3 Stocks That Could Put Amazon's Returns to Shame

If you bought Amazon.com (NASDAQ: AMZN) share at the 1995 IPO, you're looking back at a 79,000 return so far. That long-term surge includes a staggering 2,060% growth spurt in the last decade alone.

But where is the next Amazon-like growth stock for the ages? Whether you tapped into Amazon's massive expansion years ago or feel like you missed the boat on that opportunity, it's always smart to keep an eye out for new ideas.

We asked a handful of your fellow investors here at The Motley Fool what tickers they feel might live up to Amazon's inspiring example at this moment in time. Read on to see why they selected Wayfair (NYSE: W), Visa (NYSE: V), and Netflix (NASDAQ: NFLX).

Image source: Getty Images.

Growth equals change equals growth for Netflix

Anders Bylund (Netflix): I do expect Amazon to keep providing strong stock returns and improving business results for the long haul. The stock is part of my portfolio, and a very helpful one at that. But Amazon shares play a far smaller role in my long-term investing strategy than Netflix, and for good reason.

Netflix is redefining the global entertainment market, one country at a time. In some places, the streaming video specialist faces off against local services -- often with good results. In others, Netflix paves entirely new paths for video entertainment consumption in this increasingly digital era.

The media giant that CEO Reed Hasting built from the bottom up already has 55 million domestic subscribers and another 63 million accounts abroad. And that's just the beginning. Netflix hopes to collect up to 90 million domestic subscribers when all is said and done, the necessary broadband infrastructure and payment abilities are spreading like wildfire around the developing world, and we're really watching a future media giant in the making.

You might think Netflix is big now, but that's only true in the narrowly defined (yet growing) niche of streaming video services. In the larger media world, Netflix remains a toddler next to the big boys of Hollywood. Walt Disney's annual sales are about five times larger, for example.

And that's where Netflix is headed next, driven by the original programming that serves as rocket fuel for the streaming service right now. This company is not afraid to disrupt itself when it's time to move on. The next generation of Netflix users may think of it more as a content creator than a specific viewing service.

The stock has been very good to me so far, growing my initial investment more than 18-fold in six short years. And the best is yet to come.

The business that makes Amazon and so many others possible

Tyler Crowe (Visa): E-commerce has been made possible by so many different developments over the years, but perhaps the one that is underappreciated is the one that was around for decades before it: credit cards. We take credit and debit cards for granted in North America. Internationally, though, cash is still king by a long shot. For a company like Visa, that simply means there is that much more market out there to capture.

In 2017, Visa processed $2.03 trillion in total payments, a large portion of which was in the U.S. In emerging markets such as Latin America, the Middle East, and Africa, though, Visa processes less than 5% of all transactions despite having a larger international presence than its largest rival, Mastercard.

According to management, growing its presence globally is one of three avenues to unlock more than $100 trillion in processed payments globally. Those avenues include the steady migration away from cash globally, the growing presence of e-commerce, and the extremely lucrative markets of business-to-business and government payment systems.

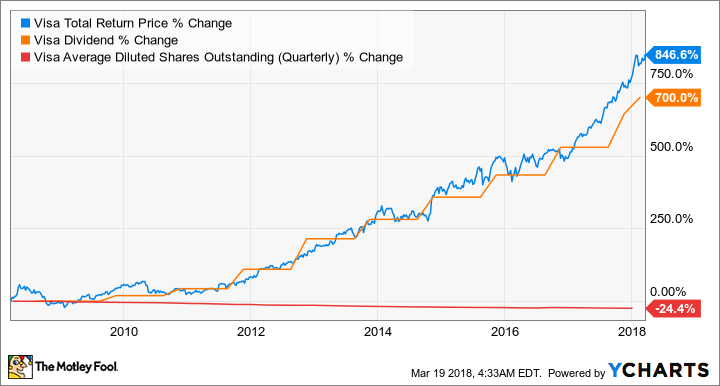

V Total Return Price data by YCharts.

What is perhaps the most compelling aspect of Visa and this monumental growth opportunity is the fact that Visa's offering as a payment platform is not a capital-intense business, so it won't require high levels of investment to obtain that growth. For investors, that means Visa is likely to throw off loads of free cash flow that can be returned to shareholders.

Many of the trends that bode well for Amazon also benefit Visa, and Visa has more places where its company has the potential for exponential growth. So, if there is a business that could outpace Amazon over the long haul, it's Visa.

A defensible e-commerce niche

Demitri Kalogeropoulos (Wayfair): It hasn't yet found a way to profit from selling home furnishings online, but Wayfair is making big strides in that direction. Its 43% sales spike in 2017 corresponded to significant market growth, for one. Wayfair's customers are showing rising satisfaction these days, too, as repeat shoppers accounted for 3.9 million orders over the holiday quarter, or 62% of the total.

These encouraging growth numbers support management's plan to extend their competitive moat through a fulfillment infrastructure that promises to make bulky deliveries like sofas and tables quick and cost-effective. At the same time, Wayfair sees a big opportunity to expand deeper into international markets like the U.K and Germany.

These priorities might make 2018 the e-commerce specialist's fourth straight year of suffering a net loss. Investors should also keep a close eye on advertising spending, which might indicate a weakening market position if it spikes higher. On the bright side, if Wayfair keeps growing at the 40% rate it is targeting, then its hold on this attractive market niche just grows stronger, and it becomes that much harder for rivals to elbow in on its turf.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Anders Bylund owns shares of Amazon, Netflix, and Walt Disney. Demitrios Kalogeropoulos owns shares of Netflix and Walt Disney. Tyler Crowe owns shares of Visa and Walt Disney. The Motley Fool owns shares of and recommends Amazon, Mastercard, Netflix, Visa, Walt Disney, and Wayfair. The Motley Fool has a disclosure policy.