3 Storage Devices Stocks to Watch for in a Prospering Industry

The Zacks Computer-Storage Devices industry benefits from encouraging trends in PC shipments and solid momentum in cloud computing, Internet of Things (IoT), auto, connected devices, virtual reality and Artificial Intelligence (AI). These factors propel the demand for robust data storage solutions, bolstering the requirement for computer storage products. This is favoring the prospects of prominent industry players like Pure Storage PSTG, Teradata TDC and Super Micro Computer SMCI. Democratization of higher internal memory smartphones, faster Internet speed and 5G is likely to act as a tailwind for the industry participants. Rapid deployment of 5G networking is driving the proliferation of IoT, Advanced Driver Assistance Systems (ADAS) and Augmented Reality/Virtual Reality (AR/VR) devices. However, negative impacts stemming from the pandemic-triggered supply chain disruptions and component shortages are a concern in the near term.

Industry Description

The Zacks Computer-Storage Devices industry comprises companies that design, develop, manufacture and market various hard disk drives (HDDs) and solid-state drives (SSDs). These drives are utilized in PCs, laptops, mobiles, servers, network-attached storage (NAS) devices, video game consoles, digital video recorders and other consumer electronic devices. A few industry participants, including Pure Storage, provide software-defined all-flash solutions that are uniquely fast and cloud-capable for customers. Many industry players offer high-performance modular memory subsystems, mount and blade server systems, enterprise storage and data management software and hardware products and services. Some industry participants also provide purpose-built servers for storing and accessing data over a shared network or the Internet.

4 Trends Shaping the Future of the Computer - Storage Industry

New Normal Trends & Rapid Implementation of 5G Opening New Business Avenues: Coronavirus-induced work-from-home and hybrid work models have triggered demand for data-intensive applications like video conferencing and cloud services. Effective storage is essential for harnessing data and is expected to raise demand for high-storage capable SSDs and internal memory in advanced smartphones. Accelerated deployment of 5G and rebound in the smartphone market are likely to propel the industry to newer heights. Extensive implementation of cloud computing solutions, increased Internet usage and rapidly-growing media and regulatory compliance, driven by coronavirus-led work-from-home setup, have led to data explosion for enterprises, which bodes well for the industry participants.

Innovation in Cloud Storage Technologies to Drive Adoption: Extensive storage options from collocated hardware (such as hard disks and tape drives) to many cloud storage solutions has put the industry on a growth trajectory. The industry players are well poised for growth on the back of a rapid increase in the amount of data, the complexity of data formats and the need to scale resources at regular intervals. The companies rely on Artificial Intelligence for IT Operations (AIOps) and machine learning (ML) to manage and optimize storage solutions. To streamline data storage, companies are relying on virtualization technologies. As more data is amassed from IoT, the companies are turning to edge computing architecture to reduce latency and boost flexibility. Kubernetes storage is becoming increasingly popular as it facilitates greater agility and scalability. This has bolstered the deployment of high-capacity mass storage products, which is a positive for industry players.

Relative Slowdown in IT Spending A Concern: Per a Gartner report, worldwide IT spending is expected to increase 3% in 2022 compared with 2021 levels and reach $4.5 trillion. Higher technology spending will drive the upside as enterprises continue to build sound technological infrastructure. However, the geopolitical disruptions, inflationary pressures and protracted pandemic-induced supply chain troubles remain major concerns. Also, consumer spending cuts on the purchase of PCs, tablets and printers are likely to bring down the IT spending growth to much less than the 10.2% spurt witnessed in 2021, added Gartner.

Slowing Momentum in PC Shipments Might Hinder Growth Prospects: Worldwide PC shipments dropped 12.6% to 72 million units in the second quarter of 2022, according to the data compiled by Gartner. The latest Gartner report depicts the end of the massive spike in PC demand due to the pandemic-led work-from-home and online learning wave. In the second quarter, sales were affected by the Ukraine war, inflationary pressure and a decline in the sale of Chromebooks, added Gartner. A slowing PC market does not augur well for the industry participants.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Computer Storage is housed within the broader Zacks Computer And Technology Sector. It carries a Zacks Industry Rank #22, which places it in the top 9% of more than 251 Zacks industries.

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are optimistic about this group’s earnings growth potential. The industry’s loss estimates for 2022 has improved to $2.59 against a loss estimate of $3.39 as of Apr 30, 2022.

Before we present a few stocks you may want to consider for your portfolio, considering bright prospects, let us look at the industry’s recent stock-market performance and valuation picture.

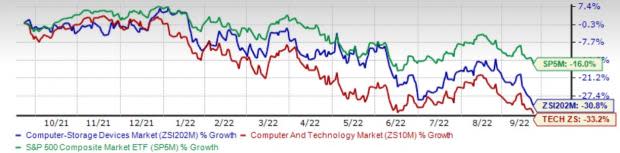

Industry Outperforms Sector but Lags S&P 500

The Zacks Computer-Storage Devices industry has outperformed the broader sector but lags the Zacks S&P 500 composite in the past year.

The industry has lost 30.8% over this period compared with the S&P 500’s decline of 16%. The broader sector has declined 33.2% in the same time frame.

One-Year Price Performance

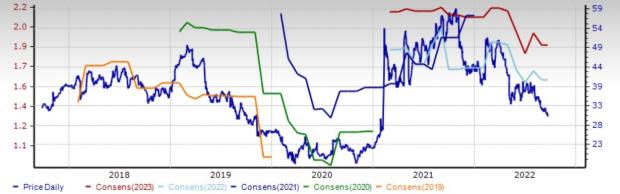

Industry's Current Valuation

On the basis of forward 12-month P/E (or Price/Earnings), which is a commonly used multiple for valuing computer storage devices companies, we see that the industry is currently trading at 13.37X compared with the S&P 500’s 16.30X. It is also below the sector’s forward-12-month P/E of 19.57X.

In the past five years, the industry has traded as high as 20.8X and as low as 10.43X, with the median being 14.51X, as the charts below indicate.

Forward 12-Month Price-to-Earnings (P/E) Ratio

Forward 12-Month P/E Ratio

3 Computer-Storage Devices Stocks to Add to Watchlist

Pure Storage: Pure Storage performance is gaining from continued momentum in Pure as-a-Service, Portworx and Evergreen Storage subscription services. The company is benefiting from strength across FlashArray and FlashBlade businesses and strong growth prospects in the data-driven markets of AI, ML, Internet of Things (IoT), Real-time Analytics and Simulation. In the last reported quarter, Pure Storage added 350 customers. The company’s customer base includes 56% of Fortune 500 companies.

The company provided an upbeat outlook for fiscal 2023 revenues. For fiscal 2023, Pure Storage now expects revenues of $2.75 billion, indicating year-over-year growth of 26%. Earlier, Pure Storage expected revenues of $2.66 billion, indicating year-over-year growth of 22%.

Pure Storage carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here. .

Shares of the company have gained 2% in the past year. The Zacks Consensus Estimate for fiscal 2023 earnings for the company improved 24.2% to $1.18 per share in the past 60 days. Its long-term earnings growth rate is pegged at 35.5%

Price and Consensus: PSTG

Super Micro Computer: The San Jose, CA-based company designs, develops, manufactures and sells energy-efficient, application-optimized server solutions based on the x86 architecture. The company's solutions include a range of rack mount and blade server systems and components. Super Micro also produces server boards, chassis and server systems.

In the last reported quarter, the company’s revenues of $1.64 billion surged 53.3% year over year. For fiscal 2023 (ending June 30, 2023), the company now expects net sales to be in the range of $6.2 -$7 billion.

Shares of Super Micro Computer, which sports a Zacks Rank #1, have gained 46.8% in the past year. The Zacks Consensus Estimate for fiscal 2023 earnings for the company improved 30.4% to $7.50 per share in the past 60 days.

Price and Consensus: SMCI

Teradata: The San Diego, CA-based company is a leading provider of hybrid cloud analytics software.

Teradata is benefiting from solid growth in public cloud annual recurring revenues. This is attributed to rising cloud deals and strong momentum in the Americas, Europe, the Middle East & Africa, and the Asia Pacific and Japan regions. Cost improvements in subscription and cloud business remain positive. The company is gaining momentum among customers on the back of its analytics platform, Vantage on-prem, which remains another positive factor.

At present, Teradata carries a Zacks Rank #2 (Buy). Moreover, its long-term earnings growth rate is pegged at 27.4%.

Price and Consensus: TDC

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Teradata Corporation (TDC) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Pure Storage, Inc. (PSTG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research