3 Things Intel Corp.'s Data Center Chief Wants You to Know

Chipmaker Intel (NASDAQ: INTC) is betting big on its data center group (DCG), which sells processors and other components that power most of the world's data centers, to be its revenue and profit growth engine in the years ahead.

Considering just how important this business, which generated more than $17 billion in sales and $7.5 billion in operating income last year, is to Intel's future, investors are naturally quite interested in understanding the company's long-term strategy here.

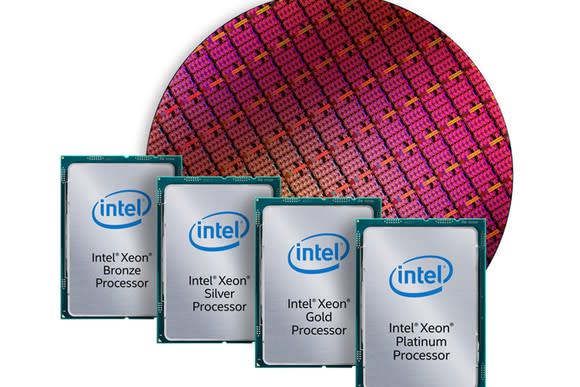

Image source: Intel.

Intel executive Navin Shenoy, who took over DCG back in May after former DCG chief Diane Bryant took an extended leave of absence, recently provided quite a lot of insight into the business at an investor conference. Here are three things that he had to say that I don't think current or potential investors in Intel stock will want to miss.

It's not just about processors

The bulk of Intel's DCG revenue comes from the sale of processors. In 2016, out of the $17.2 billion in revenue that DCG took in, $15.9 billion -- or around 91% -- came from the sale of what Intel refers to as "platforms," which is a fancy word for processors and the chipsets that they require to function.

In a bid to accelerate DCG revenue growth, Intel aims to capture more dollar content within the data center beyond platforms used in servers.

"One thing that I've recognized here in the last five or six months is that the silicon [total addressable market] opportunity that we have in front of us is much larger than, perhaps, we've thought about in the past," Shenoy said.

The executive said that the total addressable market for chip technology in the data center is worth about $50 billion today and that the company commands about 34% of it. That, Shenoy said, means that Intel has "huge opportunities for growth" ahead of it.

Shenoy then went on to add that he expects that total addressable market will grow to "nearly $70 billion over the next four to five years."

The growth in the market itself, coupled with what Intel hopes will be market share gains, could help Intel continue to deliver profitable growth within DCG.

Intel's artificial intelligence strategy

One of the hottest areas these days is the market for processors that can effectively handle machine learning/artificial intelligence workloads.

Although Intel's processors are commonly used for artificial intelligence workloads, specialized processors, such as NVIDIA's (NASDAQ: NVDA) graphics processing units (GPUs), are believed to be much more efficient than Intel's general-purpose processors for certain artificial intelligence tasks.

Naturally, those who follow Intel are probably interested in gaining some insight into what the company's longer-term strategy is to optimize its product portfolio for machine learning/artificial intelligence workloads.

Shenoy said that the company is "reinventing Xeon" -- the brand name for the company's general-purpose data center processors -- to be able to cope more effectively with artificial intelligence workloads.

He claims that the company's latest Xeon processors, which are known as Xeon Scalable, are 2.4 times faster than the company's prior-generation Xeon processors in machine learning inference workloads.

Though general-purpose processors are Intel's core competency, it isn't betting its AI strategy solely on such chips.

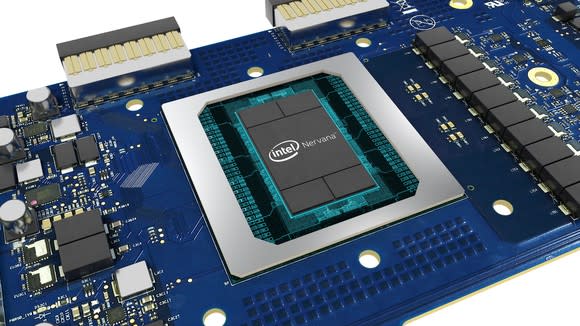

Image source: Intel.

Shenoy also talked about how Intel is leveraging its field-programmable gate array (FGPA) technology, which it acquired when it bought FPGA maker Altera two years ago, to address this market.

Beyond general-purpose processors and FPGAs, though, Intel is also betting big on specialized neural network processors based on the technology that it acquired when it bought start-up Nervana Systems to handle machine learning training workloads, which currently seem to run best on NVIDIA's GPU technology.

"This is a custom [application-specific integrated circuit] designed from the ground up for training kind of AI workload," Shenoy said.

Shenoy indicated that the first Nervana-based product will arrive next year and that the company aims to deliver new products on an annual basis.

It's not yet clear how well this product family will ultimately do in the marketplace, particularly against GPUs, but the company seems optimistic about its chances.

The memory opportunity

One market that Intel doesn't participate in today is the server DRAM market. The company hasn't communicated any plans to enter the DRAM market proper, but it does intend to try to displace DRAM with memory modules based on its new 3D XPoint memory technology.

Shenoy prefaced his explanation of Intel's opportunity here by pointing out that traditional DRAM -- which is found in virtually every computing device sold today -- "is a fast technology but it's volatile in terms of its technology nature and it tends to be expensive."

For those of you unfamiliar with the term volatile, it simply means that it's a type of memory that doesn't retain its contents once power to it is removed.

The executive then said that NAND flash, which is commonly used as a storage medium in personal computers, smartphones, and data centers, is "slower but it has the characteristics of being persistent."

NAND is a non-volatile technology, meaning that it retains the information written to it even when the power to it is removed. Or, to use Shenoy's phasing, the data stored on NAND flash-based devices is persistent.Â

Intel's 3D XPoint technology, Shenoy says, has "characteristics of both of those types of technology."

"You have the speed that you get with DRAM, you have the persistence that you have with NAND, and you have high density that you have with NAND as well, even higher in some cases," the exec continued.

Intel's plan, then, is to try to bring 3D XPoint-based memory modules to data centers as a DRAM substitute, which should allow it to capture value that it previously wasn't able to. Shenoy says that it'll begin shipping these memory modules in the second half of 2018 and that the company sees the market opportunity for these products growing to $8 billion by 2021.

To the extent that Intel can capitalize on that opportunity, DCG stands to enjoy a nice boost to its growth rate.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Ashraf Eassa owns shares of Intel. The Motley Fool owns shares of and recommends Nvidia. The Motley Fool recommends Intel. The Motley Fool has a disclosure policy.