3 Stocks That Are Absurdly Cheap Right Now

The stock market has surged through June, as the S&P 500 is again flirting with all-time highs. Dovish signals from the Federal Reserve, signs of a detente in the U.S.-China trade war, and President Trump's retreat from tariffs on Mexico have all helped the market recoup last month's losses.

With stock prices as high as ever, you may be wondering if there are still any bargains to be had on the market today. Luckily, our contributors have found three stocks that look absurdly cheap right now. Here's why they recommend Steel Dynamics (NASDAQ: STLD), Alliance Resource Partners (NASDAQ: ARLP), and Hawaiian Holdings (NASDAQ: HA).

Image source: Getty Images.

Worth the risk of a cyclical peak

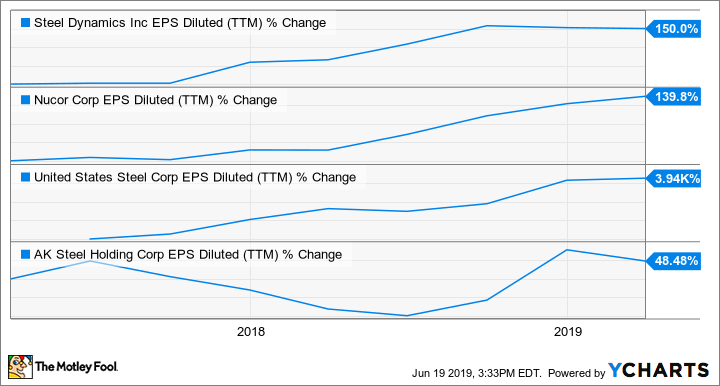

Jason Hall (Steel Dynamics): Steelmaking remains a stubbornly hard industry to invest in (or at least profitably). Over the past couple of years, the combination of lower corporate taxes, a relatively strong U.S. economy, and the implementation of tariffs to push imported steel (much of which was being subsidized by foreign countries) out of the market was expected to result in a resurgence in American steel.

And to some extent it has been resurgent, with profits up solidly over the past few years:

STLD EPS Diluted (TTM) data by YCharts.

However, even with profits up, investors have been pretty negative on the industry more recently. Here's how some of Steel Dynamics' peers' stocks have fared since the beginning of 2018:

So what gives? In short, there are concerns that demand is weakening, and the temporary boost in steel prices following last year's tariffs hasn't stuck. But I think the recent sell-off has created an opportunity for investors to consider one of the few steelmakers worth owning: Steel Dynamics.

At recent prices, it trades for less than 5.6 times trailing earnings and 4.9 times cash flows, both of which are about as cheap as it's been over the past decade. The biggest reason why it's that cheap is because the industry isn't expected to earn nearly as much money in 2019 as last year, as well as fears that steel demand is nearing a cyclical peak.

So there's some risk that the cycle could be peaking, and Steel Dynamics' earnings could weaken more than expected over the next year or so. However, I think the long-term prospects for the company to continue taking market share, as well as the structural advantages of its mini mill-based operations to adapt to changes in steel demand, should make it a long-term market beater.

This ultra-high-yield, single-digit-P/E stock is nothing like its peers

Sean Williams (Alliance Resource Partners): You'd struggle to find a cheaper stock right now than Alliance Resource Partners, which has a forward price-to-earnings ratio of less than 7.

Why's it so cheap, you ask? Well, for starters, blame guilt by association. Alliance Resource is a coal producer, and coal has a pretty bad rap on Wall Street. Over the past decade, many of the biggest names in coal declared bankruptcy under a mountain of debt and crumbling coal prices.

There have also been recent concerns about coal exports to overseas markets. The rising tensions between the U.S. and China over trade, coupled with lower natural gas prices in Europe (which encourage utilities to switch to coal-fired power plants) and aggressive pricing by competitors, has made export life difficult for Alliance Resource Partners.

But here's the thing: This company is nothing like its many bankrupted peers. Alliance Resource's management team has historically run the company very conservatively, which is fully visible on its balance sheet. Alliance Resource has a reasonable $547 million in net debt and a total debt-to-equity of 42%. For added context, the company's operating cash flow over the trailing 12-month period is higher than its total debt, suggesting that its debt isn't a big concern.

It's secret to success and staying profitable, even when coal prices have declined significantly, is twofold. First, Alliance Resource negotiates volume and price commitments well in advance. It's not uncommon for the company to enter a given year with 80% to 90% of its production spoken for, as well as 50% of its production in the following year. By locking in output and price commitments ahead of time, Alliance Resource avoids the wild fluctuations tied to the wholesale coal market.

And secondly, there's the export market. Although exports are bound to see their ups and downs, the long-term outlook for international coal is promising. Having exported only a small fraction of its annual production in 2016, Alliance Resource is now selling about a quarter of its coal in overseas markets. There are plenty of opportunities in emerging markets for coal, which is perfect for Alliance Resource Partners' long-run outlook.

And just in case you like icing on your cake, Alliance Resource has a dividend yield of 12.4% -- and that's not a typo. For all of these reasons, Alliance Resource Partners is the absurdly cheap stock you should consider buying.

Your ticket to paradise

Jeremy Bowman (Hawaiian Holdings): Airlines have long been an unloved industry, but after a wave of consolidation in recent years, low fuel prices, and a strong economy, the sector looks to be on stronger footing than ever before.

The market remains skeptical of airlines, however, setting up some appealing options for value-seeking investors, and none look better than Hawaiian Holdings, the parent of Hawaiian Airlines.

The niche carrier trades at a trailing P/E ratio of just 5.2, or 6.7 based on this year's expected earnings. These are estimated to fall, since competitors like Southwest and Alaska Airlines have stepped up service to Hawaii, forcing Hawaiian to lower prices. However, Hawaiian isn't likely to cede its leadership of service to the islands, as it offers direct service from 13 mainland U.S. cities and several destinations in Asia and Australia. The company also has a commanding position in routes within the Hawaiian islands, with 80% market share, and that dominance is unlikely to be challenged by the major domestic carriers. Those routes generate 22% of its revenue but likely a higher percentage, as they are short-haul flights that require relatively little fuel.

In a sign of rising demand, the number of planes the company owns has grown from 37 to 49 over the last two years, and it has orders for six new planes in 2019.

Hawaii, meanwhile, is a unique destination in the world and should appeal to West Coasters flush with cash as the tech industry booms and to millennials who have shown a preference for spending on experiences over things.

At a P/E of 6.7, Hawaiian looks like a bargain, and the stock should recover some of its recent losses, since it's poised to deliver steady growth over the coming years in spite of increasing competition in its market.

More From The Motley Fool

Jason Hall owns shares of Nucor. Jeremy Bowman has no position in any of the stocks mentioned. Sean Williams has no position in any of the stocks mentioned. The Motley Fool recommends Hawaiian Holdings and Nucor. The Motley Fool has a disclosure policy.