3 Large-Cap Stocks With Superior Performances

- By Alberto Abaterusso

Several large-cap stocks have had positive performances over the past month, year to date, the last 12 months and past three years.

Wall Street issued recommendation ratings ranging from overweight to buy for all of them, meaning they will likely continue to show positive momentum in the coming weeks.

In addition, the companies have solid balance sheets and run profitable operations.

Vertex Pharmaceuticals Inc. (VRTX) has climbed 2.2% over the past month, 4.3% so far this year, 10.3% over the last 52 weeks and 91.2% over the past three years through May 28.

The company does not currently pay a dividend.

The stock closed at $172.76 per share on Tuesday for a market capitalization of $44.25 billion.

Vertex has a price-earnings ratio of 20.81 versus the industry median of 28.79, a price-book ratio of 9.53 versus the industry median of 4.1 and a price-sales ratio of 13.75.

The Boston-based biotechnology company has a high GuruFocus financial strength rating of 8 out of 10 and a profitability and growth rating of 6 out of 10.

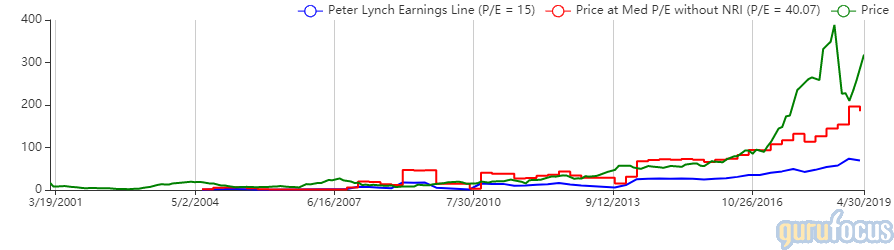

The Peter Lynch chart suggests the stock is not cheap.

The stock has an overweight recommendation rating and an average target price of $210 .

Align Technology Inc (ALGN) has gained 14.6% over the past month, 54% year to date, 8.3% over the last 52 weeks and 316.7% over the past three years through May 28.

The company doesn't currently pay a dividend.

The stock traded around $304.81 per share on Tuesday for a market capitalization of $24.39 billion. It has a price-earnings ratio of 65.82 versus the industry median of 30.17, a price-book ratio of 19.56 versus the industry median of 3.06 and a price-sales ratio of 11.88 versus the industry median of 3.15.

The San Jose, California-based medical devices company received a high rating of 8 out of 10 for both financial strength and profitability and growth from GuruFocus.

The Peter Lynch chart suggests the stock is overvalued.

Align has a buy recommendation rating and an average target price of $340.73 per share .

Waste Connections Inc. (WCN) has gained 6.7% over the past month, 27.3% year to date, 26.2% over the last 12 months and 102% over the past three years through May 28.

Currently, Waste Connections is paying a quarterly dividend of 16 cents per share. Based on the closing price on Tuesday, the distribution leads to a forward dividend yield of 0.68% compared to the industry median of 1.96%. The company has paid dividends since 2002.

Shares of Waste Connections closed at $93.71 on Tuesday for a market capitalization of $24.8 billion. The stock has a price-earnings ratio of 45.95 versus the industry median of 22.75, a price-book ratio of 3.79 compared to the industry median of 1.98 and a price-sales ratio of 4.99 versus the industry median of 1.4.

GuruFocus rated the Canadian waste management company's financial strength 6 out of 10 and its profitability and growth 8 out of 10.

The Peter Lynch chart suggests the stock is expensive.

In addition, Waste Connections has an overweight recommendation rating and an average target price of $137.02 .

Disclosure: I have no positions in any securities mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here .

This article first appeared on GuruFocus.