3 ‘Strong Buy’ Stocks Investment Firm B. Riley FBR Recommends

To everything turn, turn, turn.

There is a season earn, earn, earn.

So the song almost goes. With earnings season in full swing, eagle eyed market watchers are looking for opportunities amongst the deluge of reports. With this in mind, we decided to take a look at three stocks investment firm B. Riley FBR thinks are about to provide investors with some solid upside. Importantly, according to TipRanks -- a Financial Accountability Engine that measures and ranks analysts based on their performance -- all 3 are currently Strong Buys.

Let's dive in:

Celsius Holdings (CELH)

Energy drink maker Celsius Holdings will release third-quarter results Thursday, and analysts’ consensus estimates anticipate Q3 revenue of $18.3 million, while staying on target of $100 million revenue for the full year. Following on from a record 2Q revenues of $16.1 million, over 70% more than the same quarter last year, and an increase of gross profit by 70%, expectations are high.

Celsius’s end game is to become a leading global brand, and as part of its expansion strategy, it recently acquired Nordic wellness company, Func Food. Apart from offering a new distribution platform for Europe, the acquisition is valued way below revenue multiple and will provide immediate accretion to shareholders. This follows the August launch of BCAA, a new post workout product line, further continuing Celsius’s expansion.

B.Riley FBR’s analyst Jeff Van Sinderen thinks demand for the company's product is growing, noting, “We continue to believe that, with enthusiastic consumer adoption and products that remain differentiated in the marketplace, CELH is positioned to continue to capture market share from legacy energy drinks… With more resources going into the North American segment and opportunity for incremental revenue through category expansion, strong opportunity to grow the EU business that is now under the company’s direct control and the company on track to post rapid growth in FY19 with potential to accelerate in FY20.”

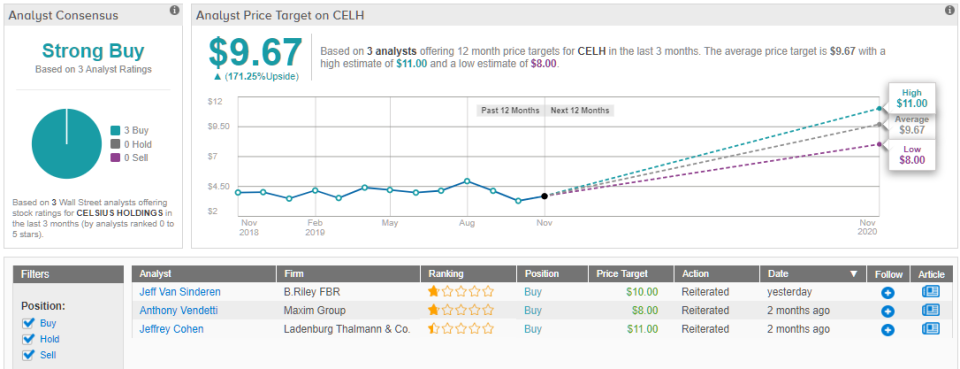

The analyst suggests that if everything goes as planned, buy-rated CELH will be a $10 stock in the next 12 months, implying well over 170% return. (To watch Sinderen's track record, click here)

Over the last three months, CELH stock has received 3 "buy" ratings, with no "hold" or "sell" ratings. As a result, the stock has a ‘Strong Buy’ analyst consensus rating. These analysts believe (on average) that the stock has big upside potential of over 170% from the current share price. This would take CELH from $3.56 all the way to $9.67. (See Celsius stock analysis on TipRanks)

Quantum (QMCO)

Video storage specialist, Quantum, reports its fiscal second-quarter earnings today after market closes. Quantum provides high streaming performance for video and rich media applications, alongside large-scale low-cost data protection.

The company’s product line has been continually expanding, and now includes StorNext, its award-winning file system, F-Series, a new line of NVMe storage arrays, and its removable storage systems R-Series, amongst others. It also recently announced its new line of storage-as-a-service offering, Quantum Distributed Cloud Services.

The enterprise storage sector is crowded, including big name players such as DELL, IBM, and ORCL vying for market share, but B.Riley FBR’s 5-star analyst Craig Ellis thinks Quantum has strong long-term fundamental and stock upside potential. As a result, the analyst reiterated a Buy rating on QMCO stock along with a $7.25 price target, which implies about 17% upside from current levels.

Ellis noted, “We preview an in-line F2Q20 with our and Street's at-midpoint estimates, and an outlook affirming our forecasts and headline consensus. As such, we believe the financial performance will indicate QMCO is tracking toward FY20’s sales, gross margin, and adjusted EBITDA targets [...] If our three-year forecasts play out, the relative growth and EPS expansion will likely sharply outpace peers, arguing for relative multiple expansion. While debt cost concerns persist, we believe the issue is manageable, with cash generation and strategic options. We expect an up-list from OTC in the near future and, with that, a boost to liquidity, further removing an overhang for stock performance."

This is in line with other analysts’ view on QMCO’s prospects, as it gets a Strong Buy rating from the Street, with an average target price of $7.08, just slightly below Ellis’s target. (See Quantum stock analysis on TipRanks)

Intricon (IIN)

Riley FBR’s final recommendation is Intricon, a designer and manufacturer of miniature body-worn devices. The company’s emphasis revolves around three different markets: professional audio communications, hearing health and medical.

Unlike the previous 2 recommendations, Intricon has just posted its 3Q19 earnings, with most results coming in slightly below estimates. Net revenue came in at $26.9 million, down from 3Q18 of $29.6 million, and gross margin came in at 25.2%, down from 31.6% in the prior-year third quarter.

The underwhelming report hasn’t put off B. Riley FBR’s analyst Andrew D'Silva, who reiterated a Buy rating on the stock along with a $35 price target. This provides Intricon with upside of 90% from its current price of $18.37. (To watch D'Silva's track record, click here)

D’silva believes there are several short-term catalysts which can propel Intricon forward. Among those are its largest customer, Medtronic, increasing international roll out of the MiniMed 670G Insulin Pump System, the unveiling of its next iteration, the MiniMed 780G, and the FDA providing recommendations around the OTC Hearing Aid Act.

Final rules for the OTC Hearing Aid Act should be released in the next 6 months, with a draft expected later this month. D’silva says, “This is important because IIN's value-based hearing healthcare (VBHH) sales channels are expected to meaningfully benefit from the FDA finalizing its rules, as it is expected to provide the industry with clarity, which we believe should clear hurdles for IIN related to partnering opportunities with other DTC/VBHH providers.”

Intricom’s cheerleaders are few but loud, with all 3 analysts polled over the last 3 months giving the stock the thumbs up. TipRanks analytics showcase IIN as a Strong Buy, while the average price target stands at $32.33 -- 76% upside from current levels. (See Intricon stock analysis on TipRanks)