3 Medical Companies With the Strength to Weather Coronavirus Fears

As investors continue grappling with coronavirus fears, three medical companies with high financial strength and trading below Peter Lynch's valuation line of 15 times earnings are Bio-Rad Industries Inc. (NYSE:BIO)(NYSE:BIO.B), Global Cord Blood Corp. (NYSE:CO) and Fonar Corp. (NASDAQ:FONR) according to All-in-One Screener results, a GuruFocus Premium feature.

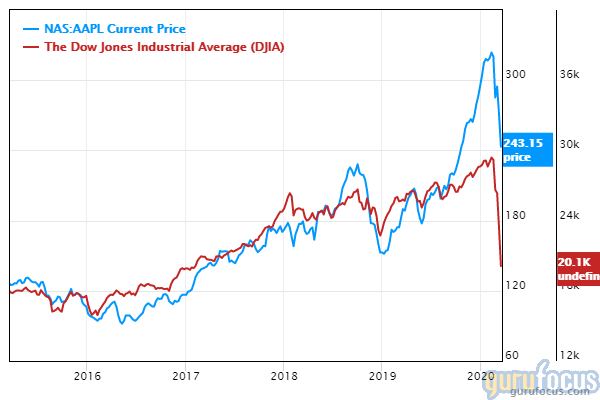

Dow continues losses as Senate stimulus bill fails, CVS announces hiring spree

On Monday, the Dow Jones Industrial Average closed at 18,576.04, down 597.94 points or 3.12% from last Friday's close of 19,173.98. The 30-stock index closed below 19,000 for the first time since around Nov. 20, 2016, and nearly erased its entire gain since Donald Trump was elected president of the United States.

Democrats and Republicans continued negotiating a "massive stimulus funding package" aimed at boosting the U.S. economy as the virus continues spreading across the nation. CNBC added that the stimulus bill stalled for a second day: Senate Minority Leader Chuck Schumer said that although the Senate is "very close to reaching a deal," it will not pass until Republicans agree to "key changes" sought by Democrats.

Health care services provider CVS Health Corp. (NYSE:CVS) announced this morning that it seeks to employ 50,000 jobs across the U.S. to keep up with demand for over-the-counter medicines, prescriptions and other items during the coronavirus outbreak.

As the Covid-19 virus continues grappling the economy, investors might seek opportunities in medical companies that are developing research and tools to combat the virus. With the All-in-One Screener, one can identify medical companies that have high financial strength and are trading below the Peter Lynch valuation line of 15 times earnings.

Bio-Rad

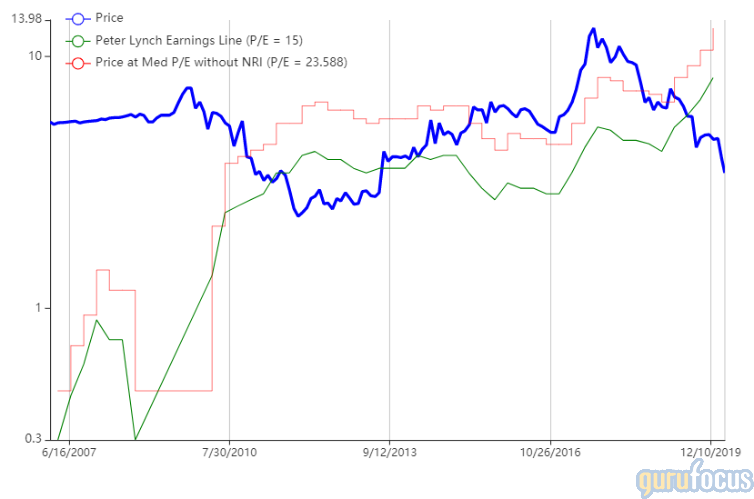

Bio-Rad manufactures and supplies systems used to separate and analyze chemical and biological materials to life sciences and health care companies. The company's price-earnings ratio of 5.64 is near a 10-year low and outperforms 98% of global competitors.

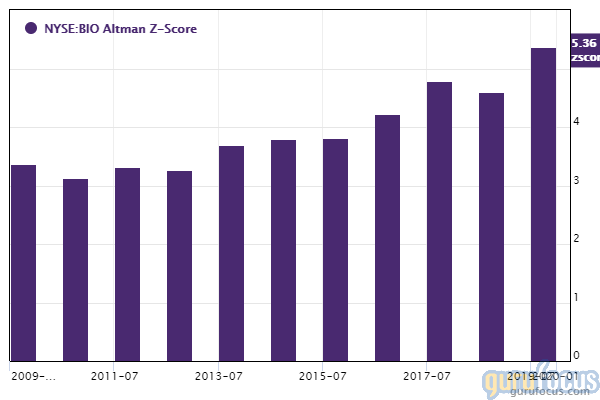

GuruFocus ranks the Hercules, California-based company's financial strength and profitability 7 out of 10 on several positive investing signs, which include a strong Altman Z-score of 5, a debt-to-Ebitda ratio that outperforms 84.54% of global competitors and an operating margin that has increased approximately 5.50% per year on average over the past five years.

Gurus with large holdings in Bio-Rad include John Rogers (Trades, Portfolio)' Ariel Investment and Ken Fisher (Trades, Portfolio).

Global Cord Blood

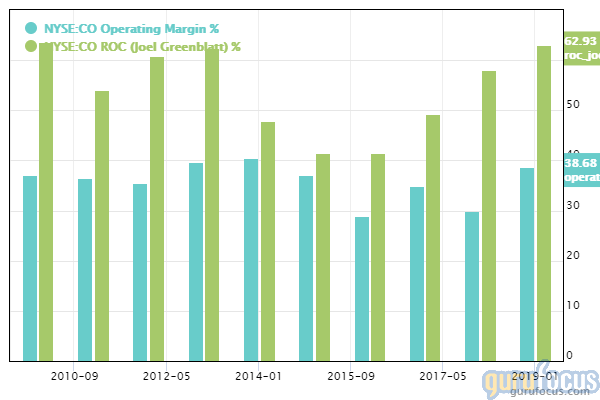

Global Cord Blood provides cord blood processing and storage services for expectant patients interested in capturing the evolving medical treatments and technologies such as cord blood transplants. The Chinese diagnostics and research company's price-earnings ratio of 5.45 is near a 10-year low and outperforms 93.27% of global competitors.

GuruFocus ranks Global Cord Blood's profitability 8 out of 10 on several positive investing signs, which include an operating margin and a Joel Greenblatt (Trades, Portfolio) return on capital outperforming over 91% of global competitors.

Fonar

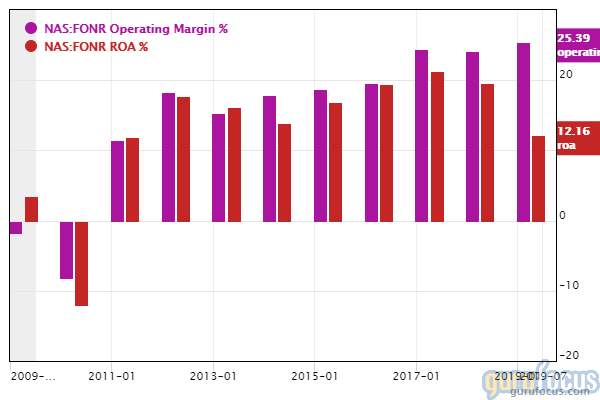

Fonar designs, manufactures, sells and services magnetic resonance imaging scanners for the detection and diagnostics of human disease, abnormalities, injuries and other medical conditions. GuruFocus ranks the New York-based company's profitability 8 out of 10 on several positive investing signs, which include expanding operating margins and a return on assets that outperforms 84.71% of global competitors.

Disclosure: No positions.

Read more here:

5 Buffett-Munger Stocks to Spring Toward in 2nd Quarter

5 Dividend Growth Stocks Hedge Fund Gurus Own

5 Predictable Stocks Giving Markets a St. Patrick's Day Boost

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.