3 Silver Mining Stocks to Watch Amid Industry Challenges

The recent weakness in silver prices amid rising interest rates, a stronger dollar and slowing growth affected the Zacks Mining - Silver industry. Demand for the metal is expected to remain strong, aided by industrial fabrication and in jewelry and silverware. The impending demand-supply imbalance will help jack up prices.

We suggest keeping tabs on companies like Buenaventura Mining Company BVN, MAG Silver MAG and Vizsla Silver Corp. VZLA, which are poised to benefit from enhanced operational efficiency, disciplined cost management and solid projects.

About the Industry

The Zacks Mining - Silver industry comprises companies that are engaged in the exploration, development and production of silver. These include big and small players operating mines of widely-varying types and scales. Silver-bearing ores are mined by open-pit or underground methods and then crushed and ground. Miners continually look for opportunities to expand their reserves and resources through targeted near-mine exploration and business development. They strive to upgrade and improve the quality of their existing assets, internally as well as through acquisitions. Only 20% of silver comes from mining activities, where silver is the primary source of revenues. The balance comes from projects, wherein silver is a by-product of mining other metals, such as copper, lead and zinc. Thus, several companies in the silver mining industry are engaged in mining other metals as well.

What's Shaping the Future of Mining-Silver Industry

Ongoing Weakness in Silver Prices a Bane: Silver had made a solid start in 2022 and hit a high of $26.90 per ounce in March as the Russia-Ukraine turmoil fueled safe-haven demand. However, with the strengthening of the dollar, silver soon lost its sparkle. Prices dipped to a 2-year low to around $17 an ounce in September and are currently trending at around a $21 mark. Rising interest rates, a stronger dollar, inflation and sluggish growth have induced the 10% drop in its value so far this year. Further, the recent slowdown in the industrial due to muted customer spending and supply-chain snarls weighed on silver.

Inflationary Costs Strain Margins: The industry players are currently facing escalating production costs, including electricity, wages, water and materials. Mining companies are major consumers of energy, with around 50% of their production costs closely linked to energy prices. A shortage of skilled workforce spiked wages. With no control over silver prices, the industry must focus on improving its sales volumes while being cost-effective. The companies are investing heavily in R&D and resorting to technological innovations required at almost every level of operation to increase efficiency, sustain growth and rein in costs.

Demand to Remain Strong: Silver demand in all key sectors is expected to remain upbeat this year. The Silver Institute projects global silver demand to hit a new record of 1.21 billion ounces in 2022, indicating a 16% increase from the year-ago reported figure. Industrial demand is expected to grow to 539 million ounces as ongoing vehicle electrification, rising adoption of 5G technologies and the government focus on green infrastructure will drive demand and offset weakness in other areas. Jewelry and silverware demand is expected to rise 29% and 72%, respectively, in 2022. This will be mainly driven by India, courtesy of improving consumer sentiment. Silver physical investment is likely to be up 18% in 2022, led by the ongoing macroeconomic uncertainties and inflationary pressures. In contrast to strong demand, mined silver production is expected to rise a meager 1% from the year-ago reported figure to 830 million ounces, as higher output from Mexico will be offset by declines in Peru, China and Russia. The global silver market seems to close the year with a deficit of 194 million ounces, marking the second consecutive deficit this year – a multi-decade high. This will somewhat help boost prices.

Zacks Industry Rank Indicates Lackluster Prospects

The group's Zacks Industry Rank, basically the average of the Zacks Rank of all the member stocks, indicates gloomy prospects in the near term. The Zacks Mining - Silver industry, a 12-stock group within the broader Zacks Basic Materials sector, currently carries a Zacks Industry Rank #230, which places it in the bottom 9% of 252 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group's earnings growth potential. So far this year, the industry's earnings estimate for the current year has plunged 91%.

Despite bleak near-term prospects, we will present a few Mining-Silver stocks that one can retain, given their prospects. But it's worth looking at the industry's shareholder returns and its current valuation first.

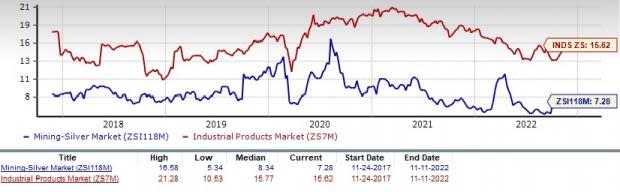

Industry Versus Broader Market

The Mining-Silver Industry has underperformed both the S&P 500 and its sector over the past year. The stocks in this industry have collectively lost 31.4% in the past year compared with the Zacks S&P 500's drop of 17.3% and the Zacks Basic Material sector’s fall of 5.6%.

One-Year Price Performance

Industry's Current Valuation

Based on the forward 12-month EV/EBITDA ratio, a commonly used multiple for valuing silver-mining companies, we see that the industry is currently trading at 7.25X compared with the S&P 500's 10.75X and the Basic Material sector's forward 12-month EV/EBITDA of 15.62X. This is shown in the charts below.

Enterprise Value/EBITDA (EV/EBITDA) F12M Ratio

Enterprise Value/EBITDA (EV/EBITDA) F12M Ratio

Over the past five years, the industry has traded as high as 16.58X and as low as 5.34X, with the median being at 8.34X.

3 Mining-Silver Stocks to Keep an Eye on

Buenaventura Mining Company: In March, BVN received the Government of Peru's approval of all required permits for the San Gabriel Mine Project, an important milestone in advancing such an important project. Construction-related activities at San Gabriel are currently underway. San Gabriel will almost double Buenaventura's current gold production starting 2025 and contribute between 120,000 and 150,000 gold ounces, annually. This project is aligned with its strategy to deliver projects and strengthen its precious metals portfolio. BVN announced multiple transactions this year to enhance balance-sheet strength, reduce debt, invest in growth projects and focus on its portfolio. BVN has a solid pipeline of projects to deliver growth in the long haul. Its efforts to curtail costs at its mines led to significant cost savings in each pit, thereby driving a solid EBITDA performance. BVN also deepened its focus on exploration to extend the life of mines.

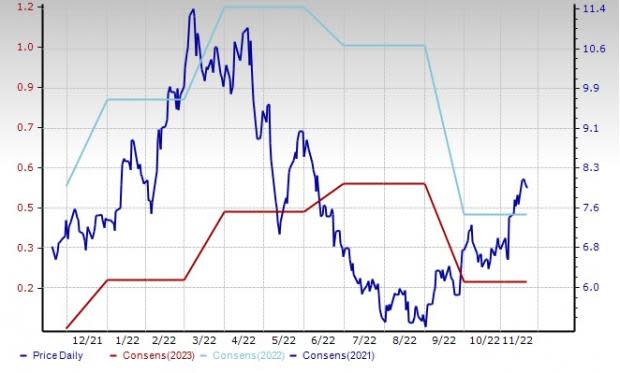

The Zacks Consensus Estimate for this Lima, Peru-based entity's current-year earnings has been stable at 43 cents per share over the past 30 days. BVN’s shares have gained 17% in the past year. BVN currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Price & Consensus: BVN

MAG Silver: MAG’s principal asset is the high-margin underground silver project Juanicipio located in Zacatecas, Mexico in which it has 44% interest. The project is currently being developed with its operator Fresnillo Plc (FNLPF), which holds the remaining 56% stake. As reported by Fresnillo, on a 100% basis, a record 180,808 tons of mineralized development and stope material were processed through the Fresnillo plants during the three months ended Sep 30, 2022, at an average head grade of 513 silver grams per ton. Electrical commissioning is expected shortly and a target ramp-up to 85-90% of nameplate capacity is envisioned within months of commissioning. Juanicipio is poised to be a significant silver producer. Along with the Juanicipio 2022 exploration program, MAG is progressing on Deer Trail and Larder projects. The Larder Gold Project, located in the prolific Abitibi greenstone belt in Northern Ontario, Canada, was added to MAG’s portfolio through the acquisition of Gatling Exploration Inc. The project hosts three high-grade gold deposits along the Cadillac-Larder Lake Break, 35 km east of Kirkland Lake.

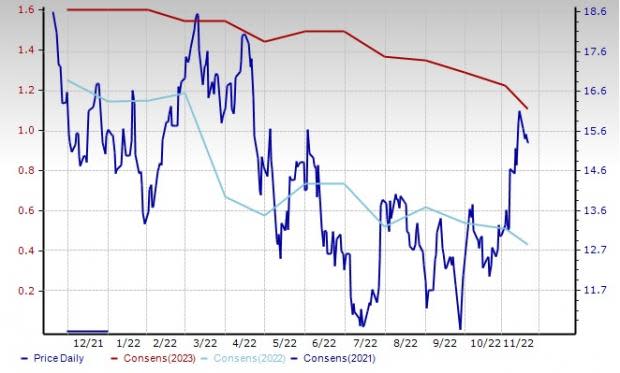

The Zacks Consensus Estimate for this Vancouver Canada-based player’s 2022 earnings indicates 616% growth from the year-ago reported figure. The company has a trailing four-quarter earnings surprise of 15.3%, on average. Its shares have declined 17.7% over the past year, mainly due to lower silver prices. MAG currently carries a Zacks Rank of 3.

Price & Consensus: MAG

Vizsla Silver: VZLA is focused on advancing its flagship, 100%-owned high-grade Panuco silver-gold project in Sinaloa, Mexico, one of the highest-grade silver primary discoveries in the world. The project benefits from power, water and road access. So far, Vizsla has executed more than 210,000 meters of drilling at Panuco, leading to the discovery of several new high-grade veins. For 2022, Vizsla has a budget of more than 120,000 meters of resource/discovery-based drilling, designed to upgrade and expand the maiden resource as well as test other high-priority targets across the district.

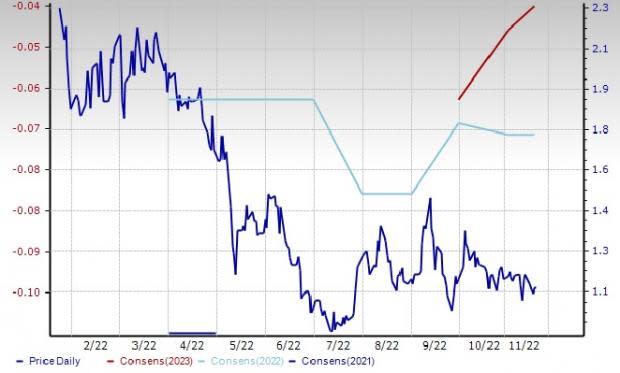

The Zacks Consensus Estimate for this Vancouver, Canada-based player’s 2022 earnings indicates 22% growth from the year-ago reported figure. VZLA has a trailing four-quarter earnings surprise of 25%, on average. Its shares have declined 51% over the past year, mainly due to lower silver prices. VZLA currently carries a Zacks Rank of 3.

Price & Consensus: VZLA

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Buenaventura Mining Company Inc. (BVN) : Free Stock Analysis Report

MAG Silver Corporation (MAG) : Free Stock Analysis Report

Vizsla Silver Corp. (VZLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research