3 Low P/E Shipping Stocks Outperforming the S&P 500 in 2022

The market has been shaken violently throughout the year due to a hawkish Fed, soaring energy costs, supply chain disruptions, and geopolitical issues. Of course, these aren’t the only reasons, but they have definitely been the most impactful.

With the cheap lending days behind us, many stocks have sold off, leaving investors frustrated and unsure of what’s coming next. It’s anybody’s guess as to where the market heads next, but at least we have seen a few consecutive days of green so far this week – undoubtedly a major positive that we hope to build on.

If we continue the current pace, the indexes look to notch their first weekly close in the green for June, snapping a three-week skid of brutal price action.

Bears have had the upper hand all year long, and it’s tiring, to say the least. It’s important to note that the sellers can’t stay in control forever, and when buyers finally step back up, they’ll no doubt go back into hibernation.

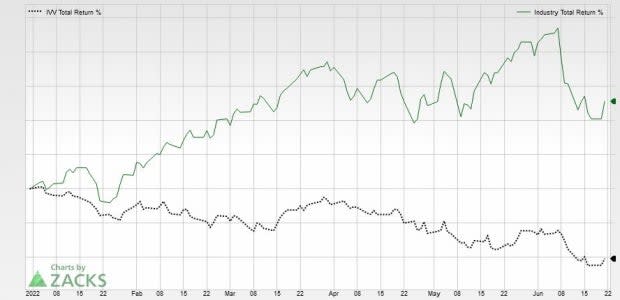

Throughout the gloom and doom, there have been several favorable spots in the market throughout the year – believe it or not. One such industry that has easily outpaced the S&P 500 year-to-date is the Zacks Transportation – Shipping Industry.

The industry has a mighty 25% year-to-date return and is currently ranked in the top 13% of all Zacks Industries. Due to it residing in the top half of Zacks Ranked Industries, we expect it to outperform the market over the next three to six months.

Below is a year-to-date chart of the industry’s performance while blending in the S&P 500 for comparison.

Image Source: Zacks Investment Research

As we can see, investors who have had exposure to this industry have reaped considerable gains, undoubtedly limiting drawdowns in other positions.

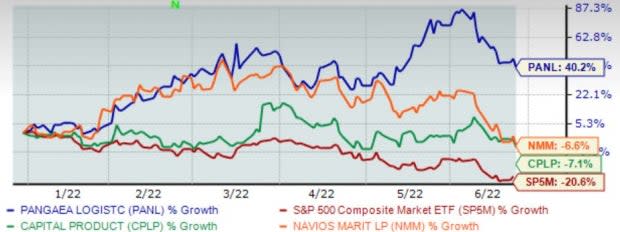

Three companies operating within the industry include Navios Maritime Partners NMM, Pangaea Logistics Solutions PANL, and Capital Product Partners CPLP. All three companies sport the highly-coveted Zacks Rank #1 (Strong Buy), have attractive valuation levels, and have strong earnings growth for the current and next fiscal year.

The chart below illustrates the year-to-date performance of all three companies while comparing the S&P 500.

Image Source: Zacks Investment Research

Let’s get into why these three companies would be great bets for anybody seeking exposure to the red-hot industry.

Capital Product Partners LP

Capital Product Partners LP CPLP is an international shipping company and leader in the seaborne transportation of refined oil products and chemicals. Analysts have been pushing their estimates higher across the board over the last 60 days, a reason the company sports a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

CPLP boasts attractive valuation levels, as well. Its 3.3X forward earnings multiple is a fraction of 2018 highs of 23.2X and is nowhere near its five-year median of 7.2X. Additionally, the value represents a mouthwatering 81% discount relative to the S&P 500’s forward P/E ratio of 16.8X.

CPLP boasts a Style Score of an A for value.

Image Source: Zacks Investment Research

Watch out for the company’s next quarterly report – the $1.13 EPS estimate reflects a massive triple-digit growth in earnings of 113% from the year-ago quarter. Pivoting to current year EPS estimates, the $4.69 estimate for FY22 represents another massive expansion in the bottom line of nearly 70%.

Quarterly revenue is forecasted to climb 87% year-over-year to $70.5 million in the upcoming earnings, and sales estimates of $282 million for FY22 display a 62% expansion within the top line year-over-year.

Navios Maritime Partners

Navios Maritime Partners NMM is an international owner and operator of dry cargo vessels. Over the last 60 days, analysts have significantly upped their earnings outlook across all timeframes, pushing it into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

NMM sports a beautifully low forward P/E ratio of 1.4X, well below highs of 49.4X in 2020. Additionally, shares trade at a staggering 92% discount relative to the S&P 500.

NMM sports a Style Score of an A for Value.

The consensus estimate trend has increased nearly 28% over the last 60 days for the upcoming quarter, with the $4.35 EPS estimate penciling in a marginal 1% growth in earnings from the year-ago quarter. For the full fiscal year, the earnings estimate of $17.76 reflects a sizable 13% growth in the bottom line year-over-year.

Top line growth appears robust. For the upcoming quarter, the $289 million quarterly revenue estimate reflects a mighty 90% expansion in quarterly revenue compared to sales of $152 million in the year-ago quarter. Furthermore, for FY22, the top line is forecasted to expand a notable 60%.

Pangaea Logistics Solutions

Pangaea Logistics Solutions PANL operates as a global logistics company. Like NMM and CPLP, analysts have been revising their earnings estimates positively over the last 60 days, pushing it into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

The company boasts an attractively low forward earnings multiple of 3.3X, well below its five-year median of 5.4X and nowhere near highs of 61.3X in 2020. Additionally, the value represents a deep 81% discount relative to the S&P 500’s forward P/E ratio.

Image Source: Zacks Investment Research

PANL sports a Style Score of an A for Value.

In addition to solid valuation levels, PANL also displays robust earnings growth. For the upcoming quarter, the $0.37 EPS estimate reflects a sizable 28% growth in the bottom line from the year-ago quarter. In FY22, earnings are expected to increase by a double-digit 18%.

PANL is penciled in to rake in $180 million in revenue for the upcoming quarter, a nice double-digit increase in the top line of 24% from the year-ago quarter. Furthermore, for FY22, annual revenue is forecasted to expand by 5.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research