3 Stocks Trading Below the Peter Lynch Fair Value

- By Alberto Abaterusso

Investors screening the market for opportunities amid growing companies may want to consider the following three stocks, as their share prices are trading lower than their Peter Lynch Fair Values.

The Peter Lynch Fair Value, which is based on the idea that the fair price-earnings ratio for a growing company is in line with its growth rate, derives from the combination of the following three components:

The stock's PEG ratio.

The stock's five-year Ebitda growth rate.

The stock's earnings per share (EPS) without non-recurring items (NRI) for the trailing twelve months (TTM) through the most recent quarter.

Louisiana-Pacific Corp

The first stock that holds the criteria is Louisiana-Pacific Corp (NYSE:LPX), a Nashville, Tennessee-based manufacturer of building materials and equipment that are mainly used to construct, repair and restyle residential buildings and to realize outdoor architectures.

On Wednesday, Louisiana-Pacific Corp's share price closed at $65.33, significantly below its Peter Lynch Fair Value per share of $117.65, for a price-to-Peter-Lynch-Fair-Value ratio of about 0.56. This ranks higher than 75% of the 374 companies that operate in the construction industry.

The stock has a market capitalization of $6.68 billion following a 190.5% increase that took place over the past year. The 52-week range is $21.84 to $76.35.

The stock has a GuruFocus financial strength rating of 8 out of 10 and a profitability rating of 6 out of 10.

As of May, the stock has a median recommendation rating of overweight on Wall Street. The average target price is $79.75 per share.

Primerica Inc

The second stock that matches the criteria is Primerica Inc (NYSE:PRI), a Duluth, Georgia-based provider of financial products such as life insurance, investment and savings, auto, homeowners' and medical insurance products to North American middle-income households.

On Wednesday, Primerica Inc's share price traded at $158.31 at close, which is below the Peter Lynch Fair Value per share of $175.62, yielding a price-to-Peter-Lynch-Fair-Value ratio of approximately 0.90. This ranks higher than 55% of the 89 companies that operate in the insurance industry.

The stock has a market capitalization of $6.24 billion following a 45% increase that occurred over the past year. The 52-week range is $105.75 to $165.35.

The stock has a GuruFocus financial strength rating of 4 out of 10 and a profitability rating of 7 out of 10.

As of May, the stock has a median recommendation rating of overweight on Wall Street and an average target price of $172 per share.

Synnex Corp

The third stock that has the requirements is Synnex Corp (NYSE:SNX), a Fremont, California-based provider of business process services in the Americas, Europe, Africa and Asia-Pacific.

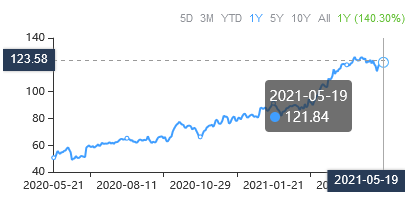

At close on Wednesday, Synnex Corp's share price traded at $121.84, below its Peter Lynch Fair Value per share of $140.57, for a price-to-Peter-Lynch-Fair-Value ratio of about 0.87. This ranks higher than 82% of the 503 companies that operate in the software industry.

The stock has a market capitalization of $6.32 billion after a 140.30% jump that happened over the past year. The 52-week range is $47.43 to $126.55.

The stock has a GuruFocus financial strength rating of 6 out of 10 and a profitability rating of 8 out of 10.

As of May, the stock has a median recommendation rating of overweight on Wall Street. Sell-side analysts have established an average target price of $123 per share.

Disclosure: I have no position in any security mentioned.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.