3 Things to Watch in the Stock Market This Week

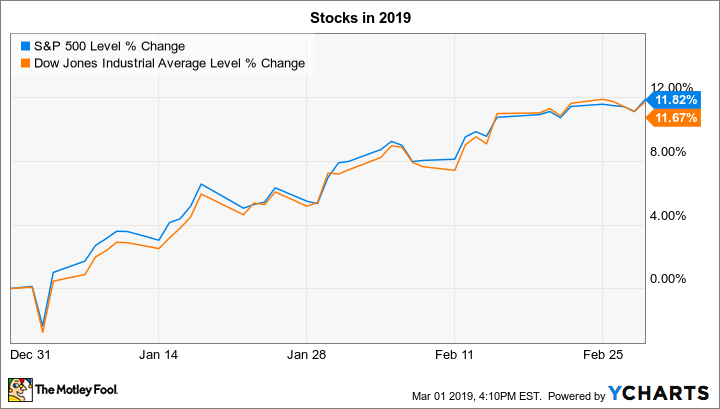

Stocks posted modest gains last week as investors processed earnings reports from many of the world's biggest companies. The Dow Jones Industrial Average (DJINDICES: ^DJI) and the S&P 500 (SNPINDEX: ^GSPC) each added less than 0.5% to keep year-to-date returns at roughly 11%.

Fourth-quarter earnings season isn't over yet, and there are highly anticipated reports on the way from Ambarella (NASDAQ: AMBA), Costco (NASDAQ: COST), and National Beverage (NASDAQ: FIZZ). Here's a look at what investors can expect to see from these companies over the next few trading days.

Ambarella's customer base

Semiconductor-chip specialist Ambarella will announce its fiscal fourth-quarter results on Tuesday, March 5, and investors are bracing for some tough numbers. Sales are down through the first three quarters of the year and are expected to slump by about 29% for the period that just closed.

Image source: Getty Images.

Ambarella's story is more about the future, though, and that's where shareholders have placed most of their cautious optimism. Its engineers are working on generational upgrades to its computer-vision lineup, which are designed to place the company right in the middle of key growth industries including driverless cars and artificial intelligence. CEO Fermi Wang is likely to talk up that chip in Wednesday's report while discussing its power to solve problems in areas like security surveillance. But investors will be more interested to hear an update on how many customers have signed up for what's likely to be its first mass-production product in the nascent computer-vision space.

Costco's renewal rate

Costco is one of just a few retailers that continues to reveal sales metrics on a monthly basis, and so investors already know that its positive momentum is holding up well into early 2019. Sales at existing locations are up about 8% over the 22 weeks that ended in early February, in fact, and have been rising at a robust 27% pace in the online channel, as well.

Sales gains aren't the most critical metric for Costco's business, though, and that's why Thursday's report will be important for investors to follow for updates on its membership trends. The warehouse giant has been benefiting from an uptick both in subscriber renewal rates and in the prices it charges customers for club access. These wins have allowed operating income to more than double in the past decade at a time when peers like Walmart and Target have posted declines. Investors are thus likely to forgive potentially bad news in Thursday's report including rock-bottom gross profit margin -- so long as Costco continues to show impressive strength at attracting and keeping an army of loyal customers.

National Beverage's profit margin

Investors are especially interested in National Beverage's upcoming earnings report set for Wednesday, March 6. That's because its last announcement in early December revealed a sharp growth slowdown that management blamed on bad press surrounding a lawsuit targeting its LaCroix franchise. The company maintains that there's no truth behind the lawsuit's allegations that claim the sparkling water products are made using unnatural ingredients. Even so, the brand apparently took a hit in late 2018.

CEO Nick Caporella and his team claimed in December that order growth has returned to normal, suggesting that the company has already put the incident behind it. We'll find out if that's true on Wednesday. Investors will also learn whether the company believes a large and persistent marketing expense will be required going forward as National Beverage aims to repair its image with health-conscious consumers.

More From The Motley Fool

Demitrios Kalogeropoulos owns shares of Costco Wholesale. The Motley Fool owns shares of and recommends Ambarella. The Motley Fool recommends Costco Wholesale and National Beverage. The Motley Fool has a disclosure policy.