3 Stocks That Are Absurdly Cheap Right Now

On Oct. 17, the Dow Jones Industrial Average (DJINDICES: ^DJI) crossed 23,000 for the first time ever. That's just one example of how the stock market has continued to move higher since the end of the Great Recession. And while there are some indicators that stocks as a class are, if not overvalued, then at least quite pricey, there are still values to be had.

Frankly, some stocks are even downright cheap. Here are three that our contributing investors have found to be somewhere between fire-sale and dirt cheap at recent prices: offshore drilling contractor Ensco PLC (NYSE: ESV), oil and gas midstream storage specialist Buckeye Partners, L.P. (NYSE: BPL), and tire stalwart Goodyear Tire & Rubber Co. (NASDAQ: GT).

Keep reading to learn why these stocks are so cheap right now and, more importantly, whether our experts think they're worth buying.

Image source: Getty Images.

Fire-sale price for a watertight business

Jason Hall (Ensco PLC): The sharp decline in oil prices from above $100 in 2014 nearly halted new investments in offshore drilling over the past few years. It's also forced Ensco and other drilling contractors to survive on existing contracts, as well as idle and even scrap older vessels to cut costs.

Offshore has also faced pressure from onshore shale. Shale development costs and time have fallen sharply, and North American shale is now the "swing" production, able to quickly add production to absorb market growth. This situation has played some role in depressing oil prices and also slowed interest in spending to develop offshore projects.

The market is behaving as if offshore drilling is doomed:

ESV Price to Book Value data by YCharts

The market is trading Ensco as if it were on the cusp of failure, which just isn't very likely. The company has $1.85 billion in cash, a manageable $4.75 billion in debt (none of which is due within the next 12 months), and $2.25 billion available on its credit revolver. The company also has $3 billion in contracted revenue on its backlog. All of these things mean it has the resources to ride out an even more protracted downturn.

But Offshore is recovering. Bid activity and contracts awarded are improved this year, and that situation should continue. At 20% of its book value, Ensco is discounted far more than the risks indicate it should be. Historically, Ensco has generally traded at a much higher multiple, often well above two times book value. Even a small improvement in the prospects for offshore drillers should make Ensco a serious multibagger from here.

A little too much fear

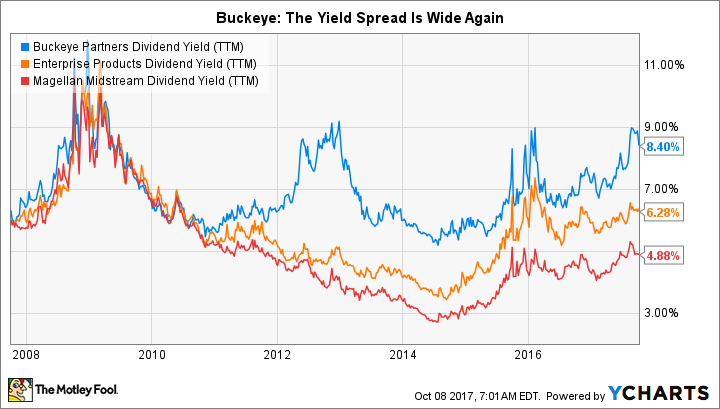

Reuben Gregg Brewer (Buckeye Partners, L.P.): Storage-focused midstream partnership Buckeye Partners' yield is toward the high end of its recent history. Meanwhile, the spread between Buckeye's yield and competitors such as Enterprise Products Partners LP (NYSE: EPD) is also relatively wide. These facts hint that Buckeye is a bargain today. And with an 8.5% yield, it certainly looks enticing even on an absolute basis.

BPL Dividend Yield (TTM) data by YCharts

The problem is that Buckeye just completed the relatively large acquisition of 50% of global storage company VTTI. The good news is that this deal further expands the partnership's global reach. The bad news is that debt levels are on the rise because of the deal and distribution coverage fell below 1 in the second quarter.

Buckeye has a long history of regular annual distribution increases -- 22 years and counting. That includes periods where coverage was below 1, as in 2013 and 2014. As investments made in those years added to cash flows, however, coverage rose above 1. Buckeye has some more expenses tied to VTTI deal, and it's building some new pipelines, So its spending probably isn't over yet.

However, there's no reason to believe that this period of investment will be different from previous ones. I expect coverage to rise above 1 as these new investments begin to pay off. And that means the high yield relative to history and peers is likely to be a solid buying opportunity for investors willing to stomach a little uncertainty.

Gone flat, but still rolling

Neha Chamaria (Goodyear Tire & Rubber): Goodyear stock got punctured after the tire manufacturer delivered a dismal set of second-quarter numbers in July, and it's down nearly 9% since. But with Goodyear now trading for only 7 times forward earnings -- despite consensus estimates pegging the company's earnings per share to jump nearly 40% next year -- this has become one dirt-cheap stock worth your attention.

First, the risks. Goodyear faced several headwinds during the second quarter, including volatile raw-material prices and softer demand for tires from the original equipment market. Management also lowered its full-year operating income outlook to $1.6 billion-$1.65 billion, representing a nearly 20% decline from 2016 levels.

However, much of the pessimism may already be baked into Goodyear's stock price. Just days ago, Goodyear increased its dividend by 40%, indicating that management isn't reading much into the one-off bad second quarter. Considering that Goodyear paid less than 30% of its free cash flow in dividends during the trailing 12 months, the increased dividend looks sustainable.

One key factor worth noting is that Goodyear gets nearly 70% of its revenue from the replacement market, which is facing strong growth catalysts such as aging vehicles and demand for greater fuel efficiency. Goodyear is one of the leading players in the replacement market.

Also, Goodyear has a strong growth pipeline, with some of its projects including a new plant in Mexico and capacity expansions in China, India, and South Africa through 2020.

Overall, Goodyear looks like a fairly strong growth story, and the price that you get to pay today for the stock to be part of the story is reasonable by any count.

More From The Motley Fool

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

NVIDIA Scores 2 Drone Wins -- Including the AI for an E-Commerce Giant's Delivery Drones

Jason Hall owns shares of Ensco. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool owns shares of Ensco. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.