3 Risky but Potentially High-Reward Stocks

It's never easy buying a cyclical stock, not least one that has had some negative news flow behind it. That said, investing is all about favorable risk/reward situations rather than just buying the hot stock of the moment. Shares in Caterpillar (NYSE: CAT), roofing and insulation material company Owens Corning (NYSE: OC), and vehicle driveline supplier Dana Incorporated (NYSE: DAN) have all been beaten up in the last year, and their valuations now look cheap. They are all worth considering for risk-seeking investors looking for upside potential in their stocks. Here's why.

Overblown fears for Caterpillar?

The mining and construction machinery company faces a significant amount of uncertainty in 2019. Its construction end markets growth is slowing, with the cycle starting to look long in the tooth -- Caterpillar's outlook for 2019 calls for Europe to be steady, while China is expected to be flat.

Moreover, there's evidence that capital spending from mining companies is being held back in response to weakening commodity prices -- Caterpillar and Cummins management have talked of a temporary halt to spending. However, sustained slowdowns often start with what industry insiders think are temporary events. Mining is very important for Caterpillar's stock because investors have been expecting a long-term upcycle for miners' spending to flow through into Caterpillar's bottom line.

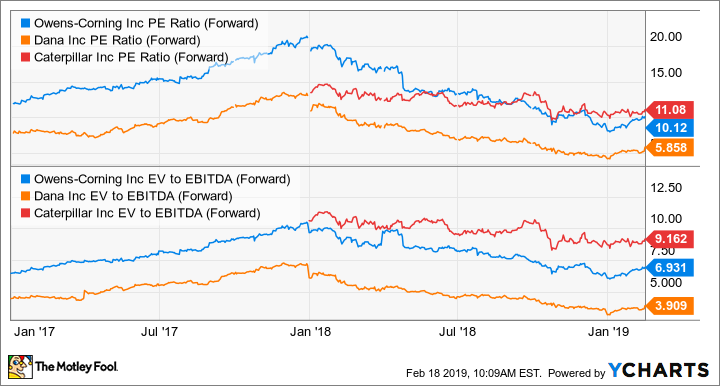

That's the bad news, but it may well have been already priced into its valuation. As you can see below, all three of the stocks discussed here trade on seemingly cheap valuations.

OC PE Ratio (Forward) data by YCharts

Moreover, if you believe that capital spending in mining and energy (Caterpillar also has significant exposure to well servicing) follows commodity price movements, any upturn in prices will lead to upside potential for Caterpillar -- of course, if you could accurately predict commodity prices, you would have no need for equity investing!

The bottom line is that on a risk/reward basis Caterpillar looks like a good value, as it seems priced for a major slowdown that may not come.

Owens Corning

As you can see above, the company's valuation is undemanding, but that's because it's coming off the back of a disappointing year -- things didn't go as planned for Owens Corning in 2018.

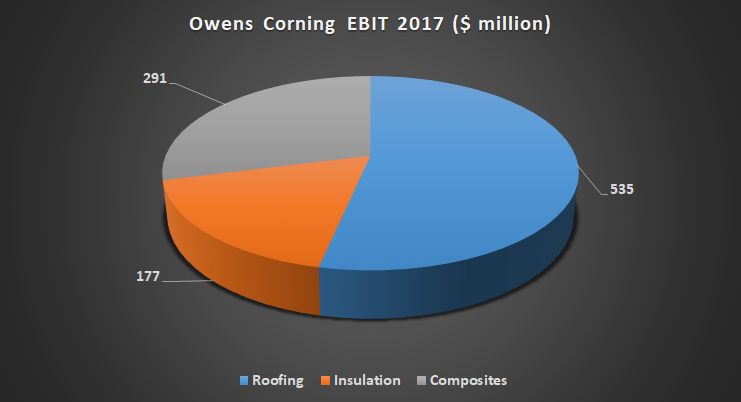

Data source: Owens Corning presentations. Chart by author. EBIT = earnings before interest and taxes.

Going into 2018, management was expecting a mid-single-digit decline in the U.S. asphalt shingle market (roofing segment) compared to the chart above. The composites segment was expected to grow earnings before interest and taxes (EBIT) to $311 million, driven by industrial and roofing demand. Finally, insulation EBIT was expected to grow to $327 million driven by a better pricing environment as improving end demand continued to reduce overcapacity in the industry.

Fast forward to the third quarter and the full-year guidance was changed to a 10% decline in the U.S. asphalt shingle market, composite EBIT is now expected to be around $260 million, and insulation EBIT is expected to be around $287 million. Companywide adjusted EBIT is expected to be $855 million, similar to last year's figure. Where did all the growth go?

In short, the problem is a combination of a weaker-than-expected housing market that affected all three segments, lower storm-related demand for roofing, and cost increases (material and transportation).

Image source: Getty Images.

But here's the thing. Roofing demand mainly comes from remodeling demand, and although remodeling growth is expected to slow in 2019, Harvard University's Leading Indicator of Remodeling Activity (LIRA) is still expecting solid growth in 2019.

Quoting from the latest report "The LIRA projects that gains in renovation and repair spending to owner-occupied homes in the U.S. will shrink from 7.5 percent in 2018 to 5.1 percent in 2019." It's a figure very close to the historical average gain of 5.2% according to the report.

Moreover, storm-related demand could easily bounce back based on weather patterns, while the cost increases that hurt margin across all three segments will come up against easier comparisons in 2019.

All told, it's worth keeping a close eye on the company's fourth-quarter earnings, because if Owens Corning can merely meet analyst estimates for guidance for 2019 (used to create the forward valuations shown above), the stock will look like a good value.

Dana Corporation

It seems no one wants to buy stocks with exposure to light vehicle and commercial vehicle production these days. It's no secret that the current automotive production cycle has already passed a peak, but has the market gone too far with the sell-off of Dana Corporation?

There's certainly downside risk, and Dana's carrying $1.47 billion in net debt. Compared to a current market cap of $2.74 billion, that's cause for concern.

The company's key production assumptions for 2019 look pretty much in line with what others are predicting. For example, North America light truck production is expected to decline by 1.5% at the midpoint of Dana's guidance, while light vehicle engine production is expected to decline 3.1% on a similar basis.

No matter what Dana is still expecting a third consecutive year of double-digit growth of sales, profit, and free-cash-flow growth. In fact, Dana's forecast for $335 million in adjusted FCF for 2019 puts it on a forward-price-to-FCF multiple of just 8.3 times.

That looks like a very good value, and history suggests the automotive/commercial vehicle market will grow again in the future -- something that should boost growth at Dana.

Stocks to buy?

The risk inherent in all three stocks makes them unsuitable for risk-averse investors, but if you are willing to take a little risk in your portfolio in order to capture some significant upside, they all deserve a close look. Caterpillar is probably the safest of the three, but Owens Corning and Dana Corporation look worth buying if they simply continue to meet their own estimates.

More From The Motley Fool

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Cummins. The Motley Fool has a disclosure policy.