eliminating office space entirely. Second, employees appreciate the freedom to work remotely. Because remote workers only require a strong Wi-Fi connection and a laptop, many take advantage of their newfound freedom by combining leisure travel and work, driving demand for Airbnb. What’s even better for Airbnb’s prospects is that guests are staying longer at each destination recently. Airbnb’s last earnings report states, “Gross nights booked in Q4 2022 for more than a week are 40% higher than Q4 2019.”

Price & Volume Action

Beyond its impressive fundamental picture and robust expected growth moving forward, ABNB will likely attract institutional investors. Why? Institutions look for the rare combination of high liquidity and strong growth. Airbnb has this rare combination. The hospitality giant has a $78 billion market cap to complement its double-digit revenue growth and triple-digit EPS growth.

Demand for shares is showing up in the price and volume action. After reporting Q4 earnings on February 15th, shares vaulted by 13% on volume quadrupling the norm. Though shares pulled back with the market last week, the price action was uniform, and volume plummeted.

Image Source: Zacks Investment Research

Presently, the hospitality business is not a zero-sum game in which only Airbnb or traditional hotels can win. Hotel giants such as Hyatt Hotels H, Hilton Worldwide HLT, and Marriott International MAR are showing strong growth and price action. However, Airbnb is the current dominant player in the hospitality space due to its innovative product offering, newness as a public company, and strong growth.

New Relic

Zacks Rank #2 (Buy) stock New Relic NEWR is a software analytics provider that empowers clients to develop applications, review real-time analytics, and monitor production.

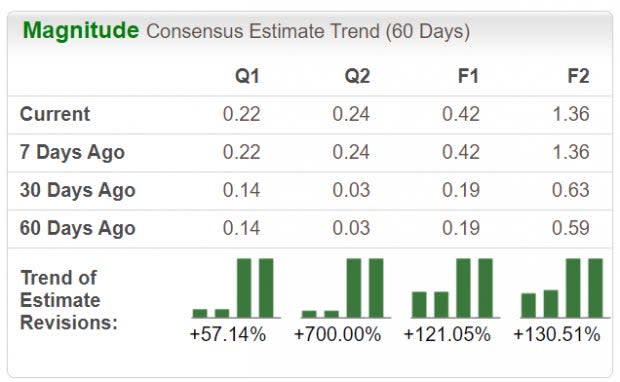

Current Earnings & Estimates: After several unprofitable quarters, New Relic has swung to profitability in the past two. New Relic is also growing revenue at a double-digit clip. While the software provider is turning the corner and on the right track, the analyst community expects standout earnings over the next year.

Image Source: Zacks Investment Research

Catalyst: New Relic’s technology is aimed at helping engineering teams to organize themselves and make better decisions based on data. In a recent presentation, New Relic’s management team highlighted that the number of professional computer engineers is expected to rise from 25 million to 34 million by 2025. To put it simply, more engineers should equate to more growth.

Price & Volume Action

Shares of New Relic spiked higher following its earnings report on February 8th. Volume turnover was heavy, coming in at six times the norm. Like ABNB, NEWR is digesting the big gains on miniscule volume. Look for shares to gain traction if they can break out above the trendline in the chart below.

Image Source: Zacks Investment Research

Meta Platforms

Zacks Rank #2 stock Meta Platforms META has taken investors on a wild ride over the past few years. At the direction of CEO Mark Zuckerberg, the parent company of WhatsApp, Facebook, and Instagram drastically changed its strategy and began to focus heavily on the metaverse.

Current Earnings & Estimates: During Meta’s restructuring efforts, earnings and sales have dropped off precipitously (EPS growth was -52% in the most recent quarter). Nevertheless, what’s important in the stock market is how the earnings compare to analyst estimates and what the road ahead looks like. From that standpoint, analysts expect EPS to 9.65 this year, up from 8.59 reported in 2022. In Q4, META also smashed consensus estimates by more than 40%.

Image Source: Zacks Investment Research

Catalyst: Meta has three main catalysts:

Stock Buybacks: Meta is dramatically increasing its share buyback program. Buybacks increase demand for shares while decreasing supply.

International Growth: While Meta is already the dominant social media player domestically, the company is experiencing steady growth in the Asia Pacific region.

New Offerings: Meta’s “Reels” product is becoming very popular on Instagram. Reels allow users to view and share short-form videos – similar to Byte Dance’s Tik Tok or Snapchat SNAP. If Meta can monetize this part of the business successfully, advertising revenue should soar.

Price & Volume Action

Meta finally cleared its 200-day moving average after being stuck below it for a year. After announcing its recent earnings surprise and buyback, META shares rocketed higher by 23% on volume nearly four times the average. Such a big upside move in a mega-cap stock like Meta is both rare and bullish.

Image Source: Zacks Investment Research

Conclusion

Airbnb, New Relic, and Meta are three stocks with ingredients found in big winning stocks. With the market and the economy turning, these companies are showing considerable earnings potential and the strong price and volume action to go along with it. Furthermore, each has easy-to-understand catalysts that should act as a tailwind for years to come. Prospective investors should wait for a clear break above the trendlines pictured in the charts above to get involved.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marriott International, Inc. (MAR) : Free Stock Analysis Report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

New Relic, Inc. (NEWR) : Free Stock Analysis Report

Snap Inc. (SNAP) : Free Stock Analysis Report

Airbnb, Inc. (ABNB) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report