3 Stocks to Consider as Gold and Silver Trade Higher

- By Alberto Abaterusso

Gold price outlook

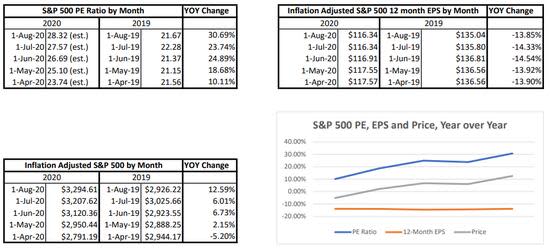

Based on the below data on the S&P 500 index (the benchmark for the U.S. stock market), U.S.-listed equities are, in general, overvalued at the moment.

These statistics show that current market prices are disproportionated in view of the most recent data on net earnings published by the U.S. publicly traded companies that make up the index. These levels are not justified if corporate profits are the main factor driving the market values of stocks.

Contrary to what analysts say today, second-quarter earnings cannot be a reason for optimism just because, by far exceeding their estimates, they have generated positive surprises producing beneficial outcomes for the share prices. It shouldn't be omitted that the estimates on companies' profits had been largely revised downwards (before the end of the second quarter). This has resulted in excessive discrepancies between forecasted and actual net earnings.

Furthermore, as we have seen from the tables above, earnings are decreasing on a year over year basis, reflecting the diminished ability of companies to generate and grow profits.

Investors who are looking for ways to protect the value of their holdings from elevated volatility may thus want to increase the exposure of their portfolios to precious metals, primarily gold and silver, which serve as safe-haven assets. That is why gold and silver already gained 25% and 50%, respectively, year to date.

The price per ounce of gold and silver has regressed slightly over the past three days from $2,008.75 and $28.325 recorded by the London bullion market on Tuesday to $1,927.15 and $26,915 on Thursday. The metals also retreated on the Comex, with gold futures trading at $1,946.50 an ounce and silver futures at $27.147 an ounce at close on Thursday, down about 3.3% from earlier levels this week.

However, I think the future is bright for gold and silver lovers, with prices that are highly expected to keep on rising due to continued uncertaintly and volatility in the markets.

One way to benefit from the precious metals bull market is to purchase shares of strong gold and silver operators. My proposals are for Northern Dynasty Minerals Ltd (NAK), Galiano Gold Inc (GAU) and Comstock Mining Inc (LODE), as they are performing strongly, having already topped the VanEck Vectors Junior Gold Miners (GDXJ) exchange-traded funds by 219%, 25% and 106% so far this year, respectively.

Northern Dynasty Minerals Ltd

The stock traded at a price of $1.55 per share at close on Thursday for a market capitalization of $778.18 million, a price-book ratio of 6.12 (versus the industry median of 2.25) and an enterprise value-Ebitda ratio of -16.28 (versus the industry median of 10.85). The last indicator is negative because Northern Dynasty Minerals Ltd is not producing the precious metal yet but only exploring for mineral properties in the U.S. However, its share price appears to benefit a lot already from rising commodities prices, as it went up nearly 261% over the last 7.5 months.

The stock is currently trading about 9% above the middle point of the 52-week range of $0.35 to $2.49, between the 35- and 70-simple moving average (SMA) lines and far from overbought levels as the 14-day Relative Strength Index (RSI) stands at 48.

The main metallic project of the Vancouver-based explorer is the Pebble mineral asset in southwest Alaska for future production of gold, silver, copper and molybdenum. Here, measured and indicated mineral resources contain about 71 million ounces of yellow metal, 345 million ounces of silver, 57 billion pounds of copper and 3.4 billion pounds of molybdenum.

Pebble, which is a world-class mineral deposit, is fully owned, located in a favorable jurisdiction, on track for permitting and development and holds huge potential for the creation of a long-life asset using the most advanced mining techniques with a small impact for the environment.

As of August, the stock has three buy recommendation ratings on Wall Street and an average target price of $2.51, reflecting nearly 62% share price upside from Thursday's close.

Galiano Gold Inc

The stock price traded at around $1.68 at close on Thursday, which marked a nearly 77% increase so far this year, determining a market capitalization of $372.63 million and a price-book ratio of 2.06 (versus the industry median of 2.25). Additionally, the enterprise value-Ebitda ratio is -2.35 (versus the industry median of 10.85).

The share price is significantly below the higher limit of the 52-week range of $0.76 to $2.12 and still on par with the 35-day SMA line. Also, the 14-day RSI of 51 tells that the stock price stands quite far from overbought levels.

Galiano Gold Inc is the operator of the Asanko Gold Mine, a fifty-fifty joint venture with the South African gold producer Gold Fields (GFI). The gold producing asset is located in Ghana, the only country in the West African region to pose an acceptable level of risk to mining activities.

Thanks to a record gold output of 69,772 ounces produced in the second quarter of 2020, as a result of strong operating activities which saw processing unprecedented 1.64 million tons of mineral at an average grade of 1.4 grams of gold per ton of ore, the company could strengthen its cash position. The company has almost $70 million in cash on hand and equivalents and zero debt.

The company sold 61,385 ounces of gold in the quarter at a price of $1,651 per ounce, allowed for proceedings for approximately $101.3 million.

As of August, the stock has a recommendation rating of overweight on Wall Street with an average target price of $2.05 per share, which reflects a 22% growth from Thursday's closing price.

Comstock Mining Inc

The share price hit $1.09 at close on Thursday for a market capitalization of $35.24 million, following a nearly 148% increase over the period from Jan. 1 to Aug. 20. The price-book ratio is 1.13 (versus the industry median of 0.8) and an enterprise value-Ebitda ratio is 28.5 (versus the industry median of 11.91).

The stock is not cheap when comparing it to the 35-, 70- and 140- day SMA lines, as it trades largely above all of them. However, it still represents a 7.2% discount to the middle point of the 52-week range of $0.23 to $2.12.

Comstock Mining Inc is a U.S. gold and silver operator with income-producing investment assets in Nevada, a State which is known to be rich in precious metal resources and very easy going from a mining standpoint, dragging the venture risk down to very low levels.

Its investment assets are represented by interest stakes in Tonogold Resources Inc (TNGL) and in Mercury clean Up LLC. Tonogold is a Californian junior miner focusing on mining leases on mineral properties in Nevada and Mexico, while Mercury is a Nevada-based company holding exclusive worldwide rights to a proprietary system to reclaim mercury from tailings stemming from mining and other operating activities.

These assets performed very well, recording approximately a $2.4 million total increase in their value, which drove a positive switch in the earnings per share 5 cents in the second quarter of 2020, up from a net loss of 13 cents per share in the final quarter of 2019. Significant improvements reported in operating costs and interest expenses also gave a good contribution to the positive income achievement.

The extension of certain agreements on some non-mining properties for a total consideration of about $10.1 million helped Comstock Mining Inc to completely reimburse the remaining portion of $4 million in guaranteed senior corporate loans, so the balance sheet became more robust.

As of August, the stock has one buy recommendation rating on Wall Street with a target price of $4.50.

Disclosure: I have no position in any security mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.