3 Stocks with Earnings Growth Trends in 2023

2023 is set up like it may be another challenging year for stocks, but the Zacks Rank can help. Using the Zacks Rank we can identify stocks that are forecasted to have improving earnings. Companies with growing earnings in a slowing economy can provide a cushion many investors’ portfolios need.

A major headwind for stocks continues to be persistent inflation. Picking stocks in commodities-based businesses can be a great way to use inflation as a tailwind. Aligning macro trends with signals from the Zacks Rank can act like a cheat code for investors.

It is also worth considering that although many analysts agree the near future looks gloomy, consensus agreements can be wrong.

Current data may be showing a slowing economy, but broadly speaking things are still quite robust. There is a possibility that we will have a persistently strong economy in 2023, so I also share a stock that should perform well in that case.

Archer-Daniels-Midland

Archer-Daniels-Midland ADM is an international agricultural commodities company. ADM trade, transport, store, process and merchandise a wide range of raw agricultural materials. Archer-Daniels-Midland currently sports a Zacks Rank #1 (Strong Buy) indicating strong positive earnings revision growth.

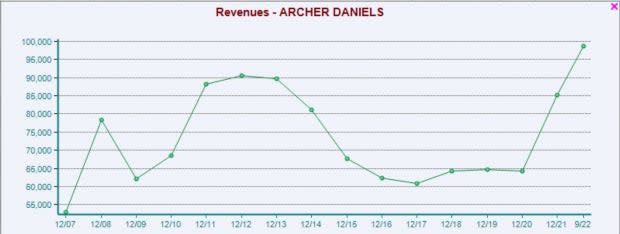

Inflation has been a boon for the commodities and raw materials industries and ADM was not excluded. Revenue and more importantly, earnings have rallied tremendously since inflation gained momentum. In the charts below we can see revenue jumped from ~$65 billion to nearly $100 billion between 2020 and 2022, and EPS more than doubled.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

ADM currently trades at a P/E of 11.5x, which is below both its industry average and its own 10yr median. And ADM offers a dividend yield of 1.9%, which it has continuously raised throughout the company history.

Image Source: Zacks Investment Research

Cleveland-Cliff Inc.

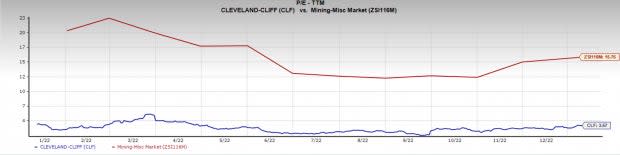

Cleveland-Cliff, formerly Cliff Natural Resources, is a flat-rolled steel producer and the largest supplier of steel to the automotive industry in North America. Since 2019 CLF has experienced a huge boom in revenue going from just under $2 billion in 2019 to over $20 billion today, in part thanks to strategic acquisitions. CLF has a Zacks Rank #1 (Strong Buy), and trades at a P/E of 3.6x, which is well below the industry average of 15x, and its 10yr median of 6x.

Image Source: Zacks Investment Research

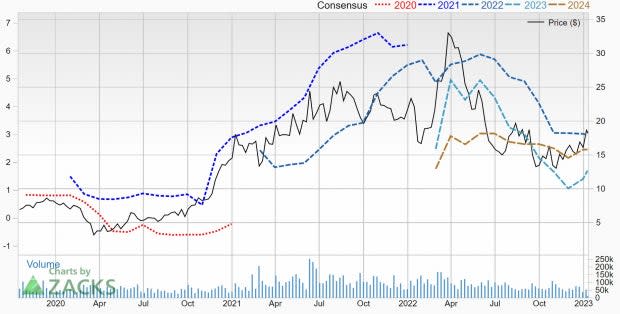

In the chart below we can see that after rolling over in mid-2022, 2023 earnings trends have begun to turn higher again. This is encouraging action for the stock as Zacks research demonstrates that upwards revisions in earnings expectations strongly correlates with future price gains.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

United Rentals

United Rentals is a construction and industrial equipment rental company. URI rents out a range of different equipment including forklifts, earthmoving equipment, and scissor lifts to customers such as industrial firms, utilities, homeowners, and government entities.

United Rentals is a company that would benefit from positive trends in housing, construction, and infrastructure. While many analysts are expecting these industries to slow considerably over the next year, it is very possible those analysts are wrong. Furthermore, it is hard to argue with the earnings data, and stock price.

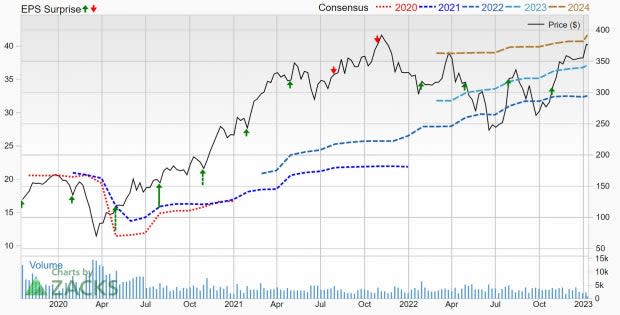

URI is nearing its all-time high stock price, and earnings revisions continue to trend higher. You can see in the chart below how consistently earnings expectations have trended higher since 2020. This is a rare sight and may indicate that there is another leg higher in the economy before things eventually roll over.

Image Source: Zacks Investment Research

Along with the other two, URI has a Zacks Rank #1 (Strong Buy) but because of its economic drivers may provide a return that is uncorrelated a commodities business like ADM.

Conclusion

Whether the economy will be weak or strong this year is truly unknown, but that doesn't mean you can’t find stocks that may perform well. The Zacks Rank is one tool that can provide investors with stocks that regularly outperform the market.

Additionally, it is interesting to consider that the Zacks Ranks may provide some insights into what is happening in the economy. Caterpillar CAT, the well-known construction company, recently made new highs, and like URI has positively trending earnings revisions. Not something you would expect to see in a recession.

While analyzing the market it can be easy to get carried away by narratives, but it’s extremely important to keep an open mind. When you have divergent data, you will want to take notes, and maybe adjust course.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

ClevelandCliffs Inc. (CLF) : Free Stock Analysis Report

United Rentals, Inc. (URI) : Free Stock Analysis Report